| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

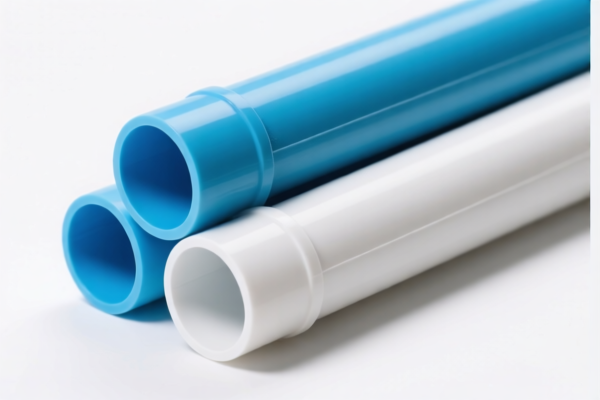

Product Classification: PVC Plastic Tube Accessories

HS CODEs and Tax Information Summary:

- HS CODE: 3917400095

- Description: PVC tube fittings fall under this code, which covers plastic tubes, fittings, and flexible hoses.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is one of the most commonly applicable codes for PVC tube fittings.

-

HS CODE: 3917320010

- Description: PVC tube fittings made of polyvinyl chloride (PVC) are classified under this code.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff compared to 3917400095.

-

HS CODE: 3904400000

- Description: This code applies to polymers of polyvinyl chloride or other halogenated ethylene, including raw materials for PVC products.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is more suitable for raw PVC materials rather than finished fittings.

-

HS CODE: 3917400060

- Description: PVC plastic tube connectors are classified under this code.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to connectors and may be more accurate for certain types of fittings.

-

HS CODE: 3917390020

- Description: PVC injection-molded tube fittings are classified under this code, which includes "plastic fittings."

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest total tax rate among the options, but it applies only to injection-molded PVC fittings.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect classification.

- Check Required Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Confirm Product Type: Injection-molded vs. extruded fittings may fall under different HS codes.

- Monitor Tariff Changes: The special tariff after April 11, 2025 applies to all the above codes, so plan accordingly for increased costs.

- Consider Anti-Dumping Duties: If the product is imported from countries under anti-dumping investigations, additional duties may apply (not listed here, but worth checking).

Let me know if you need help determining the most accurate HS code for your specific product.

Product Classification: PVC Plastic Tube Accessories

HS CODEs and Tax Information Summary:

- HS CODE: 3917400095

- Description: PVC tube fittings fall under this code, which covers plastic tubes, fittings, and flexible hoses.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is one of the most commonly applicable codes for PVC tube fittings.

-

HS CODE: 3917320010

- Description: PVC tube fittings made of polyvinyl chloride (PVC) are classified under this code.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff compared to 3917400095.

-

HS CODE: 3904400000

- Description: This code applies to polymers of polyvinyl chloride or other halogenated ethylene, including raw materials for PVC products.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is more suitable for raw PVC materials rather than finished fittings.

-

HS CODE: 3917400060

- Description: PVC plastic tube connectors are classified under this code.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to connectors and may be more accurate for certain types of fittings.

-

HS CODE: 3917390020

- Description: PVC injection-molded tube fittings are classified under this code, which includes "plastic fittings."

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest total tax rate among the options, but it applies only to injection-molded PVC fittings.

✅ Proactive Advice:

- Verify Material and Unit Price: Ensure the product is indeed made of PVC and not a composite or mixed material, as this can affect classification.

- Check Required Certifications: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Confirm Product Type: Injection-molded vs. extruded fittings may fall under different HS codes.

- Monitor Tariff Changes: The special tariff after April 11, 2025 applies to all the above codes, so plan accordingly for increased costs.

- Consider Anti-Dumping Duties: If the product is imported from countries under anti-dumping investigations, additional duties may apply (not listed here, but worth checking).

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.