| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

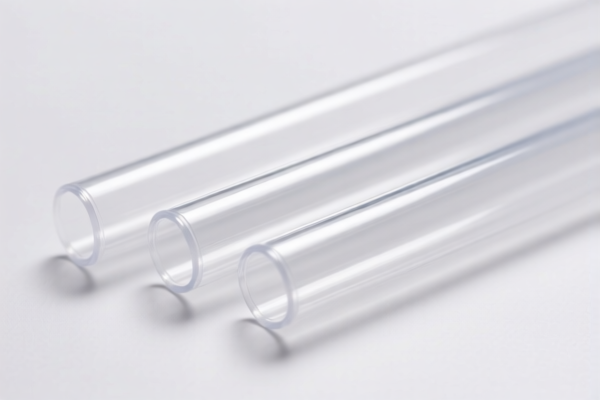

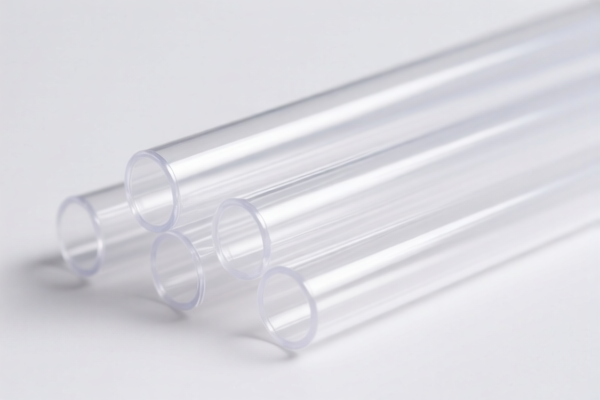

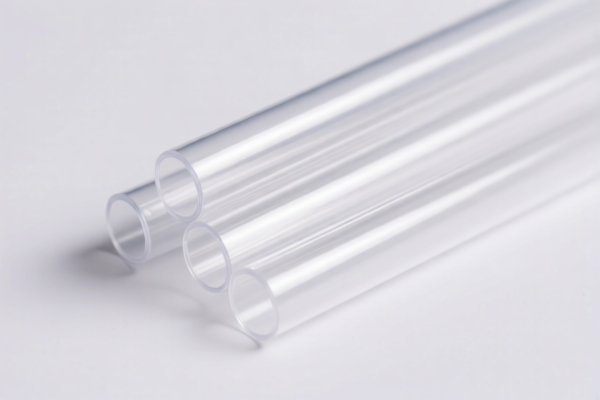

Product Classification: PVC Plastic Transparent Tubes

HS CODEs and Tax Information Overview:

- HS CODE 3917230000

- Description: Hard PVC transparent tubes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to rigid PVC tubes.

-

HS CODE 3917320010

- Description: PVC transparent tubes made of polyvinyl chloride (PVC).

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is explicitly for PVC plastic tubes.

-

HS CODE 3917390020

- Description: Soft PVC transparent tubes.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to soft PVC tubes and fittings.

-

HS CODE 3916200091

- Description: PVC plastic tubes (as part of single filaments, rods, and profiles).

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC tubes categorized under single filaments, rods, and profiles.

-

HS CODE 3920490000

- Description: PVC transparent sheets.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC transparent sheets, not tubes.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is made of rigid or soft PVC, as this will determine the correct HS code and applicable tax rate.

- Check Required Certifications: Ensure compliance with any import certifications or documentation required by the destination country.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which may significantly increase the total cost.

- Consider Anti-Dumping Duties: If the product is made of iron or aluminum (not applicable here), check for any anti-dumping duties that may apply.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Product Classification: PVC Plastic Transparent Tubes

HS CODEs and Tax Information Overview:

- HS CODE 3917230000

- Description: Hard PVC transparent tubes.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to rigid PVC tubes.

-

HS CODE 3917320010

- Description: PVC transparent tubes made of polyvinyl chloride (PVC).

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is explicitly for PVC plastic tubes.

-

HS CODE 3917390020

- Description: Soft PVC transparent tubes.

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to soft PVC tubes and fittings.

-

HS CODE 3916200091

- Description: PVC plastic tubes (as part of single filaments, rods, and profiles).

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for PVC tubes categorized under single filaments, rods, and profiles.

-

HS CODE 3920490000

- Description: PVC transparent sheets.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for PVC transparent sheets, not tubes.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product is made of rigid or soft PVC, as this will determine the correct HS code and applicable tax rate.

- Check Required Certifications: Ensure compliance with any import certifications or documentation required by the destination country.

- Monitor Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, which may significantly increase the total cost.

- Consider Anti-Dumping Duties: If the product is made of iron or aluminum (not applicable here), check for any anti-dumping duties that may apply.

Let me know if you need help selecting the most appropriate HS code based on your product specifications.

Customer Reviews

No reviews yet.