Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

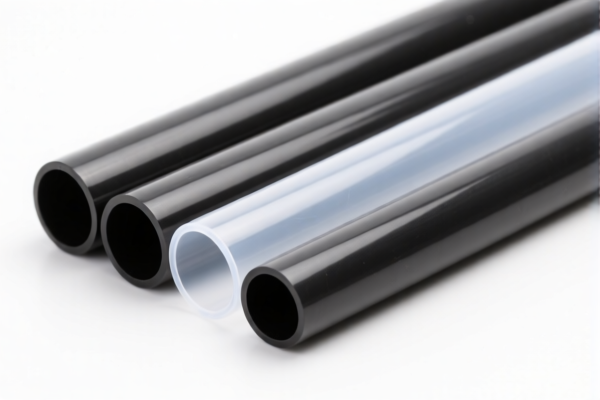

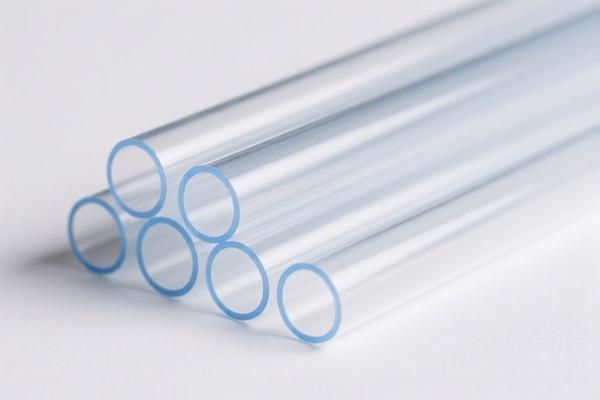

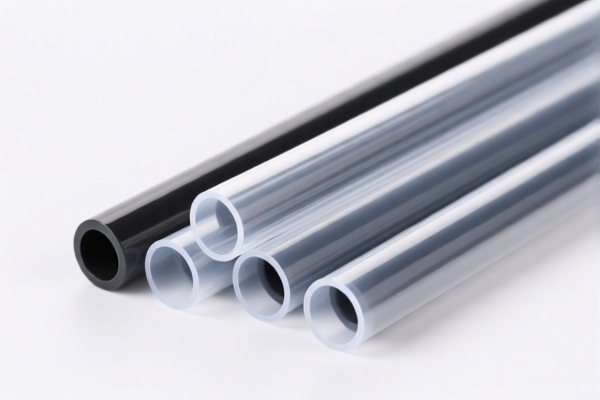

Product Classification: PVC Plastic Thin-Walled Tubes

HS CODE: 3917320010

🔍 Classification Summary

- Product Type: PVC (Polyvinyl Chloride) thin-walled tubes

- HS Code: 3917320010

- Description: This code applies to thin-walled plastic tubes made of PVC, typically used in industrial or construction applications.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to imports after this date.

- Impact: This will increase the total tax burden significantly, so it is crucial to plan import timelines accordingly.

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum Products: Not applicable for PVC plastic tubes.

- Note: Anti-dumping duties are generally not imposed on PVC products, but always verify with customs or a compliance expert for the latest updates.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed PVC and not a different polymer (e.g., PE, PP), as this can affect classification.

- Check Unit Price and Quantity: Tariff rates may vary based on the declared value and quantity.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH) are needed for import into the destination country.

- Consult Customs Broker: For accurate classification and tariff calculation, especially with the upcoming April 11, 2025 tariff changes.

📚 Other Possible HS Codes (for Reference)

- 3917230000: For rigid PVC tubes (hard PVC)

- 3920490000: For PVC plastic films (not tubes)

- 3917320010: Also applies to soft PVC tubes (if thin-walled)

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: PVC Plastic Thin-Walled Tubes

HS CODE: 3917320010

🔍 Classification Summary

- Product Type: PVC (Polyvinyl Chloride) thin-walled tubes

- HS Code: 3917320010

- Description: This code applies to thin-walled plastic tubes made of PVC, typically used in industrial or construction applications.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to imports after this date.

- Impact: This will increase the total tax burden significantly, so it is crucial to plan import timelines accordingly.

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum Products: Not applicable for PVC plastic tubes.

- Note: Anti-dumping duties are generally not imposed on PVC products, but always verify with customs or a compliance expert for the latest updates.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed PVC and not a different polymer (e.g., PE, PP), as this can affect classification.

- Check Unit Price and Quantity: Tariff rates may vary based on the declared value and quantity.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH) are needed for import into the destination country.

- Consult Customs Broker: For accurate classification and tariff calculation, especially with the upcoming April 11, 2025 tariff changes.

📚 Other Possible HS Codes (for Reference)

- 3917230000: For rigid PVC tubes (hard PVC)

- 3920490000: For PVC plastic films (not tubes)

- 3917320010: Also applies to soft PVC tubes (if thin-walled)

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.