Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

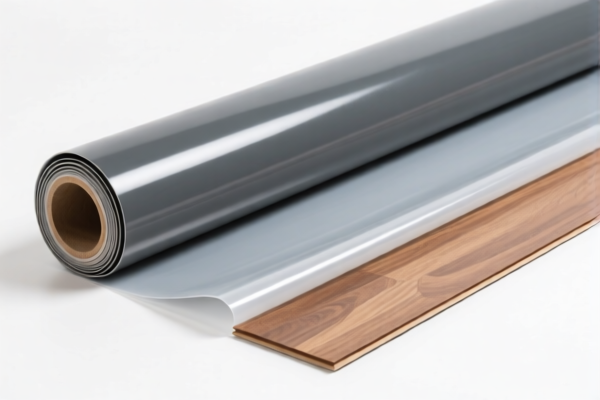

Product Classification: PVC Home Floor Covering Rolls

HS CODEs and Tax Details:

- HS CODE: 3918101020

- Description: PVC floor rolls, plastic floor coverings in roll form.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918901000

- Description: Plastic floor coverings in roll form (not specifically PVC).

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101030

- Description: PVC roll floor, falls under the 3918 classification.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918102000

- Description: Plastic carpets, floor or wall/ceiling coverings in roll form.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101040

- Description: PVC roll floor, plastic floor coverings in roll form.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- All listed HS codes have the same total tax rate of 60.3%, with the same breakdown of base, additional, and special tariffs.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will be applied, increasing the total tax burden significantly. Ensure your import timeline is planned accordingly.

- No specific anti-dumping duties on iron or aluminum are mentioned for these products, as they are PVC-based.

- Material and Certification Requirements: Verify the exact composition of the PVC floor (e.g., PVC content, additives, etc.) and confirm if any certifications (e.g., fire resistance, environmental standards) are required for import.

✅ Proactive Advice:

- Confirm the exact HS code based on the product's composition and form (e.g., whether it's 100% PVC or mixed with other materials).

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Review required documentation such as product specifications, certificates of origin, and compliance with local safety standards.

-

Plan for the April 11, 2025, tariff increase to avoid unexpected costs. Product Classification: PVC Home Floor Covering Rolls

HS CODEs and Tax Details: -

HS CODE: 3918101020

- Description: PVC floor rolls, plastic floor coverings in roll form.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918901000

- Description: Plastic floor coverings in roll form (not specifically PVC).

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101030

- Description: PVC roll floor, falls under the 3918 classification.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918102000

- Description: Plastic carpets, floor or wall/ceiling coverings in roll form.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3918101040

- Description: PVC roll floor, plastic floor coverings in roll form.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- All listed HS codes have the same total tax rate of 60.3%, with the same breakdown of base, additional, and special tariffs.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will be applied, increasing the total tax burden significantly. Ensure your import timeline is planned accordingly.

- No specific anti-dumping duties on iron or aluminum are mentioned for these products, as they are PVC-based.

- Material and Certification Requirements: Verify the exact composition of the PVC floor (e.g., PVC content, additives, etc.) and confirm if any certifications (e.g., fire resistance, environmental standards) are required for import.

✅ Proactive Advice:

- Confirm the exact HS code based on the product's composition and form (e.g., whether it's 100% PVC or mixed with other materials).

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Review required documentation such as product specifications, certificates of origin, and compliance with local safety standards.

- Plan for the April 11, 2025, tariff increase to avoid unexpected costs.

Customer Reviews

No reviews yet.