| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the detailed classification and tariff information for PVC Foam Board for Packaging, based on the provided HS codes and tax details:

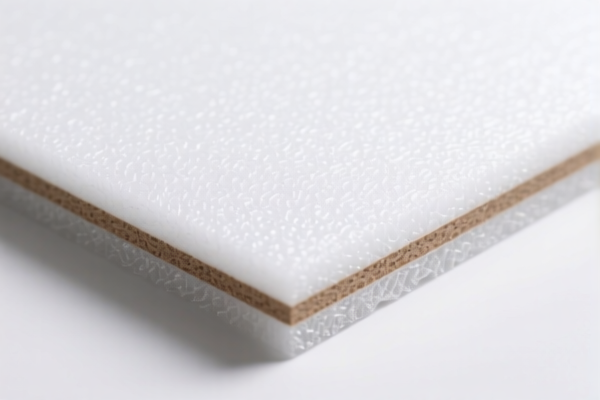

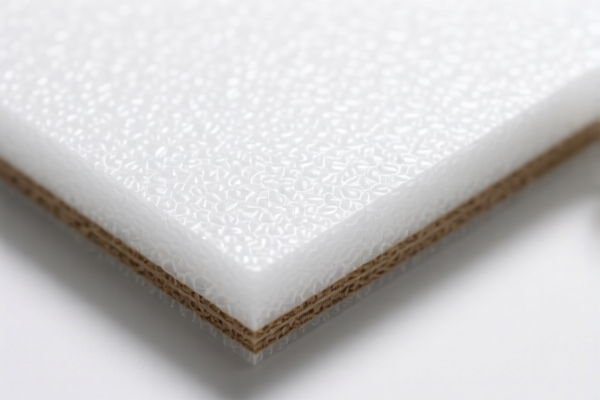

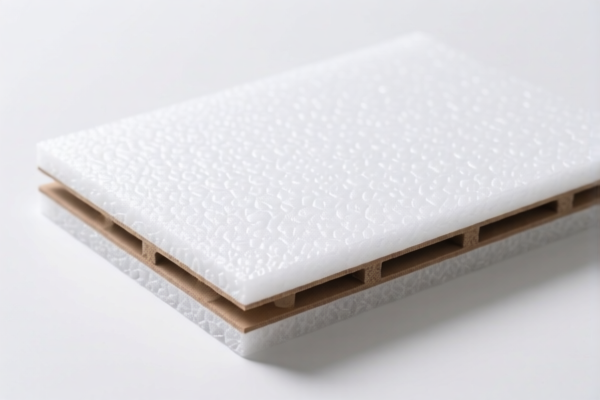

✅ HS CODE: 3921125000

Product Description: PVC foam board suitable for packaging purposes.

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most applicable code for PVC foam board used in packaging.

✅ HS CODE: 3921110000

Product Description: Foam plastic sheets made from polystyrene, suitable for packaging.

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Applicable for polystyrene-based foam boards used in packaging.

✅ HS CODE: 3921135000

Product Description: Polyurethane foam board for packaging.

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane foam boards used in packaging.

✅ HS CODE: 3921190090

Product Description: Plastic foam sheets or boards (industrial or packaging use).

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: A general category for plastic foam sheets used in industrial or packaging applications.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. This is a time-sensitive policy and should be considered in cost planning.

-

Material Verification: Confirm the exact material composition (e.g., PVC, polystyrene, polyurethane) to ensure correct HS code classification.

-

Unit Price and Certification: Check if certifications (e.g., RoHS, REACH, or specific packaging regulations) are required for export or import, depending on the destination country.

-

Tariff Calculation Example:

For HS CODE 3921125000, the total tax would be:

6.5% (base) + 25.0% (additional) + 30.0% (special after April 11, 2025) = 61.5%.

🛑 Proactive Advice:

- Double-check the product composition and intended use (packaging vs. industrial) to ensure the correct HS code is applied.

- Consult customs authorities or a customs broker for the most up-to-date and accurate classification, especially if the product is a composite or modified material.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs in your logistics and pricing strategy. Here is the detailed classification and tariff information for PVC Foam Board for Packaging, based on the provided HS codes and tax details:

✅ HS CODE: 3921125000

Product Description: PVC foam board suitable for packaging purposes.

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most applicable code for PVC foam board used in packaging.

✅ HS CODE: 3921110000

Product Description: Foam plastic sheets made from polystyrene, suitable for packaging.

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Applicable for polystyrene-based foam boards used in packaging.

✅ HS CODE: 3921135000

Product Description: Polyurethane foam board for packaging.

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyurethane foam boards used in packaging.

✅ HS CODE: 3921190090

Product Description: Plastic foam sheets or boards (industrial or packaging use).

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: A general category for plastic foam sheets used in industrial or packaging applications.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. This is a time-sensitive policy and should be considered in cost planning.

-

Material Verification: Confirm the exact material composition (e.g., PVC, polystyrene, polyurethane) to ensure correct HS code classification.

-

Unit Price and Certification: Check if certifications (e.g., RoHS, REACH, or specific packaging regulations) are required for export or import, depending on the destination country.

-

Tariff Calculation Example:

For HS CODE 3921125000, the total tax would be:

6.5% (base) + 25.0% (additional) + 30.0% (special after April 11, 2025) = 61.5%.

🛑 Proactive Advice:

- Double-check the product composition and intended use (packaging vs. industrial) to ensure the correct HS code is applied.

- Consult customs authorities or a customs broker for the most up-to-date and accurate classification, especially if the product is a composite or modified material.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs in your logistics and pricing strategy.

Customer Reviews

No reviews yet.