| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

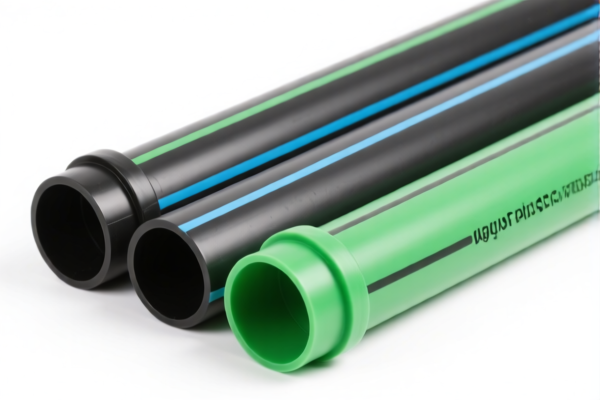

Product Classification: PVC Plastic Agriculture Tubes

Based on the provided HS codes and descriptions, the following classifications and tariff details are outlined for PVC plastic agriculture tubes and related products:

🔍 HS CODE: 3916200091

Description: PVC plastic tubes, classified under other polyvinyl chloride (PVC) polymer monofilaments, rods, sticks, and profiles.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Note: This classification is for PVC tubes that are not specifically for agricultural use but are general-purpose.

🔍 HS CODE: 3917320010

Description: PVC agricultural irrigation tubes, classified as plastic tubes made of polyvinyl chloride (PVC), not reinforced or combined with other materials, and without fittings.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This is a common classification for PVC agricultural irrigation tubes.

🔍 HS CODE: 3917230000

Description: PVC agricultural irrigation tubes, classified as rigid plastic tubes made of polyvinyl chloride (PVC).

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This classification is for rigid PVC tubes used in agriculture.

🔍 HS CODE: 3917390020

Description: PVC agricultural irrigation fittings, classified as plastic tubes and fittings made of polyvinyl chloride (PVC).

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Note: This classification applies to PVC fittings used in irrigation systems.

🔍 HS CODE: 3904210000

Description: PVC raw material for agricultural tubes, classified as the primary form of unplasticized polyvinyl chloride.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is for raw PVC material used in the production of agricultural tubes.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Material Verification: Confirm the exact material composition (e.g., unplasticized vs. plasticized PVC) and whether the product is reinforced or combined with other materials.

- Certifications: Check if any certifications (e.g., food-grade, agricultural use) are required for customs clearance.

- Unit Price: Be aware of the unit price and whether it affects the classification (e.g., bulk vs. retail packaging).

- Tariff Exemptions: Inquire about any possible exemptions or preferential trade agreements that may apply to your product.

If you provide more details about the specific product (e.g., dimensions, intended use, packaging), I can help you further refine the classification and tax calculation.

Product Classification: PVC Plastic Agriculture Tubes

Based on the provided HS codes and descriptions, the following classifications and tariff details are outlined for PVC plastic agriculture tubes and related products:

🔍 HS CODE: 3916200091

Description: PVC plastic tubes, classified under other polyvinyl chloride (PVC) polymer monofilaments, rods, sticks, and profiles.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Note: This classification is for PVC tubes that are not specifically for agricultural use but are general-purpose.

🔍 HS CODE: 3917320010

Description: PVC agricultural irrigation tubes, classified as plastic tubes made of polyvinyl chloride (PVC), not reinforced or combined with other materials, and without fittings.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This is a common classification for PVC agricultural irrigation tubes.

🔍 HS CODE: 3917230000

Description: PVC agricultural irrigation tubes, classified as rigid plastic tubes made of polyvinyl chloride (PVC).

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This classification is for rigid PVC tubes used in agriculture.

🔍 HS CODE: 3917390020

Description: PVC agricultural irrigation fittings, classified as plastic tubes and fittings made of polyvinyl chloride (PVC).

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Note: This classification applies to PVC fittings used in irrigation systems.

🔍 HS CODE: 3904210000

Description: PVC raw material for agricultural tubes, classified as the primary form of unplasticized polyvinyl chloride.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This is for raw PVC material used in the production of agricultural tubes.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Material Verification: Confirm the exact material composition (e.g., unplasticized vs. plasticized PVC) and whether the product is reinforced or combined with other materials.

- Certifications: Check if any certifications (e.g., food-grade, agricultural use) are required for customs clearance.

- Unit Price: Be aware of the unit price and whether it affects the classification (e.g., bulk vs. retail packaging).

- Tariff Exemptions: Inquire about any possible exemptions or preferential trade agreements that may apply to your product.

If you provide more details about the specific product (e.g., dimensions, intended use, packaging), I can help you further refine the classification and tax calculation.

Customer Reviews

No reviews yet.