| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926905900 | Doc | 57.4% | CN | US | 2025-05-12 |

| 3926905700 | Doc | 61.5% | CN | US | 2025-05-12 |

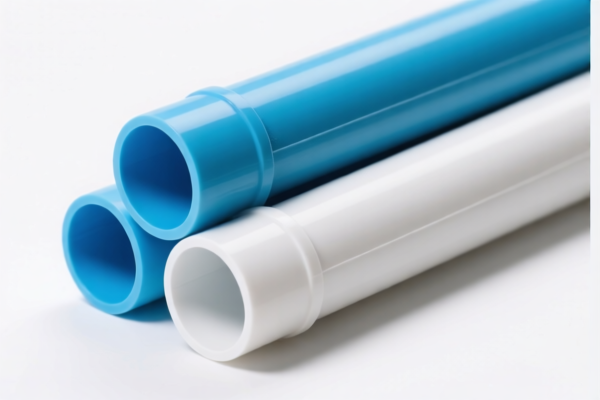

Product Classification: PVC Plastic Conveyor Tubes

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3917390020

- Product: PVC 输送管 (PVC Conveyor Tube)

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs beyond the April 11, 2025, policy.

-

HS CODE: 3917320050 / 3917320010

- Product: PVC 输水管 (PVC Water Supply Pipe) / PVC 化学品输送管 (PVC Chemical Conveyor Tube)

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applies to both general water supply and chemical conveyor tubes.

-

HS CODE: 3904220000

- Product: PVC 输液管 (PVC Intravenous Tube)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff due to medical use classification.

-

HS CODE: 3926905900 / 3926905700

- Product: PVC 输送带 (PVC Conveyor Belt)

- Total Tax Rate: 57.4% / 61.5%

- Breakdown:

- Base Tariff: 2.4% / 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Two different codes for conveyor belts; check product specifics for correct classification.

Key Observations:

-

April 11, 2025, Special Tariff:

A 30.0% additional tariff is imposed on all listed products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations. -

Anti-Dumping Duties:

No specific anti-dumping duties are listed for PVC conveyor tubes in the provided data. However, it is advisable to verify if any anti-dumping measures apply based on the country of origin. -

Tax Variations:

The base tariff varies depending on the product type (e.g., medical vs. industrial use). For example, PVC 输液管 (3904220000) has a higher base tariff due to its medical classification.

Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is indeed made of PVC and not a composite or reinforced material, which may fall under a different HS code. -

Check Required Certifications:

For medical or chemical use products (e.g., 输液管, 化学品输送管), additional certifications may be required for customs clearance. -

Confirm Product Description:

Use precise product descriptions (e.g., "conveyor tube" vs. "water supply pipe") to ensure correct HS code classification. -

Monitor Tariff Updates:

Stay informed about any changes in tariff policies, especially after April 11, 2025, as this could significantly impact import costs. Product Classification: PVC Plastic Conveyor Tubes

HS CODEs and Tax Details (April 2025 Update): -

HS CODE: 3917390020

- Product: PVC 输送管 (PVC Conveyor Tube)

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: No anti-dumping duties or special tariffs beyond the April 11, 2025, policy.

-

HS CODE: 3917320050 / 3917320010

- Product: PVC 输水管 (PVC Water Supply Pipe) / PVC 化学品输送管 (PVC Chemical Conveyor Tube)

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applies to both general water supply and chemical conveyor tubes.

-

HS CODE: 3904220000

- Product: PVC 输液管 (PVC Intravenous Tube)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff due to medical use classification.

-

HS CODE: 3926905900 / 3926905700

- Product: PVC 输送带 (PVC Conveyor Belt)

- Total Tax Rate: 57.4% / 61.5%

- Breakdown:

- Base Tariff: 2.4% / 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Two different codes for conveyor belts; check product specifics for correct classification.

Key Observations:

-

April 11, 2025, Special Tariff:

A 30.0% additional tariff is imposed on all listed products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations. -

Anti-Dumping Duties:

No specific anti-dumping duties are listed for PVC conveyor tubes in the provided data. However, it is advisable to verify if any anti-dumping measures apply based on the country of origin. -

Tax Variations:

The base tariff varies depending on the product type (e.g., medical vs. industrial use). For example, PVC 输液管 (3904220000) has a higher base tariff due to its medical classification.

Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is indeed made of PVC and not a composite or reinforced material, which may fall under a different HS code. -

Check Required Certifications:

For medical or chemical use products (e.g., 输液管, 化学品输送管), additional certifications may be required for customs clearance. -

Confirm Product Description:

Use precise product descriptions (e.g., "conveyor tube" vs. "water supply pipe") to ensure correct HS code classification. -

Monitor Tariff Updates:

Stay informed about any changes in tariff policies, especially after April 11, 2025, as this could significantly impact import costs.

Customer Reviews

No reviews yet.