| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

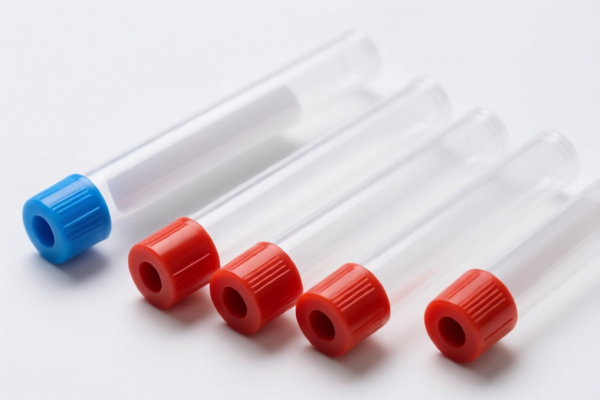

Product Classification: PVC Plastic Laboratory Tubes

HS CODE: 3917320050 (Primary Classification)

🔍 Classification Summary:

- HS Code: 3917320050

- Description: Plastic tubes, not reinforced or combined with other materials, without fittings.

- Product Match: PVC Plastic Laboratory Tubes (not reinforced, no fittings).

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 63.1%. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently applicable for PVC laboratory tubes under this classification.

📌 Alternative HS Codes (for reference):

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3916200091 | PVC plastic pipes (single filament, rods, profiles) | 60.8% |

| 3917330000 | PVC chemical tubes (unreinforced) | 33.1% |

| 3917320010 | PVC plastic tubes (general description) | 58.1% |

| 3917230000 | PVC chemical tubes (rigid) | 58.1% |

🛠️ Proactive Advice:

- Verify Material: Confirm that the tubes are made of PVC only and not reinforced or combined with other materials (e.g., metal, glass).

- Check Unit Price: Ensure the declared value aligns with the product description and classification.

- Certifications: Confirm if any customs or safety certifications (e.g., ISO, REACH, RoHS) are required for import.

- Tariff Date: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: PVC Plastic Laboratory Tubes

HS CODE: 3917320050 (Primary Classification)

🔍 Classification Summary:

- HS Code: 3917320050

- Description: Plastic tubes, not reinforced or combined with other materials, without fittings.

- Product Match: PVC Plastic Laboratory Tubes (not reinforced, no fittings).

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025, increasing the total tax rate to 63.1%. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently applicable for PVC laboratory tubes under this classification.

📌 Alternative HS Codes (for reference):

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3916200091 | PVC plastic pipes (single filament, rods, profiles) | 60.8% |

| 3917330000 | PVC chemical tubes (unreinforced) | 33.1% |

| 3917320010 | PVC plastic tubes (general description) | 58.1% |

| 3917230000 | PVC chemical tubes (rigid) | 58.1% |

🛠️ Proactive Advice:

- Verify Material: Confirm that the tubes are made of PVC only and not reinforced or combined with other materials (e.g., metal, glass).

- Check Unit Price: Ensure the declared value aligns with the product description and classification.

- Certifications: Confirm if any customs or safety certifications (e.g., ISO, REACH, RoHS) are required for import.

- Tariff Date: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.