| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920430000 | Doc | Error | CN | US | 2025-05-12 |

Okay, let's break down the classification and potential implications for your declared item: PVC PLATE based on the HS Code provided.

Here's a structured analysis:

1. HS Code: 3920.43.00.00 – Detailed Breakdown

- Chapter 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 3920: Plates, sheets, film, foil and strip, of plastics. This narrows it down to flat forms of plastic.

- 3920.4: Non-cellular and not reinforced plates, sheets, film, foil and strip. This specifies that the PVC plate is not foam-like (non-cellular) and doesn't have any strengthening materials embedded within it (not reinforced).

- 3920.43: Laminated, supported or similarly combined with other materials. This is key! Your PVC plate is combined with other materials – meaning it's not a simple, single-layer PVC sheet. This could be a backing layer, a coating, or something else.

- 3920.43.00.00: This is the most specific code, indicating "Of polymers of vinyl chloride" – which confirms it's made of PVC (Polyvinyl Chloride).

2. Key Considerations & Implications

- Lamination/Combination is Crucial: The fact that your plate is laminated or combined with other materials significantly impacts classification. The nature of those other materials is important. For example:

- If it's laminated with fabric, it might fall under a different sub-heading.

- If it has a paper backing, that could change the classification.

- Non-Cellular & Not Reinforced: This confirms it's a solid PVC sheet, not foam PVC or a composite with strengthening fibers.

- Tax Information: The system currently reports "Failed to retrieve tax information" and "Error" for total tax. This is a problem. You must get accurate tax information before proceeding with import/export. (See "Next Steps" below).

3. Potential Issues & Questions for You

- Material Composition: What exactly are the other materials combined with the PVC? Provide a detailed breakdown of the layers and their composition.

- Thickness: The thickness of the PVC plate can sometimes influence classification.

- Application: What is the intended use of the PVC plate? (e.g., construction, signage, packaging).

- Single or Multiple Layers: Is it a simple laminate (PVC + one other material) or a more complex multi-layer structure?

4. Next Steps – Very Important!

- Confirm Tax Rate: You must obtain the correct tax rate for HS Code 3920.43.00.00 for your importing country. Contact your customs broker or the customs authority directly. The "Error" message indicates a critical issue that needs to be resolved.

- Review with Customs Broker: I strongly recommend consulting with a qualified customs broker in your importing country. They can review the detailed material composition and intended use of your PVC plate to ensure accurate classification.

- Documentation: Be prepared to provide detailed documentation, including:

- Bill of Materials (BOM)

- Technical Data Sheet (TDS)

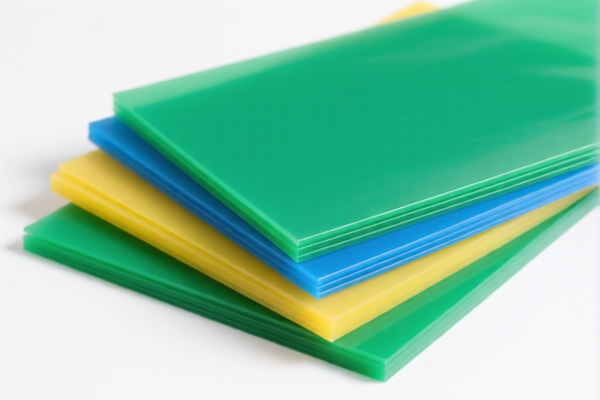

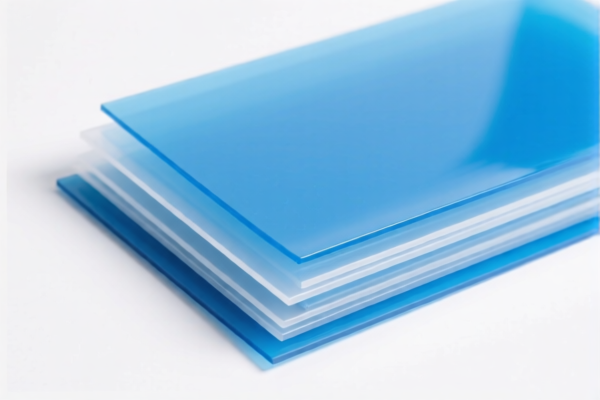

- Photos of the PVC plate (showing all layers)

- Invoice with a clear description of the materials.

- Certifications: Depending on the application and importing country, you may need certifications (e.g., REACH compliance, RoHS compliance, fire resistance certifications). Check the specific requirements for your product and destination country.

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. Always consult with a qualified customs broker or the customs authority in your importing country for accurate and up-to-date information.

Customer Reviews

The page was informative, but I was disappointed that the tariff rate was listed as an error. It would have been better if the data was complete.

Really useful for understanding how the laminated structure of PVC plates affects HS Code classification. I'll be sharing this with my export team.

The information on the HS Code classification was clear and helpful. I wish the tariff rate wasn't an error, but the analysis was thorough.

Great breakdown of HS Code 3920.43.00.00 for PVC plates. The detailed explanation of laminated materials was exactly what I needed for exporting.