| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

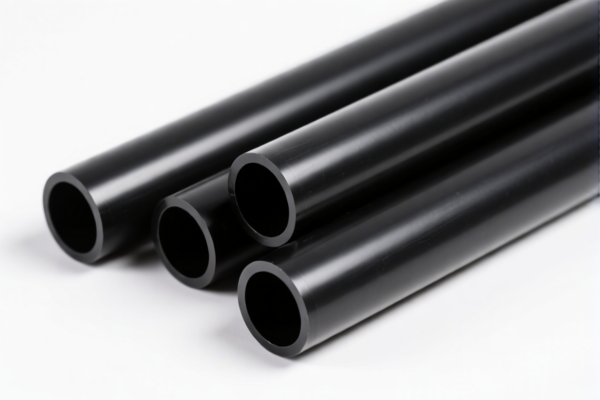

Product Classification: PVC Plastic Black Tubes

HS CODE: 3917230000, 3917320010, 3917320050, 3917330000

🔍 Classification Summary

PVC black tubes are classified under several HS codes depending on specific attributes such as usage (e.g., drainage,排污), whether they are reinforced or combined with other materials, and whether they include fittings. The most common classifications are:

- 3917230000 – Hard PVC tubes

- 3917320010 – PVC drainage tubes

- 3917320050 – Other black plastic drainage tubes (no specific material restriction)

- 3917330000 – PVC排污 tubes (not reinforced, no combination with other materials)

📊 Tariff Overview

- Base Tariff Rate: 3.1% (applies to all listed HS codes)

- Additional Tariff (General): 25.0% (applies to all listed HS codes)

- April 11, 2025 Special Tariff: 30.0% (applies to all listed HS codes)

- Anti-dumping duties on iron and aluminum: Not applicable (these are not metal products)

⚠️ Time-sensitive Policy Alert

- Additional tariffs of 30.0% will be imposed after April 11, 2025.

- This applies to all the listed HS codes. Ensure your customs declarations are updated accordingly.

📌 Proactive Advice for Importers

- Verify the material composition (e.g., is it 100% PVC or mixed with other materials?) to ensure correct HS code classification.

- Check if the tubes include fittings (e.g., connectors, valves), as this may affect the classification.

- Confirm the intended use (e.g., drainage,排污, general-purpose) to align with the most accurate HS code.

- Review required certifications (e.g., RoHS, REACH, or other local compliance standards) before import.

- Monitor tariff changes after April 11, 2025, as they may significantly increase the total import cost.

📌 Tax Summary Table

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|

| 3917230000 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917320010 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917320050 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917330000 | 33.1% | 3.1% | 0.0% | 30.0% |

If you have specific product details (e.g., dimensions, fittings, usage), I can help you further refine the HS code and tax calculation.

Product Classification: PVC Plastic Black Tubes

HS CODE: 3917230000, 3917320010, 3917320050, 3917330000

🔍 Classification Summary

PVC black tubes are classified under several HS codes depending on specific attributes such as usage (e.g., drainage,排污), whether they are reinforced or combined with other materials, and whether they include fittings. The most common classifications are:

- 3917230000 – Hard PVC tubes

- 3917320010 – PVC drainage tubes

- 3917320050 – Other black plastic drainage tubes (no specific material restriction)

- 3917330000 – PVC排污 tubes (not reinforced, no combination with other materials)

📊 Tariff Overview

- Base Tariff Rate: 3.1% (applies to all listed HS codes)

- Additional Tariff (General): 25.0% (applies to all listed HS codes)

- April 11, 2025 Special Tariff: 30.0% (applies to all listed HS codes)

- Anti-dumping duties on iron and aluminum: Not applicable (these are not metal products)

⚠️ Time-sensitive Policy Alert

- Additional tariffs of 30.0% will be imposed after April 11, 2025.

- This applies to all the listed HS codes. Ensure your customs declarations are updated accordingly.

📌 Proactive Advice for Importers

- Verify the material composition (e.g., is it 100% PVC or mixed with other materials?) to ensure correct HS code classification.

- Check if the tubes include fittings (e.g., connectors, valves), as this may affect the classification.

- Confirm the intended use (e.g., drainage,排污, general-purpose) to align with the most accurate HS code.

- Review required certifications (e.g., RoHS, REACH, or other local compliance standards) before import.

- Monitor tariff changes after April 11, 2025, as they may significantly increase the total import cost.

📌 Tax Summary Table

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | April 11 Special Tariff |

|---|---|---|---|---|

| 3917230000 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917320010 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917320050 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917330000 | 33.1% | 3.1% | 0.0% | 30.0% |

If you have specific product details (e.g., dimensions, fittings, usage), I can help you further refine the HS code and tax calculation.

Customer Reviews

No reviews yet.