| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

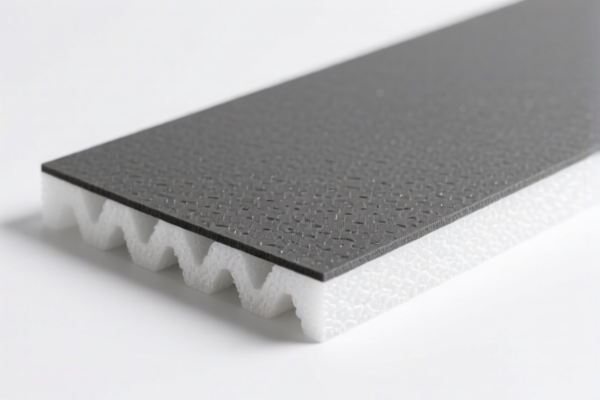

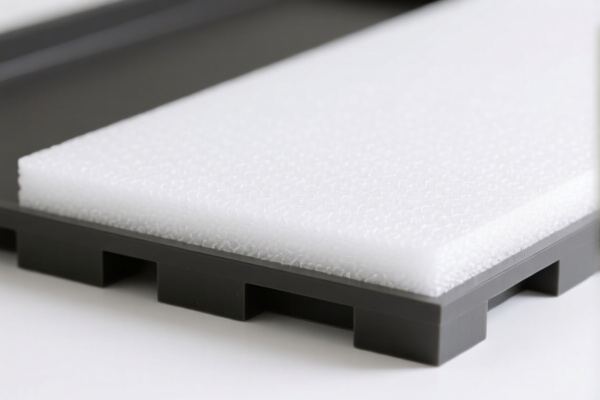

Here is the structured classification and tariff information for PVC Foam Board for Industrial Use, based on the provided HS codes and tax details:

✅ Product Classification Overview: PVC Foam Board for Industrial Use

🔢 HS CODE: 3921125000

- Product Description: PVC泡沫板 (PVC Foam Board)

- Total Tax Rate: 61.5%

- Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to PVC foam boards.

🔢 HS CODE: 3921190090

- Product Description: 塑料泡沫板(工业用) (Plastic Foam Board for Industrial Use)

- Total Tax Rate: 61.5%

- Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for industrial plastic foam boards, including PVC.

🔢 HS CODE: 3921135000

- Product Description: 聚氨酯泡沫工业板 (Polyurethane Foam Industrial Board)

- Total Tax Rate: 59.2%

- Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polyurethane foam boards, not PVC.

🔢 HS CODE: 3920490000

- Product Description: PVC塑料工业板 (PVC Plastic Industrial Board)

- Total Tax Rate: 60.8%

- Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for solid PVC industrial boards, not foam.

🔢 HS CODE: 3921110000

- Product Description: 泡沫板 (Foam Board)

- Total Tax Rate: 60.3%

- Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for foam boards, not specific to PVC.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC foam boards in the provided data. However, always verify with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

Ensure your product meets all customs and safety standards (e.g., RoHS, REACH, or other local regulations). Verify if certifications are required for import into the destination country. -

Material and Unit Price:

Confirm the exact material composition (e.g., PVC, polyurethane) and unit price to ensure correct classification and tax calculation.

📌 Proactive Advice:

- Double-check the HS code based on the material type (PVC vs. polyurethane) and intended use (industrial vs. general).

- Keep updated records of tariff changes and regulatory updates.

- If importing in large quantities, consider customs brokerage services to ensure compliance and avoid delays.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for PVC Foam Board for Industrial Use, based on the provided HS codes and tax details:

✅ Product Classification Overview: PVC Foam Board for Industrial Use

🔢 HS CODE: 3921125000

- Product Description: PVC泡沫板 (PVC Foam Board)

- Total Tax Rate: 61.5%

- Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to PVC foam boards.

🔢 HS CODE: 3921190090

- Product Description: 塑料泡沫板(工业用) (Plastic Foam Board for Industrial Use)

- Total Tax Rate: 61.5%

- Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for industrial plastic foam boards, including PVC.

🔢 HS CODE: 3921135000

- Product Description: 聚氨酯泡沫工业板 (Polyurethane Foam Industrial Board)

- Total Tax Rate: 59.2%

- Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polyurethane foam boards, not PVC.

🔢 HS CODE: 3920490000

- Product Description: PVC塑料工业板 (PVC Plastic Industrial Board)

- Total Tax Rate: 60.8%

- Breakdown of Tariffs:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for solid PVC industrial boards, not foam.

🔢 HS CODE: 3921110000

- Product Description: 泡沫板 (Foam Board)

- Total Tax Rate: 60.3%

- Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for foam boards, not specific to PVC.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC foam boards in the provided data. However, always verify with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Certifications and Documentation:

Ensure your product meets all customs and safety standards (e.g., RoHS, REACH, or other local regulations). Verify if certifications are required for import into the destination country. -

Material and Unit Price:

Confirm the exact material composition (e.g., PVC, polyurethane) and unit price to ensure correct classification and tax calculation.

📌 Proactive Advice:

- Double-check the HS code based on the material type (PVC vs. polyurethane) and intended use (industrial vs. general).

- Keep updated records of tariff changes and regulatory updates.

- If importing in large quantities, consider customs brokerage services to ensure compliance and avoid delays.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.