| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

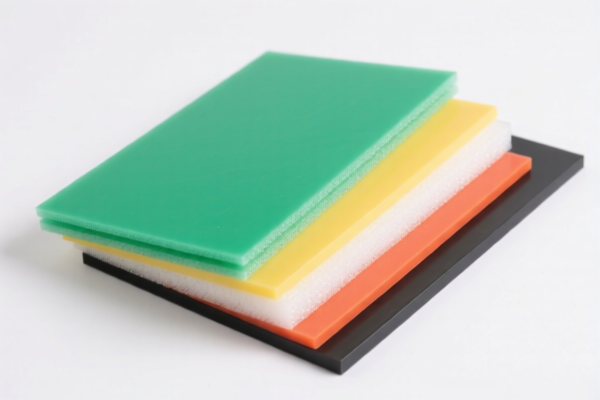

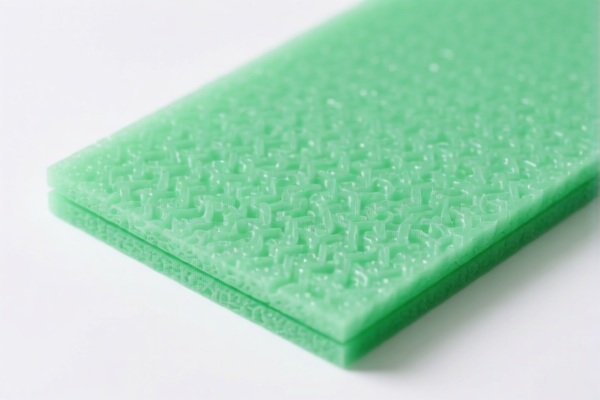

Product Name: PVC Foam Plastic Sheet (Thickness 2mm)

Classification: Plastic sheet, made of PVC (Polyvinyl Chloride), used for decorative purposes.

✅ HS CODE Classification Options:

- HS CODE:

3920490000 - Description: PVC (Polyvinyl Chloride) plastic sheets, not elsewhere specified.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Summary: This is the most likely classification for general-purpose PVC plastic sheets.

-

HS CODE:

3921125000 - Description: Decorative PVC sheets, made of vinyl polymers.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Summary: Suitable if the product is explicitly for decorative use.

-

HS CODE:

3924905650 - Description: Plastic sheets used for household or sanitary purposes, including decorative use.

- Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This classification is for decorative or household use, but may be less common for general-purpose PVC sheets.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All three classifications will be subject to an additional 30.0% tariff after this date. This is a critical date to be aware of for cost planning.

- Anti-dumping duties: Not applicable for PVC products under these HS codes.

- Material Verification: Confirm the exact composition and intended use of the product (e.g., decorative, industrial, or general-purpose) to ensure correct classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

📌 Proactive Advice:

- Verify the product's exact use and composition (e.g., is it foam or solid? Is it for decoration or industrial use?).

- Check with customs authorities or a qualified customs broker to confirm the most accurate HS code for your specific product.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Review documentation such as invoices, product specifications, and packaging to support the classification.

Let me know if you need help with customs documentation or further classification details.

Product Name: PVC Foam Plastic Sheet (Thickness 2mm)

Classification: Plastic sheet, made of PVC (Polyvinyl Chloride), used for decorative purposes.

✅ HS CODE Classification Options:

- HS CODE:

3920490000 - Description: PVC (Polyvinyl Chloride) plastic sheets, not elsewhere specified.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Summary: This is the most likely classification for general-purpose PVC plastic sheets.

-

HS CODE:

3921125000 - Description: Decorative PVC sheets, made of vinyl polymers.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Summary: Suitable if the product is explicitly for decorative use.

-

HS CODE:

3924905650 - Description: Plastic sheets used for household or sanitary purposes, including decorative use.

- Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Summary: This classification is for decorative or household use, but may be less common for general-purpose PVC sheets.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All three classifications will be subject to an additional 30.0% tariff after this date. This is a critical date to be aware of for cost planning.

- Anti-dumping duties: Not applicable for PVC products under these HS codes.

- Material Verification: Confirm the exact composition and intended use of the product (e.g., decorative, industrial, or general-purpose) to ensure correct classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

📌 Proactive Advice:

- Verify the product's exact use and composition (e.g., is it foam or solid? Is it for decoration or industrial use?).

- Check with customs authorities or a qualified customs broker to confirm the most accurate HS code for your specific product.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Review documentation such as invoices, product specifications, and packaging to support the classification.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.