| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921121950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for PVC Foam Board for Construction, based on your input:

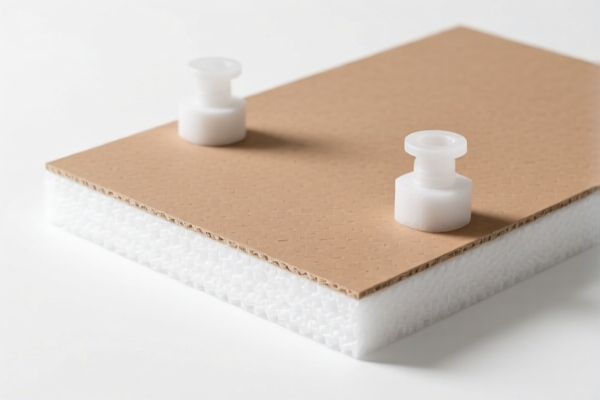

📦 Product Classification Overview: PVC Foam Board for Construction

✅ HS CODE: 3921125000

- Description: PVC foam board (general type)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most applicable code for general PVC foam boards used in construction.

✅ HS CODE: 3921121950

- Description: Textile composite PVC foam board

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies specifically to PVC foam boards that are composite with textile materials.

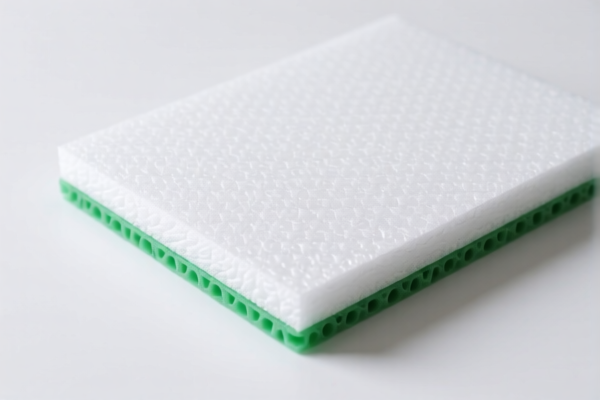

✅ HS CODE: 3921110000

- Description: Polystyrene foam board (for construction)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polystyrene foam boards used in construction, not PVC.

✅ HS CODE: 3921190090

- Description: Polyethylene foam board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polyethylene foam boards, not PVC.

✅ HS CODE: 3901909000

- Description: Polyethylene foam board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another code for polyethylene foam boards, but may be more general than 3921190090.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC foam boards in the provided data. However, always verify with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Certifications Required:

Confirm whether your product requires any technical documentation, safety certifications, or environmental compliance (e.g., REACH, RoHS, etc.) depending on the destination country. -

Material and Unit Price Verification:

Ensure the material composition and unit price of the product match the HS code description to avoid misclassification and potential penalties.

📌 Proactive Advice:

- Double-check the product composition (e.g., is it pure PVC, composite with textiles, or polyethylene?) to ensure the correct HS code is used.

- Consult with customs or a trade compliance expert if you are unsure about the classification or if your product is subject to additional duties.

- Keep updated records of product specifications and import documentation to support customs declarations.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured and professional breakdown of the HS codes and associated tariffs for PVC Foam Board for Construction, based on your input:

📦 Product Classification Overview: PVC Foam Board for Construction

✅ HS CODE: 3921125000

- Description: PVC foam board (general type)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most applicable code for general PVC foam boards used in construction.

✅ HS CODE: 3921121950

- Description: Textile composite PVC foam board

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies specifically to PVC foam boards that are composite with textile materials.

✅ HS CODE: 3921110000

- Description: Polystyrene foam board (for construction)

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polystyrene foam boards used in construction, not PVC.

✅ HS CODE: 3921190090

- Description: Polyethylene foam board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polyethylene foam boards, not PVC.

✅ HS CODE: 3901909000

- Description: Polyethylene foam board

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is another code for polyethylene foam boards, but may be more general than 3921190090.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC foam boards in the provided data. However, always verify with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Certifications Required:

Confirm whether your product requires any technical documentation, safety certifications, or environmental compliance (e.g., REACH, RoHS, etc.) depending on the destination country. -

Material and Unit Price Verification:

Ensure the material composition and unit price of the product match the HS code description to avoid misclassification and potential penalties.

📌 Proactive Advice:

- Double-check the product composition (e.g., is it pure PVC, composite with textiles, or polyethylene?) to ensure the correct HS code is used.

- Consult with customs or a trade compliance expert if you are unsure about the classification or if your product is subject to additional duties.

- Keep updated records of product specifications and import documentation to support customs declarations.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.