Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

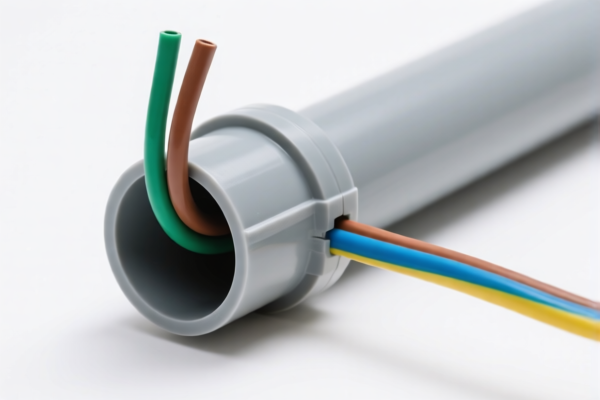

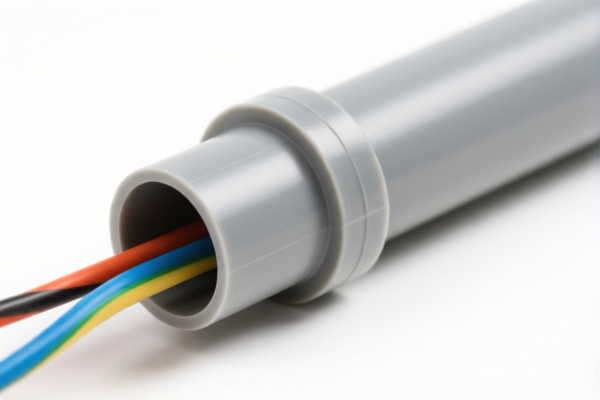

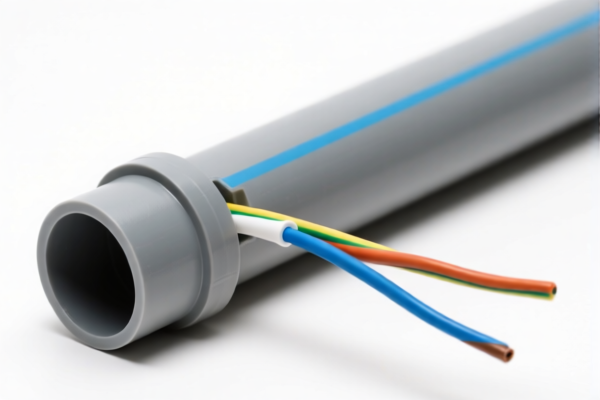

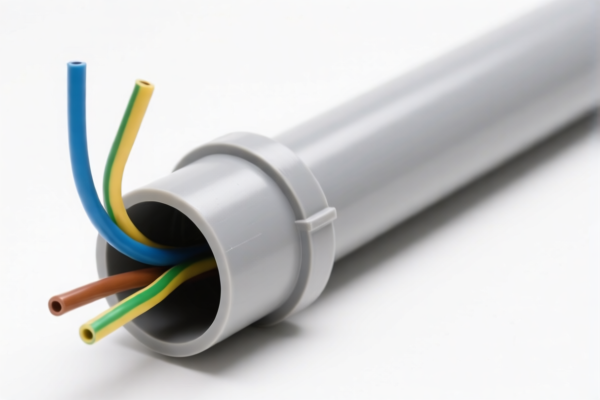

Product Classification: PVC Plastic Conduit

HS CODEs and Tax Information Summary

Below are the HS codes and corresponding tax details for PVC plastic conduit, based on your input:

✅ HS CODE: 3904220000

- Description: PVC conduit (PVC is a chlorinated ethylene polymer), classified under primary forms of plastic products, including plasticized polyvinyl chloride.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to PVC conduit that is in a primary or semi-finished form.

✅ HS CODE: 3917230000

- Description: PVC electrical conduit, classified under rigid plastic pipes made of vinyl polymers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is suitable for rigid PVC conduits used in electrical applications.

✅ HS CODE: 3917390020

- Description: PVC electrical conduit, made of polyvinyl chloride (PVC), without metal reinforcement.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for PVC conduits that are not reinforced with metal.

✅ HS CODE: 3926909987

- Description: PVC electrical conduit, classified under "other rigid tubes or pipes for use as wiring conduits" under Chapter 39.

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for other rigid plastic conduits not covered by more specific codes.

✅ HS CODE: 3916200091

- Description: PVC plastic conductive rod, classified under single filaments, rods, or profiles of polyvinyl chloride (PVC) without further processing.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to PVC rods used for conductive purposes, not for conduit.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-dumping duties: Not specifically mentioned for PVC conduit, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material and Certification: Confirm the exact material composition (e.g., whether it is plasticized or rigid PVC) and certifications required (e.g., fire resistance, electrical safety).

- Unit Price and Classification: Double-check the HS code classification based on the product's form, use, and specifications to avoid misclassification penalties.

🛠️ Proactive Advice:

- Verify the product's exact description (e.g., whether it is a conduit, rod, or other form).

- Consult with customs brokers or classification experts if the product has mixed materials or special features.

- Keep records of product specifications, material composition, and intended use for customs compliance.

Product Classification: PVC Plastic Conduit

HS CODEs and Tax Information Summary

Below are the HS codes and corresponding tax details for PVC plastic conduit, based on your input:

✅ HS CODE: 3904220000

- Description: PVC conduit (PVC is a chlorinated ethylene polymer), classified under primary forms of plastic products, including plasticized polyvinyl chloride.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to PVC conduit that is in a primary or semi-finished form.

✅ HS CODE: 3917230000

- Description: PVC electrical conduit, classified under rigid plastic pipes made of vinyl polymers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is suitable for rigid PVC conduits used in electrical applications.

✅ HS CODE: 3917390020

- Description: PVC electrical conduit, made of polyvinyl chloride (PVC), without metal reinforcement.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for PVC conduits that are not reinforced with metal.

✅ HS CODE: 3926909987

- Description: PVC electrical conduit, classified under "other rigid tubes or pipes for use as wiring conduits" under Chapter 39.

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for other rigid plastic conduits not covered by more specific codes.

✅ HS CODE: 3916200091

- Description: PVC plastic conductive rod, classified under single filaments, rods, or profiles of polyvinyl chloride (PVC) without further processing.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to PVC rods used for conductive purposes, not for conduit.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-dumping duties: Not specifically mentioned for PVC conduit, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material and Certification: Confirm the exact material composition (e.g., whether it is plasticized or rigid PVC) and certifications required (e.g., fire resistance, electrical safety).

- Unit Price and Classification: Double-check the HS code classification based on the product's form, use, and specifications to avoid misclassification penalties.

🛠️ Proactive Advice:

- Verify the product's exact description (e.g., whether it is a conduit, rod, or other form).

- Consult with customs brokers or classification experts if the product has mixed materials or special features.

- Keep records of product specifications, material composition, and intended use for customs compliance.

Customer Reviews

No reviews yet.