Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917290050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the detailed classification and tariff information for PVC Plastic Flanges based on the provided HS codes:

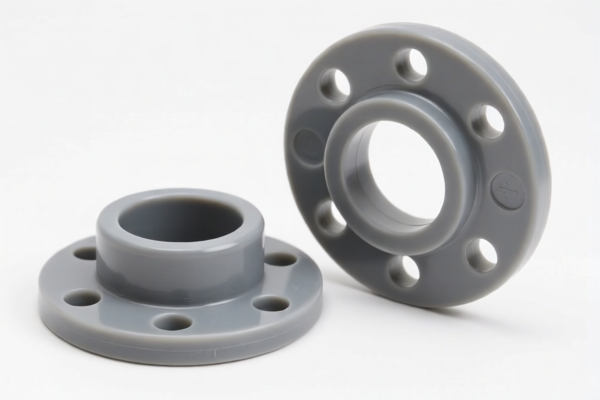

📦 Product Classification: PVC Plastic Flanges

🔢 HS CODE: 3917230000

- Product Description: PVC法兰 (PVC Flange)

- Total Tax Rate: 58.1%

- Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general PVC flanges.

🔢 HS CODE: 3917390020

- Product Description: PVC法兰管件 (PVC Flange Fittings)

- Total Tax Rate: 33.1%

- Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC flange fittings, with no additional tariffs currently applied.

🔢 HS CODE: 3917400060

- Product Description: PVC法兰管件 (PVC Flange Fittings)

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to specific types of PVC flange fittings with higher base tariffs.

🔢 HS CODE: 3917290050

- Product Description: PVC短法兰 (Short PVC Flange)

- Total Tax Rate: 58.1%

- Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to short PVC flanges.

🔢 HS CODE: 3917400095

- Product Description: 塑料管道法兰 (Plastic Pipe Flange)

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general plastic pipe flanges.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not applicable for PVC products at this time.

- Material and Certification: Verify the material composition (e.g., PVC, other plastics) and unit price to ensure correct classification. Some products may require customs certification or product compliance documentation.

✅ Proactive Advice:

- Confirm the exact product description and technical specifications to match the correct HS code.

- If importing in bulk, consider tariff planning around the April 11, 2025 deadline.

- Check with local customs or a customs broker for certification requirements and document preparation.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the detailed classification and tariff information for PVC Plastic Flanges based on the provided HS codes:

📦 Product Classification: PVC Plastic Flanges

🔢 HS CODE: 3917230000

- Product Description: PVC法兰 (PVC Flange)

- Total Tax Rate: 58.1%

- Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general PVC flanges.

🔢 HS CODE: 3917390020

- Product Description: PVC法兰管件 (PVC Flange Fittings)

- Total Tax Rate: 33.1%

- Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC flange fittings, with no additional tariffs currently applied.

🔢 HS CODE: 3917400060

- Product Description: PVC法兰管件 (PVC Flange Fittings)

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to specific types of PVC flange fittings with higher base tariffs.

🔢 HS CODE: 3917290050

- Product Description: PVC短法兰 (Short PVC Flange)

- Total Tax Rate: 58.1%

- Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to short PVC flanges.

🔢 HS CODE: 3917400095

- Product Description: 塑料管道法兰 (Plastic Pipe Flange)

- Total Tax Rate: 60.3%

- Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general plastic pipe flanges.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not applicable for PVC products at this time.

- Material and Certification: Verify the material composition (e.g., PVC, other plastics) and unit price to ensure correct classification. Some products may require customs certification or product compliance documentation.

✅ Proactive Advice:

- Confirm the exact product description and technical specifications to match the correct HS code.

- If importing in bulk, consider tariff planning around the April 11, 2025 deadline.

- Check with local customs or a customs broker for certification requirements and document preparation.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.