| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

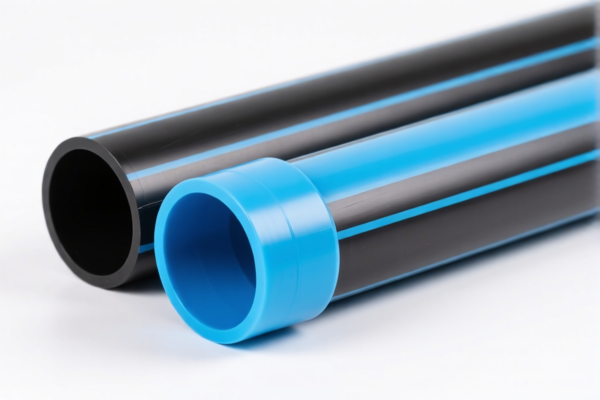

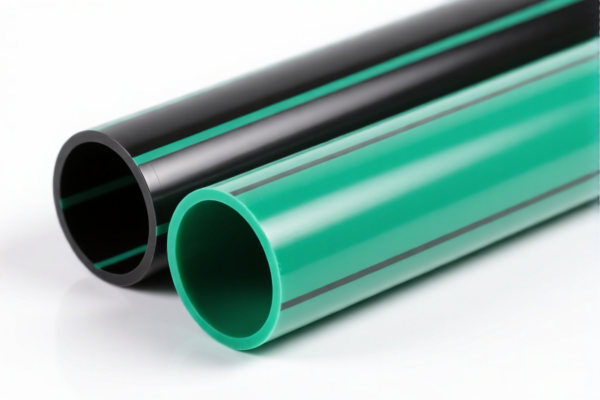

Product Classification: PVC Plastic Thick Walled Tubes

HS CODE:

- 3917230000 – Rigid PVC tubes

- 3917320010 – PVC tubes (not reinforced or combined with other materials), without fittings

🔍 Classification Summary

- Both HS codes apply to PVC thick-walled tubes, but with slight differences in product description:

- 3917230000 is for rigid PVC tubes.

- 3917320010 is for PVC tubes not reinforced or combined with other materials, and without fittings.

📊 Tariff Overview (as of now)

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1% (3.1% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your shipment timing aligns with this policy to avoid unexpected costs.

📌 Key Considerations for Customs Compliance

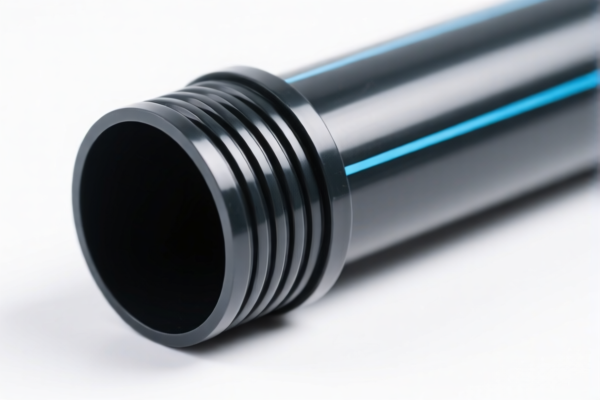

- Material Verification: Confirm that the product is pure PVC and not reinforced or combined with other materials (e.g., steel, fiber, etc.).

- Product Description: Ensure the product does not include fittings if using HS code 3917320010.

- Certifications: Check if any technical or safety certifications are required for import (e.g., RoHS, REACH, or local product standards).

- Unit Price: Verify the unit price to ensure it aligns with the tariff classification and avoids reclassification due to value thresholds.

- Documentation: Provide accurate product descriptions, material composition, and technical specifications to customs authorities.

🛑 Proactive Advice

- Double-check the product’s physical characteristics (e.g., wall thickness, material composition, presence of fittings) to ensure correct HS code selection.

- Monitor policy updates after April 11, 2025, as the special tariff may change.

- Consult a customs broker or expert if the product is part of a complex supply chain or involves multiple materials.

Let me know if you need help with certification requirements or customs documentation templates.

Product Classification: PVC Plastic Thick Walled Tubes

HS CODE:

- 3917230000 – Rigid PVC tubes

- 3917320010 – PVC tubes (not reinforced or combined with other materials), without fittings

🔍 Classification Summary

- Both HS codes apply to PVC thick-walled tubes, but with slight differences in product description:

- 3917230000 is for rigid PVC tubes.

- 3917320010 is for PVC tubes not reinforced or combined with other materials, and without fittings.

📊 Tariff Overview (as of now)

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1% (3.1% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your shipment timing aligns with this policy to avoid unexpected costs.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is pure PVC and not reinforced or combined with other materials (e.g., steel, fiber, etc.).

- Product Description: Ensure the product does not include fittings if using HS code 3917320010.

- Certifications: Check if any technical or safety certifications are required for import (e.g., RoHS, REACH, or local product standards).

- Unit Price: Verify the unit price to ensure it aligns with the tariff classification and avoids reclassification due to value thresholds.

- Documentation: Provide accurate product descriptions, material composition, and technical specifications to customs authorities.

🛑 Proactive Advice

- Double-check the product’s physical characteristics (e.g., wall thickness, material composition, presence of fittings) to ensure correct HS code selection.

- Monitor policy updates after April 11, 2025, as the special tariff may change.

- Consult a customs broker or expert if the product is part of a complex supply chain or involves multiple materials.

Let me know if you need help with certification requirements or customs documentation templates.

Customer Reviews

No reviews yet.