| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

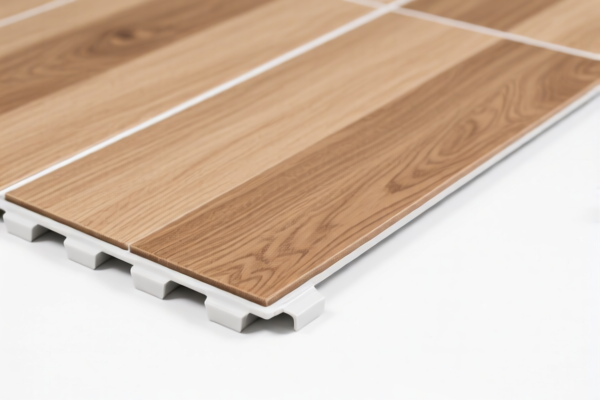

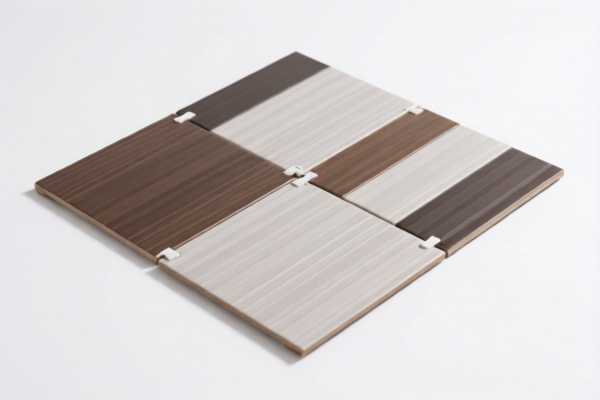

Product Classification: PVC Indoor Floor Tiles

HS CODEs:

- 3918102000

- 3918101030

- 3918101040

- 3918101020

- 3918901000

🔍 Key Tax Rate Overview

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3% (5.3% + 25.0% + 30.0%)

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your import planning. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for PVC indoor floor tiles under these HS codes.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed made of PVC and not a composite or mixed material, as this may affect classification. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult Customs Broker:

For complex cases, it is advisable to consult a customs broker or a compliance expert to ensure accurate classification and tax calculation.

📋 Summary Table for Reference

| HS CODE | Product Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax |

|---|---|---|---|---|---|

| 3918102000 | PVC瓷砖地板 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101030 | PVC地板砖(室内) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101040 | PVC地砖(室内用) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101020 | PVC地板砖 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918901000 | PVC地板砖 | 5.3% | 25.0% | 30.0% | 60.3% |

If you have more details about the product (e.g., thickness, use case, or country of origin), I can provide a more tailored analysis.

Product Classification: PVC Indoor Floor Tiles

HS CODEs:

- 3918102000

- 3918101030

- 3918101040

- 3918101020

- 3918901000

🔍 Key Tax Rate Overview

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3% (5.3% + 25.0% + 30.0%)

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in your import planning. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for PVC indoor floor tiles under these HS codes.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the product is indeed made of PVC and not a composite or mixed material, as this may affect classification. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., fire resistance, environmental standards) are required for import into the destination country. -

Monitor Tariff Updates:

Keep track of any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs. -

Consult Customs Broker:

For complex cases, it is advisable to consult a customs broker or a compliance expert to ensure accurate classification and tax calculation.

📋 Summary Table for Reference

| HS CODE | Product Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tax |

|---|---|---|---|---|---|

| 3918102000 | PVC瓷砖地板 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101030 | PVC地板砖(室内) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101040 | PVC地砖(室内用) | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101020 | PVC地板砖 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918901000 | PVC地板砖 | 5.3% | 25.0% | 30.0% | 60.3% |

If you have more details about the product (e.g., thickness, use case, or country of origin), I can provide a more tailored analysis.

Customer Reviews

No reviews yet.