Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

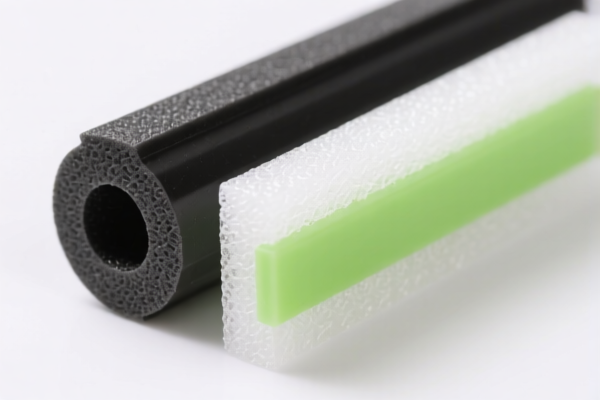

Product Name: PVC Foam Plastic Strip

HS CODE: 3921125000

🔍 Classification Summary:

- Product Type: PVC foam plastic strip (including strips, bands, or boards made of PVC foam).

- HS CODE: 3921125000 (according to the Chinese HS system).

- Description: This code applies to PVC foam plastic strips, bands, or boards, regardless of whether they are used for industrial, construction, or decorative purposes.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of PVC foam and not a composite or modified material that might fall under a different HS code.

- Unit Price and Packaging: Customs may inspect the product to ensure it matches the declared HS code and unit price.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Alternative HS Code: If the product is a solid PVC strip (not foam), it may fall under 3916.20.00.91 (HS CODE: 3916200020), which has a slightly lower total tax rate of 60.8%.

🛑 Proactive Advice:

- Double-check the product's composition to ensure it is classified under 3921125000 and not a different HS code.

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with customs brokers or legal advisors if the product is used in regulated industries (e.g., construction, automotive, or medical).

- Keep documentation ready (e.g., material certificates, invoices, and product specifications) to support the HS code classification during customs clearance.

Let me know if you need help with HS code verification or tariff calculation for other products.

Product Name: PVC Foam Plastic Strip

HS CODE: 3921125000

🔍 Classification Summary:

- Product Type: PVC foam plastic strip (including strips, bands, or boards made of PVC foam).

- HS CODE: 3921125000 (according to the Chinese HS system).

- Description: This code applies to PVC foam plastic strips, bands, or boards, regardless of whether they are used for industrial, construction, or decorative purposes.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of PVC foam and not a composite or modified material that might fall under a different HS code.

- Unit Price and Packaging: Customs may inspect the product to ensure it matches the declared HS code and unit price.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Alternative HS Code: If the product is a solid PVC strip (not foam), it may fall under 3916.20.00.91 (HS CODE: 3916200020), which has a slightly lower total tax rate of 60.8%.

🛑 Proactive Advice:

- Double-check the product's composition to ensure it is classified under 3921125000 and not a different HS code.

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with customs brokers or legal advisors if the product is used in regulated industries (e.g., construction, automotive, or medical).

- Keep documentation ready (e.g., material certificates, invoices, and product specifications) to support the HS code classification during customs clearance.

Let me know if you need help with HS code verification or tariff calculation for other products.

Customer Reviews

No reviews yet.