| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

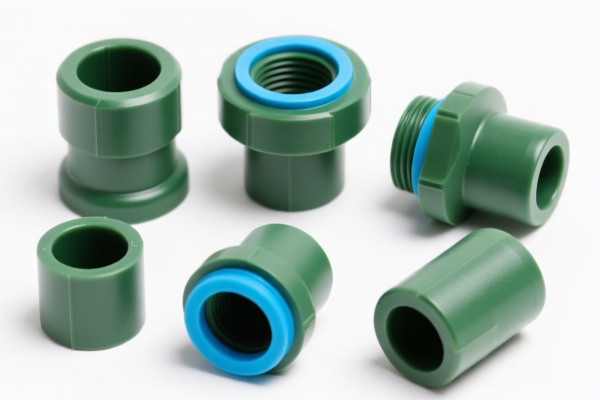

Product Classification: PVC Joints (PVC管件)

Customs HS Code Analysis and Tax Overview

Below is the detailed breakdown of the HS codes and associated tariffs for PVC joints, based on your input:

✅ HS CODE: 3904400000

- Description: PVC joints made from polyvinyl chloride (PVC) or other halogenated ethylene polymers, falling under HS Chapter 3904.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is suitable for PVC joints that are not further processed or modified.

✅ HS CODE: 3917400095

- Description: Plastic pipes, fittings, and hose fittings, including PVC joints, under HS Chapter 3917.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is broader and includes various types of plastic fittings, including PVC joints.

✅ HS CODE: 3917320010

- Description: Plastic pipes and fittings made of polyvinyl chloride (PVC), including PVC joints.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is more specific to PVC-based products and may be more accurate for PVC joints.

✅ HS CODE: 3904220000

- Description: PVC pipes made from plastic, including PVC joints, under HS Chapter 3904.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for PVC in its primary form, such as raw or semi-processed materials, and may not be ideal for finished joints.

✅ HS CODE: 3921125000

- Description: Plastic sheets, films, and foams made of PVC, including PVC joints (if applicable).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for flat or sheet-like PVC products and may not be the best fit for PVC joints.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All codes listed above will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy, so ensure your import timeline aligns with this change.

🛠️ Proactive Advice for Importers:

- Verify Material: Confirm whether the product is made of PVC or other materials, as this affects HS code classification.

- Check Unit Price: Tariff rates can vary based on the declared value and may affect the final cost.

- Certifications Required: Some products may require specific certifications (e.g., RoHS, REACH) for compliance.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance.

If you provide more details (e.g., product specifications, end-use, or country of origin), I can help you further narrow down the most accurate HS code and tax implications.

Product Classification: PVC Joints (PVC管件)

Customs HS Code Analysis and Tax Overview

Below is the detailed breakdown of the HS codes and associated tariffs for PVC joints, based on your input:

✅ HS CODE: 3904400000

- Description: PVC joints made from polyvinyl chloride (PVC) or other halogenated ethylene polymers, falling under HS Chapter 3904.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is suitable for PVC joints that are not further processed or modified.

✅ HS CODE: 3917400095

- Description: Plastic pipes, fittings, and hose fittings, including PVC joints, under HS Chapter 3917.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is broader and includes various types of plastic fittings, including PVC joints.

✅ HS CODE: 3917320010

- Description: Plastic pipes and fittings made of polyvinyl chloride (PVC), including PVC joints.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is more specific to PVC-based products and may be more accurate for PVC joints.

✅ HS CODE: 3904220000

- Description: PVC pipes made from plastic, including PVC joints, under HS Chapter 3904.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for PVC in its primary form, such as raw or semi-processed materials, and may not be ideal for finished joints.

✅ HS CODE: 3921125000

- Description: Plastic sheets, films, and foams made of PVC, including PVC joints (if applicable).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for flat or sheet-like PVC products and may not be the best fit for PVC joints.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All codes listed above will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy, so ensure your import timeline aligns with this change.

🛠️ Proactive Advice for Importers:

- Verify Material: Confirm whether the product is made of PVC or other materials, as this affects HS code classification.

- Check Unit Price: Tariff rates can vary based on the declared value and may affect the final cost.

- Certifications Required: Some products may require specific certifications (e.g., RoHS, REACH) for compliance.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance.

If you provide more details (e.g., product specifications, end-use, or country of origin), I can help you further narrow down the most accurate HS code and tax implications.

Customer Reviews

No reviews yet.