| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

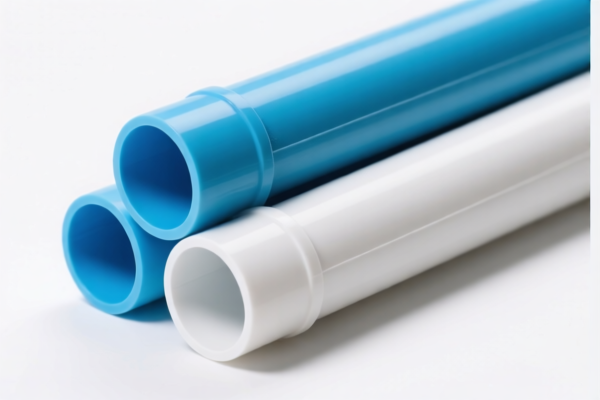

Product Classification: PVC Plastic Industrial Tubes

Customs Compliance Analysis and Tax Overview

✅ HS CODE: 3916200091

Description: PVC plastic industrial tubes, rods, profiles, etc.

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not relevant for PVC)

✅ HS CODE: 3917320050

Description: Plastic industrial tubes (not PVC)

Total Tax Rate: 58.1%

Tax Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3917390020

Description: PVC industrial flexible tubes

Total Tax Rate: 33.1%

Tax Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3920490000

Description: PVC plastic industrial sheets, strips, foils, etc.

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3916200091 (repeated)

Description: PVC plastic industrial profiles

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

-

Material Verification: Confirm the exact material composition (e.g., whether it is 100% PVC or contains additives) to ensure correct classification.

-

Certifications Required: Check if any customs certifications (e.g., commodity inspection, origin documentation) are required for your product type and destination country.

-

Unit Price and Tax Impact: The total tax rate can significantly affect the final cost. For example, a 60.8% tax rate on a $100 product would add $60.80 in tariffs.

-

Consult a Customs Broker: For complex or high-value shipments, it is advisable to consult a licensed customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the correct HS code for your specific product or if you need assistance with customs documentation.

Product Classification: PVC Plastic Industrial Tubes

Customs Compliance Analysis and Tax Overview

✅ HS CODE: 3916200091

Description: PVC plastic industrial tubes, rods, profiles, etc.

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (not relevant for PVC)

✅ HS CODE: 3917320050

Description: Plastic industrial tubes (not PVC)

Total Tax Rate: 58.1%

Tax Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3917390020

Description: PVC industrial flexible tubes

Total Tax Rate: 33.1%

Tax Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3920490000

Description: PVC plastic industrial sheets, strips, foils, etc.

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3916200091 (repeated)

Description: PVC plastic industrial profiles

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

-

Material Verification: Confirm the exact material composition (e.g., whether it is 100% PVC or contains additives) to ensure correct classification.

-

Certifications Required: Check if any customs certifications (e.g., commodity inspection, origin documentation) are required for your product type and destination country.

-

Unit Price and Tax Impact: The total tax rate can significantly affect the final cost. For example, a 60.8% tax rate on a $100 product would add $60.80 in tariffs.

-

Consult a Customs Broker: For complex or high-value shipments, it is advisable to consult a licensed customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the correct HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.