| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

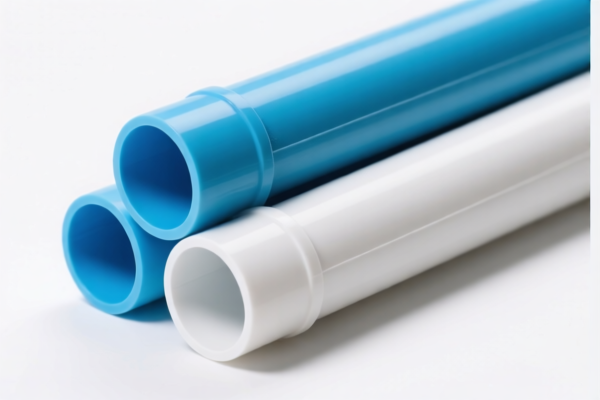

Product Classification: PVC Plastic Potable Water Tubes

HS CODEs and Tax Information Overview:

- HS CODE: 3917230000

- Description: PVC drinking water tubes, classified under this code as rigid PVC pipes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for rigid PVC pipes used for potable water.

-

HS CODE: 3917320010

- Description: PVC drinking water tubes made of pure PVC, not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is specific to non-reinforced PVC pipes.

-

HS CODE: 3917320050

- Description: PVC water supply pipes, classified under this code as plastic pipes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for general-purpose PVC water pipes.

-

HS CODE: 3904400000

- Description: PVC water pipes classified under this code as primary forms of PVC polymers.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to primary forms of PVC, not finished products.

-

HS CODE: 3904220000

- Description: PVC water pipes classified under this code as primary forms of PVC polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for primary PVC polymers, not finished products.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is made of pure PVC and not reinforced or combined with other materials (e.g., fiber, metal), as this may affect the correct HS code.

- Check Required Certifications: Confirm if certifications such as ISO, FDA, or GB standards are required for import into the destination country.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which may significantly increase the total cost.

- Consult Customs Authority: For precise classification, especially if the product has mixed materials or special features.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: PVC Plastic Potable Water Tubes

HS CODEs and Tax Information Overview:

- HS CODE: 3917230000

- Description: PVC drinking water tubes, classified under this code as rigid PVC pipes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for rigid PVC pipes used for potable water.

-

HS CODE: 3917320010

- Description: PVC drinking water tubes made of pure PVC, not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is specific to non-reinforced PVC pipes.

-

HS CODE: 3917320050

- Description: PVC water supply pipes, classified under this code as plastic pipes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is suitable for general-purpose PVC water pipes.

-

HS CODE: 3904400000

- Description: PVC water pipes classified under this code as primary forms of PVC polymers.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to primary forms of PVC, not finished products.

-

HS CODE: 3904220000

- Description: PVC water pipes classified under this code as primary forms of PVC polymers.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for primary PVC polymers, not finished products.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is made of pure PVC and not reinforced or combined with other materials (e.g., fiber, metal), as this may affect the correct HS code.

- Check Required Certifications: Confirm if certifications such as ISO, FDA, or GB standards are required for import into the destination country.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which may significantly increase the total cost.

- Consult Customs Authority: For precise classification, especially if the product has mixed materials or special features.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.