| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

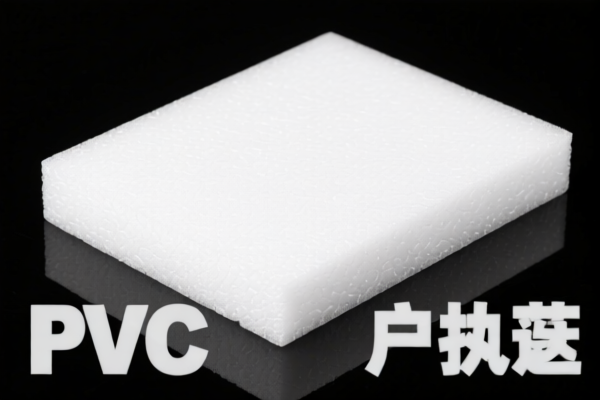

Product Classification: PVC Foam Plastic Sheet (for Interior Decoration)

HS CODE: 3920490000, 3921125000, 3924905650, 3921905050, 3926400090

✅ Classification Summary

Based on the product description — PVC Foam Plastic Sheet for Interior Decoration — the most likely and accurate HS code is 3920490000. This code is specifically for PVC (polyvinyl chloride) plastic sheets, which aligns with the product's material and intended use.

However, the following HS codes may also be relevant depending on the exact product specifications (e.g., thickness, foam structure, intended use, etc.):

📌 Tariff Overview (as of now, with future changes noted)

1. HS CODE: 3920490000

- Description: PVC plastic sheets

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is the most appropriate code for PVC foam sheets used in interior decoration.

2. HS CODE: 3921125000

- Description: PVC plastic sheets for decorative use

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Slightly higher base tariff than 3920490000, but similar overall rate.

3. HS CODE: 3924905650

- Description: Plastic sheets for household use (e.g., decorative)

- Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower overall tax rate, but may require more specific product details to confirm applicability.

4. HS CODE: 3921905050

- Description: Other plastic sheets, films, etc.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower base tariff, but may not be the most accurate for PVC foam sheets.

5. HS CODE: 3926400090

- Description: Decorative items made of plastic or other materials

- Total Tax Rate: 35.3%

- Base Tariff: 5.3%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: May apply if the product is considered a decorative item rather than a construction or interior material.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not applicable for PVC foam sheets unless the product is subject to specific anti-dumping measures (not indicated in the data provided). -

Certifications and Documentation:

- Verify the material composition (e.g., is it 100% PVC foam or a composite?)

- Confirm the unit price and quantity for accurate tax calculation

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country

-

Proactive Action:

- Confirm the most accurate HS code with customs or a classification expert based on the product’s exact specifications.

- Review the April 11, 2025 tariff change and adjust pricing or sourcing strategies accordingly.

📌 Summary Table

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Tariff |

|---|---|---|---|---|---|

| 3920490000 | PVC plastic sheets | 60.8% | 5.8% | 25.0% | 30.0% |

| 3921125000 | PVC decorative sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 3924905650 | Plastic sheets for household use | 40.9% | 3.4% | 7.5% | 30.0% |

| 3921905050 | Other plastic sheets | 34.8% | 4.8% | 0.0% | 30.0% |

| 3926400090 | Decorative plastic items | 35.3% | 5.3% | 0.0% | 30.0% |

If you have more details about the product (e.g., thickness, foam density, intended use), I can help refine the classification further.

Product Classification: PVC Foam Plastic Sheet (for Interior Decoration)

HS CODE: 3920490000, 3921125000, 3924905650, 3921905050, 3926400090

✅ Classification Summary

Based on the product description — PVC Foam Plastic Sheet for Interior Decoration — the most likely and accurate HS code is 3920490000. This code is specifically for PVC (polyvinyl chloride) plastic sheets, which aligns with the product's material and intended use.

However, the following HS codes may also be relevant depending on the exact product specifications (e.g., thickness, foam structure, intended use, etc.):

📌 Tariff Overview (as of now, with future changes noted)

1. HS CODE: 3920490000

- Description: PVC plastic sheets

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This is the most appropriate code for PVC foam sheets used in interior decoration.

2. HS CODE: 3921125000

- Description: PVC plastic sheets for decorative use

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Slightly higher base tariff than 3920490000, but similar overall rate.

3. HS CODE: 3924905650

- Description: Plastic sheets for household use (e.g., decorative)

- Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower overall tax rate, but may require more specific product details to confirm applicability.

4. HS CODE: 3921905050

- Description: Other plastic sheets, films, etc.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower base tariff, but may not be the most accurate for PVC foam sheets.

5. HS CODE: 3926400090

- Description: Decorative items made of plastic or other materials

- Total Tax Rate: 35.3%

- Base Tariff: 5.3%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: May apply if the product is considered a decorative item rather than a construction or interior material.

⚠️ Important Notes and Recommendations

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-dumping duties:

Not applicable for PVC foam sheets unless the product is subject to specific anti-dumping measures (not indicated in the data provided). -

Certifications and Documentation:

- Verify the material composition (e.g., is it 100% PVC foam or a composite?)

- Confirm the unit price and quantity for accurate tax calculation

-

Check if certifications (e.g., fire resistance, environmental compliance) are required for import into the destination country

-

Proactive Action:

- Confirm the most accurate HS code with customs or a classification expert based on the product’s exact specifications.

- Review the April 11, 2025 tariff change and adjust pricing or sourcing strategies accordingly.

📌 Summary Table

| HS CODE | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Tariff |

|---|---|---|---|---|---|

| 3920490000 | PVC plastic sheets | 60.8% | 5.8% | 25.0% | 30.0% |

| 3921125000 | PVC decorative sheets | 61.5% | 6.5% | 25.0% | 30.0% |

| 3924905650 | Plastic sheets for household use | 40.9% | 3.4% | 7.5% | 30.0% |

| 3921905050 | Other plastic sheets | 34.8% | 4.8% | 0.0% | 30.0% |

| 3926400090 | Decorative plastic items | 35.3% | 5.3% | 0.0% | 30.0% |

If you have more details about the product (e.g., thickness, foam density, intended use), I can help refine the classification further.

Customer Reviews

No reviews yet.