| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

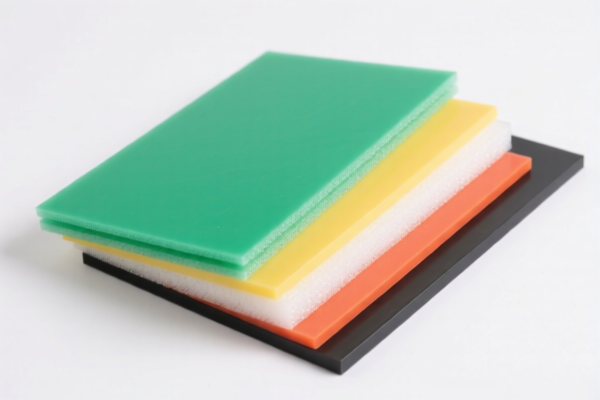

Product Classification: PVC Foam Plastic Sheet (for Display)

Based on the provided HS codes and descriptions, the PVC foam plastic sheet used for display purposes can be classified under several HS codes. Below is a structured breakdown of the classification options, tax rates, and relevant customs considerations.

1. HS CODE: 3920490000

- Description: PVC foam plastic sheet (for display) — PVC is a vinyl chloride polymer, and the product is a plastic sheet, which fits this classification.

- Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is a common classification for general-purpose PVC foam sheets.

- Ensure the product is not classified under a more specific code (e.g., 3921125000 or 3924905650) if it has specific decorative or functional features.

2. HS CODE: 3921125000

- Description: PVC foam plastic sheet (for display) — PVC is a vinyl polymer, and decorative panels are included in this category.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code is for decorative panels made of PVC.

- If the sheet is used for interior decoration or signage, this may be the most accurate classification.

3. HS CODE: 3924905650

- Description: PVC foam plastic sheet (for display) — classified under "other" categories of plastic products used for household or sanitary purposes.

- Total Tax Rate: 40.9%

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code is for plastic products used in household or sanitary applications.

- If the sheet is used for decorative or functional household purposes, this may be a valid classification.

4. HS CODE: 3921905050

- Description: PVC foam plastic sheet (for display) — classified under "other" plastic sheets, films, foils, etc.

- Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is a general category for other plastic sheets.

- If the product is not specifically decorative or functional, this may be the most appropriate classification.

5. HS CODE: 3920598000

- Description: PVC foam plastic sheet (for display) — this code exists and is applicable.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is a specific code for PVC foam sheets not covered by more detailed classifications.

- Ensure the product is not classified under a more specific code (e.g., 3921125000 or 3924905650).

Key Considerations for Customs Compliance

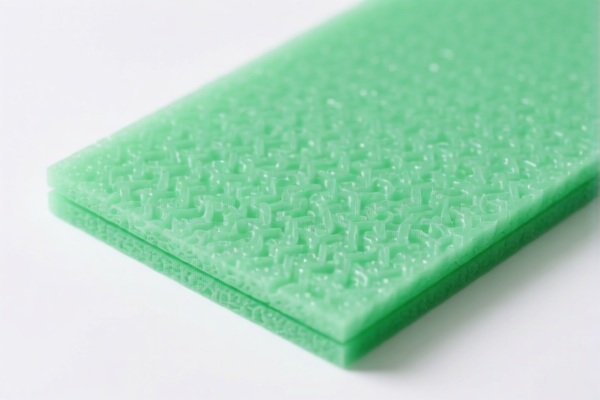

- Material Verification: Confirm the exact composition of the PVC foam sheet (e.g., whether it contains additives, foam structure, or is rigid/soft).

- Purpose of Use: If the sheet is for display, decoration, or functional use, this will influence the correct HS code.

- Unit Price and Certification: Verify the unit price and whether certifications (e.g., RoHS, REACH, or specific import permits) are required.

- April 11, 2025 Tariff Alert: All classifications listed above will be subject to an additional 30% tariff after April 11, 2025.

- Anti-Dumping Duties: Not applicable for PVC foam sheets unless specifically targeted by anti-dumping measures (check with customs or trade compliance experts).

Proactive Advice

- Double-check the product description and ensure it aligns with the most specific HS code.

- Consult with customs brokers or trade compliance experts to confirm the correct classification and avoid penalties.

- Keep records of product specifications, material composition, and intended use for customs audits.

Let me know if you need help determining the most accurate HS code based on your product’s specific features.

Product Classification: PVC Foam Plastic Sheet (for Display)

Based on the provided HS codes and descriptions, the PVC foam plastic sheet used for display purposes can be classified under several HS codes. Below is a structured breakdown of the classification options, tax rates, and relevant customs considerations.

1. HS CODE: 3920490000

- Description: PVC foam plastic sheet (for display) — PVC is a vinyl chloride polymer, and the product is a plastic sheet, which fits this classification.

- Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is a common classification for general-purpose PVC foam sheets.

- Ensure the product is not classified under a more specific code (e.g., 3921125000 or 3924905650) if it has specific decorative or functional features.

2. HS CODE: 3921125000

- Description: PVC foam plastic sheet (for display) — PVC is a vinyl polymer, and decorative panels are included in this category.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code is for decorative panels made of PVC.

- If the sheet is used for interior decoration or signage, this may be the most accurate classification.

3. HS CODE: 3924905650

- Description: PVC foam plastic sheet (for display) — classified under "other" categories of plastic products used for household or sanitary purposes.

- Total Tax Rate: 40.9%

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This code is for plastic products used in household or sanitary applications.

- If the sheet is used for decorative or functional household purposes, this may be a valid classification.

4. HS CODE: 3921905050

- Description: PVC foam plastic sheet (for display) — classified under "other" plastic sheets, films, foils, etc.

- Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is a general category for other plastic sheets.

- If the product is not specifically decorative or functional, this may be the most appropriate classification.

5. HS CODE: 3920598000

- Description: PVC foam plastic sheet (for display) — this code exists and is applicable.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes:

- This is a specific code for PVC foam sheets not covered by more detailed classifications.

- Ensure the product is not classified under a more specific code (e.g., 3921125000 or 3924905650).

Key Considerations for Customs Compliance

- Material Verification: Confirm the exact composition of the PVC foam sheet (e.g., whether it contains additives, foam structure, or is rigid/soft).

- Purpose of Use: If the sheet is for display, decoration, or functional use, this will influence the correct HS code.

- Unit Price and Certification: Verify the unit price and whether certifications (e.g., RoHS, REACH, or specific import permits) are required.

- April 11, 2025 Tariff Alert: All classifications listed above will be subject to an additional 30% tariff after April 11, 2025.

- Anti-Dumping Duties: Not applicable for PVC foam sheets unless specifically targeted by anti-dumping measures (check with customs or trade compliance experts).

Proactive Advice

- Double-check the product description and ensure it aligns with the most specific HS code.

- Consult with customs brokers or trade compliance experts to confirm the correct classification and avoid penalties.

- Keep records of product specifications, material composition, and intended use for customs audits.

Let me know if you need help determining the most accurate HS code based on your product’s specific features.

Customer Reviews

No reviews yet.