| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

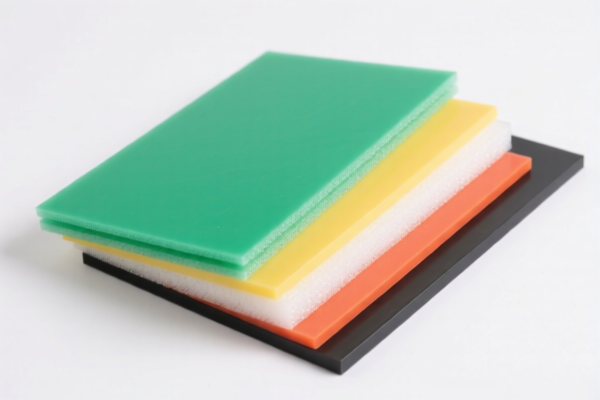

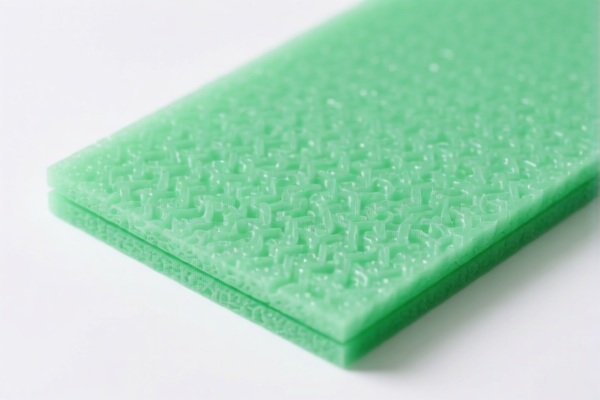

Product Name: PVC Foam Plastic Sheet (Thickness 1mm)

Classification: Plastic sheet, made of PVC (Polyvinyl Chloride), used for decorative purposes.

✅ HS CODE Classification Options:

- HS CODE:

3920490000 - Description: PVC (Polyvinyl Chloride) plastic sheets, not elsewhere specified.

- Summary: This code is most appropriate for general-purpose PVC plastic sheets.

-

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE:

3921125000 - Description: Decorative PVC sheets or panels, made of vinyl polymers.

- Summary: This code is suitable if the PVC sheet is specifically used for decorative purposes.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE:

3924905650 - Description: Plastic sheets or plates, of other plastics, for household or sanitary use.

- Summary: This code is for PVC sheets used in household or sanitary applications.

- Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes on Tax Rates:

- All three codes are subject to an additional 25% tariff, which is currently in effect.

- After April 11, 2025, an additional 30% tariff will be imposed on all three codes.

- No specific anti-dumping duties are listed for PVC foam sheets in the provided data.

🛠️ Proactive Advice:

- Verify the exact use of the product: Is it for general use, decorative purposes, or household/sanitary applications? This will help determine the most accurate HS code.

- Check the material composition: Ensure that the product is indeed made of PVC and not a blend with other materials.

- Confirm unit price and quantity: This will affect the total duty payable and may influence the classification.

- Check for required certifications: Some products may require specific documentation or certifications for customs clearance (e.g., RoHS, REACH, etc.).

📅 Time-Sensitive Alert:

- April 11, 2025: A 30% additional tariff will be applied to all three HS codes. Ensure your import planning accounts for this increase.

If you have more details about the product (e.g., end-use, composition, or origin), I can help refine the classification further.

Product Name: PVC Foam Plastic Sheet (Thickness 1mm)

Classification: Plastic sheet, made of PVC (Polyvinyl Chloride), used for decorative purposes.

✅ HS CODE Classification Options:

- HS CODE:

3920490000 - Description: PVC (Polyvinyl Chloride) plastic sheets, not elsewhere specified.

- Summary: This code is most appropriate for general-purpose PVC plastic sheets.

-

Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE:

3921125000 - Description: Decorative PVC sheets or panels, made of vinyl polymers.

- Summary: This code is suitable if the PVC sheet is specifically used for decorative purposes.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE:

3924905650 - Description: Plastic sheets or plates, of other plastics, for household or sanitary use.

- Summary: This code is for PVC sheets used in household or sanitary applications.

- Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes on Tax Rates:

- All three codes are subject to an additional 25% tariff, which is currently in effect.

- After April 11, 2025, an additional 30% tariff will be imposed on all three codes.

- No specific anti-dumping duties are listed for PVC foam sheets in the provided data.

🛠️ Proactive Advice:

- Verify the exact use of the product: Is it for general use, decorative purposes, or household/sanitary applications? This will help determine the most accurate HS code.

- Check the material composition: Ensure that the product is indeed made of PVC and not a blend with other materials.

- Confirm unit price and quantity: This will affect the total duty payable and may influence the classification.

- Check for required certifications: Some products may require specific documentation or certifications for customs clearance (e.g., RoHS, REACH, etc.).

📅 Time-Sensitive Alert:

- April 11, 2025: A 30% additional tariff will be applied to all three HS codes. Ensure your import planning accounts for this increase.

If you have more details about the product (e.g., end-use, composition, or origin), I can help refine the classification further.

Customer Reviews

No reviews yet.