| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

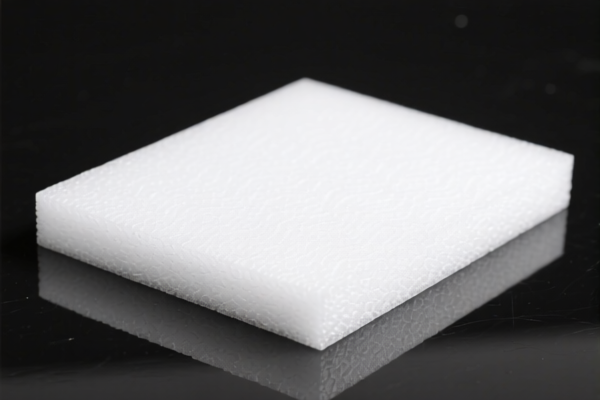

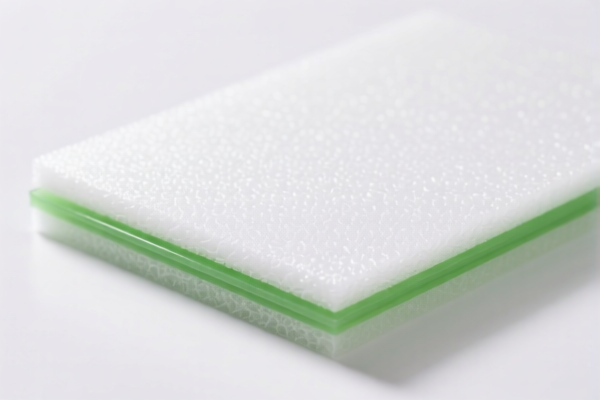

Product Classification: PVC Foam Plastic Sheet

Customs Compliance Analysis and Tax Rate Overview

Below is the detailed breakdown of the HS codes and corresponding tax rates for PVC foam plastic sheets. Please note that the classification and tax rates are based on the latest available data as of April 2025.

✅ HS Code: 3921125000

Description: PVC foam plastic sheet

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most applicable code for PVC foam plastic sheets.

- Proactive Advice: Confirm the product is foamed and not solid PVC sheet, as this affects classification.

✅ HS Code: 3921905050

Description: PVC plastic sheet (non-foam)

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to non-foamed PVC sheets.

- Proactive Advice: Ensure the product is not foam-based to avoid misclassification.

✅ HS Code: 3920431000

Description: PVC plastic sheet (specific type)

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to specific types of PVC sheets (e.g., with certain additives or thickness).

- Proactive Advice: Verify the material composition and thickness to ensure correct classification.

✅ HS Code: 3920995000

Description: PVC plastic sheet (other types)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a catch-all code for PVC sheets not covered by more specific codes.

- Proactive Advice: Use only if the product does not match more specific codes.

✅ HS Code: 3916200020

Description: PVC plastic sheet (specific type)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC sheets with specific surface treatments or uses.

- Proactive Advice: Confirm the surface treatment or intended use of the product.

📌 Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations.

- Anti-dumping duties: Not applicable for PVC foam plastic sheets (no known anti-dumping duties on this product as of now).

- Certifications: Ensure the product meets customs documentation requirements, including material specifications, unit price, and origin.

🛠️ Action Steps for Importers:

- Verify the product type (foam vs. non-foam, thickness, surface treatment).

- Check the exact HS code based on the product description.

- Calculate total tax including base, additional, and special tariffs.

- Review documentation (e.g., commercial invoice, packing list, certificate of origin).

- Stay updated on policy changes, especially the April 11, 2025 tariff adjustment.

Let me know if you need help with customs documentation templates or tariff calculation tools.

Product Classification: PVC Foam Plastic Sheet

Customs Compliance Analysis and Tax Rate Overview

Below is the detailed breakdown of the HS codes and corresponding tax rates for PVC foam plastic sheets. Please note that the classification and tax rates are based on the latest available data as of April 2025.

✅ HS Code: 3921125000

Description: PVC foam plastic sheet

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most applicable code for PVC foam plastic sheets.

- Proactive Advice: Confirm the product is foamed and not solid PVC sheet, as this affects classification.

✅ HS Code: 3921905050

Description: PVC plastic sheet (non-foam)

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to non-foamed PVC sheets.

- Proactive Advice: Ensure the product is not foam-based to avoid misclassification.

✅ HS Code: 3920431000

Description: PVC plastic sheet (specific type)

Total Tax Rate: 58.1%

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to specific types of PVC sheets (e.g., with certain additives or thickness).

- Proactive Advice: Verify the material composition and thickness to ensure correct classification.

✅ HS Code: 3920995000

Description: PVC plastic sheet (other types)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a catch-all code for PVC sheets not covered by more specific codes.

- Proactive Advice: Use only if the product does not match more specific codes.

✅ HS Code: 3916200020

Description: PVC plastic sheet (specific type)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to PVC sheets with specific surface treatments or uses.

- Proactive Advice: Confirm the surface treatment or intended use of the product.

📌 Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed on all the above codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations.

- Anti-dumping duties: Not applicable for PVC foam plastic sheets (no known anti-dumping duties on this product as of now).

- Certifications: Ensure the product meets customs documentation requirements, including material specifications, unit price, and origin.

🛠️ Action Steps for Importers:

- Verify the product type (foam vs. non-foam, thickness, surface treatment).

- Check the exact HS code based on the product description.

- Calculate total tax including base, additional, and special tariffs.

- Review documentation (e.g., commercial invoice, packing list, certificate of origin).

- Stay updated on policy changes, especially the April 11, 2025 tariff adjustment.

Let me know if you need help with customs documentation templates or tariff calculation tools.

Customer Reviews

No reviews yet.