| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

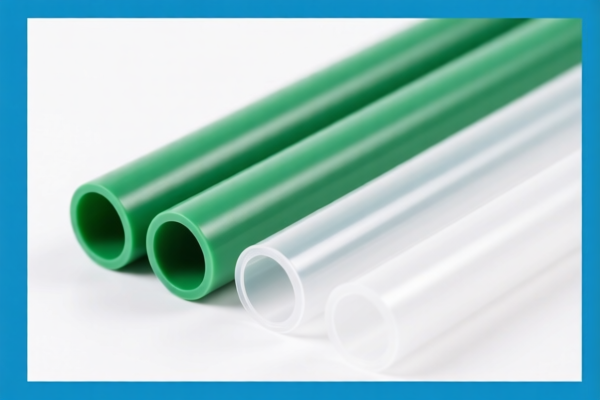

Here is the structured classification and tariff information for PVC Plastic Food Grade Tubes based on the provided HS codes and tax details:

📦 Product Classification Overview: PVC Plastic Food Grade Tubes

✅ HS CODE: 3917230000

Description: PVC Food Grade Tubes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This code is for finished PVC food-grade tubes.

✅ HS CODE: 3904210000

Description: PVC Food Grade Tube Raw Material

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to raw materials used in manufacturing PVC tubes.

✅ HS CODE: 3917320010

Description: PVC Food Grade Tube

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This code is for specific types of PVC food-grade tubes.

✅ HS CODE: 3917330000

Description: PVC Food Grade Tube

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Note: This code may apply to tubes with specific dimensions or uses.

✅ HS CODE: 3917390020

Description: PVC Food Grade Conduit (Conveyor Tube)

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Note: This code is for specialized PVC tubes used in food transport or conveyor systems.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact material composition and whether it qualifies as "food grade" to ensure correct classification.

- Certifications: Check if any food safety certifications (e.g., FDA, GB standards) are required for import into your destination country.

- Unit Price: Be aware that the total tax rate is based on the unit price of the product. Higher unit prices may trigger different classification or additional duties.

- Customs Declaration: Accurate HS code selection is critical to avoid delays or penalties. Double-check the product description and technical specifications.

📌 Proactive Advice:

- Consult a customs broker or import compliance expert for complex cases.

- Keep documentation on file, including material safety data sheets (MSDS), product specifications, and certifications.

- Monitor policy updates related to food-grade plastics and import regulations, especially after April 11, 2025.

Let me know if you need help with HS code selection or customs documentation! Here is the structured classification and tariff information for PVC Plastic Food Grade Tubes based on the provided HS codes and tax details:

📦 Product Classification Overview: PVC Plastic Food Grade Tubes

✅ HS CODE: 3917230000

Description: PVC Food Grade Tubes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This code is for finished PVC food-grade tubes.

✅ HS CODE: 3904210000

Description: PVC Food Grade Tube Raw Material

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Note: This code applies to raw materials used in manufacturing PVC tubes.

✅ HS CODE: 3917320010

Description: PVC Food Grade Tube

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Note: This code is for specific types of PVC food-grade tubes.

✅ HS CODE: 3917330000

Description: PVC Food Grade Tube

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Note: This code may apply to tubes with specific dimensions or uses.

✅ HS CODE: 3917390020

Description: PVC Food Grade Conduit (Conveyor Tube)

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Note: This code is for specialized PVC tubes used in food transport or conveyor systems.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact material composition and whether it qualifies as "food grade" to ensure correct classification.

- Certifications: Check if any food safety certifications (e.g., FDA, GB standards) are required for import into your destination country.

- Unit Price: Be aware that the total tax rate is based on the unit price of the product. Higher unit prices may trigger different classification or additional duties.

- Customs Declaration: Accurate HS code selection is critical to avoid delays or penalties. Double-check the product description and technical specifications.

📌 Proactive Advice:

- Consult a customs broker or import compliance expert for complex cases.

- Keep documentation on file, including material safety data sheets (MSDS), product specifications, and certifications.

- Monitor policy updates related to food-grade plastics and import regulations, especially after April 11, 2025.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.