| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 9503000090 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

Here is the structured and professional analysis of the HS codes and tariff rates for PVC Foam Plastic Sheet (for Model Making), based on the provided data:

✅ Product Classification Overview: PVC Foam Plastic Sheet (for Model Making)

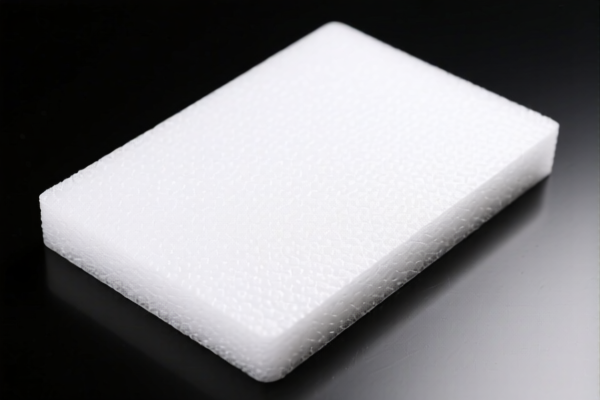

The product is a PVC foam plastic sheet used in model making, which is a type of plastic sheet. Based on the provided HS codes, several classifications are possible depending on the specific use and description of the product. Below is a breakdown of the relevant HS codes and their associated tariffs.

📦 HS Code Analysis

1. HS CODE: 3920490000

- Description: PVC (polyvinyl chloride) plastic sheets.

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is the most likely classification for PVC foam plastic sheets used in model making.

- Ensure the product is not classified under a more specific code (e.g., 3920190000 for rigid PVC sheets).

- Verify the material composition (e.g., is it foam or rigid?).

2. HS CODE: 3921125000

- Description: Decorative PVC sheets or panels.

- Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for decorative PVC products, which may not apply if the product is for model making (non-decorative use).

- Not recommended unless the product is explicitly for decorative purposes.

3. HS CODE: 3924905650

- Description: Plastic sheets used for household or sanitary purposes.

- Tariff Summary:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

- Notes:

- This code is for household or sanitary use, which may not align with model making.

- Not ideal unless the product is used in a household or sanitary context.

4. HS CODE: 9503000090

- Description: Toys, games, and model parts.

- Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 30.0%

- Notes:

- This code is for toys and model parts, which may be applicable if the PVC sheet is used as a model-making component.

- Consider this code if the product is clearly intended for model-making or toy production.

- Check if the product is classified as a toy or model part.

5. HS CODE: 3921905050

- Description: Other plastic sheets, films, etc.

- Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This is a catch-all code for other plastic sheets.

- Less preferred unless the product does not fit under more specific codes.

⚠️ Important Tariff Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff is applied to all the above codes after April 11, 2025.

- Anti-dumping duties: Not applicable for PVC foam sheets (not iron or aluminum).

- Certifications: Ensure the product has necessary certifications (e.g., REACH, RoHS) if exporting to the EU.

- Unit Price: Verify the unit price and material composition to ensure correct classification.

🛠️ Proactive Advice for Importers

- Confirm the exact use of the PVC foam sheet (model making, decorative, or general use).

- Check the material composition (e.g., foam, rigid, thickness, additives).

- Review the product description and technical specifications to match the most accurate HS code.

- Consult a customs broker or classification expert if the product is borderline between categories.

- Keep records of product samples and documentation for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured and professional analysis of the HS codes and tariff rates for PVC Foam Plastic Sheet (for Model Making), based on the provided data:

✅ Product Classification Overview: PVC Foam Plastic Sheet (for Model Making)

The product is a PVC foam plastic sheet used in model making, which is a type of plastic sheet. Based on the provided HS codes, several classifications are possible depending on the specific use and description of the product. Below is a breakdown of the relevant HS codes and their associated tariffs.

📦 HS Code Analysis

1. HS CODE: 3920490000

- Description: PVC (polyvinyl chloride) plastic sheets.

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is the most likely classification for PVC foam plastic sheets used in model making.

- Ensure the product is not classified under a more specific code (e.g., 3920190000 for rigid PVC sheets).

- Verify the material composition (e.g., is it foam or rigid?).

2. HS CODE: 3921125000

- Description: Decorative PVC sheets or panels.

- Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for decorative PVC products, which may not apply if the product is for model making (non-decorative use).

- Not recommended unless the product is explicitly for decorative purposes.

3. HS CODE: 3924905650

- Description: Plastic sheets used for household or sanitary purposes.

- Tariff Summary:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.9%

- Notes:

- This code is for household or sanitary use, which may not align with model making.

- Not ideal unless the product is used in a household or sanitary context.

4. HS CODE: 9503000090

- Description: Toys, games, and model parts.

- Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 30.0%

- Notes:

- This code is for toys and model parts, which may be applicable if the PVC sheet is used as a model-making component.

- Consider this code if the product is clearly intended for model-making or toy production.

- Check if the product is classified as a toy or model part.

5. HS CODE: 3921905050

- Description: Other plastic sheets, films, etc.

- Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This is a catch-all code for other plastic sheets.

- Less preferred unless the product does not fit under more specific codes.

⚠️ Important Tariff Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff is applied to all the above codes after April 11, 2025.

- Anti-dumping duties: Not applicable for PVC foam sheets (not iron or aluminum).

- Certifications: Ensure the product has necessary certifications (e.g., REACH, RoHS) if exporting to the EU.

- Unit Price: Verify the unit price and material composition to ensure correct classification.

🛠️ Proactive Advice for Importers

- Confirm the exact use of the PVC foam sheet (model making, decorative, or general use).

- Check the material composition (e.g., foam, rigid, thickness, additives).

- Review the product description and technical specifications to match the most accurate HS code.

- Consult a customs broker or classification expert if the product is borderline between categories.

- Keep records of product samples and documentation for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.