Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

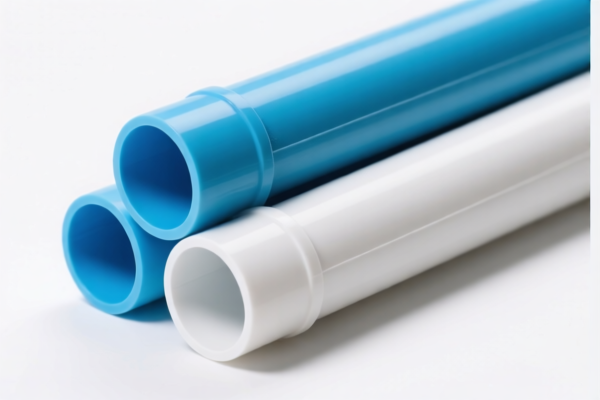

Here is the structured classification and tariff information for PVC Plastic Sprinkler Tubes based on the provided HS codes:

📦 Product Classification Overview: PVC Plastic Sprinkler Tubes

✅ HS CODE: 3917390020

- Description: PVC Sprinkler Tubes, made of polyvinyl chloride (PVC), classified as plastic pipes and fittings.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3917330000

- Description: PVC Sprinkler Tubes, classified as plastic pipes and fittings.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3917320010

- Description: PVC Sprinkler Tubes, made of polyvinyl chloride (PVC), classified as plastic pipes and fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3917230000

- Description: PVC Water Pipes, classified as rigid plastic pipes, under plastic pipes and fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3904400000

- Description: PVC Water Pipes, classified as primary forms of plastic products, under polyvinyl chloride copolymers.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for PVC products in this context, but always verify if applicable based on the country of origin.

- Material and Certification: Ensure the product is indeed made of PVC and not a composite or modified material. Confirm if any certifications (e.g., ISO, RoHS) are required for import.

🛠️ Proactive Advice for Importers:

- Verify the exact material composition of the product (e.g., is it 100% PVC or a blend?).

- Check the unit price and whether it falls under any preferential trade agreements.

- Confirm the HS code with customs or a classification expert to avoid misclassification penalties.

- Review the April 11, 2025 tariff schedule early to adjust pricing or sourcing strategies accordingly.

Let me know if you need help with HS code verification or tariff calculation for a specific shipment. Here is the structured classification and tariff information for PVC Plastic Sprinkler Tubes based on the provided HS codes:

📦 Product Classification Overview: PVC Plastic Sprinkler Tubes

✅ HS CODE: 3917390020

- Description: PVC Sprinkler Tubes, made of polyvinyl chloride (PVC), classified as plastic pipes and fittings.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3917330000

- Description: PVC Sprinkler Tubes, classified as plastic pipes and fittings.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3917320010

- Description: PVC Sprinkler Tubes, made of polyvinyl chloride (PVC), classified as plastic pipes and fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3917230000

- Description: PVC Water Pipes, classified as rigid plastic pipes, under plastic pipes and fittings.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3904400000

- Description: PVC Water Pipes, classified as primary forms of plastic products, under polyvinyl chloride copolymers.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for PVC products in this context, but always verify if applicable based on the country of origin.

- Material and Certification: Ensure the product is indeed made of PVC and not a composite or modified material. Confirm if any certifications (e.g., ISO, RoHS) are required for import.

🛠️ Proactive Advice for Importers:

- Verify the exact material composition of the product (e.g., is it 100% PVC or a blend?).

- Check the unit price and whether it falls under any preferential trade agreements.

- Confirm the HS code with customs or a classification expert to avoid misclassification penalties.

- Review the April 11, 2025 tariff schedule early to adjust pricing or sourcing strategies accordingly.

Let me know if you need help with HS code verification or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.