| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917230000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

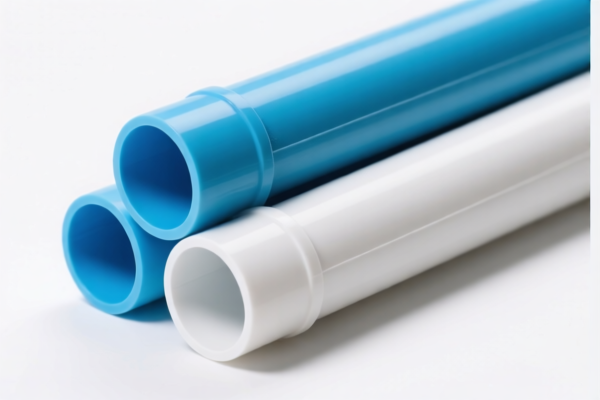

Product Classification: PVC Plastic Ventilation Tubes

HS CODEs and Tax Information Summary:

- HS CODE: 3917320010

- Description: PVC ventilation tubes made of polyvinyl chloride (PVC), classified under "Other plastic pipes and pipe fittings, not reinforced, not combined with other materials, without fittings."

- Total Tax Rate: 58.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is one of the most commonly applicable codes for standard PVC ventilation tubes.

-

HS CODE: 3904220000

- Description: PVC ventilation tubes made from polyvinyl chloride (PVC), a halogenated ethylene polymer, classified under "Other forms of polyvinyl chloride."

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff due to classification under primary forms of PVC.

-

HS CODE: 3917230000

- Description: PVC ventilation tubes made of vinyl polymers, classified under "Hard plastic pipes."

- Total Tax Rate: 58.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for rigid PVC ventilation tubes.

-

HS CODE: 3917390020

- Description: PVC ventilation tubes made of polyvinyl chloride (PVC), classified under "Other plastic pipes."

- Total Tax Rate: 33.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower total tax due to no additional tariff, but still subject to the April 11 special tariff.

-

HS CODE: 3917320050

- Description: Plastic ventilation tubes classified under "Other plastic pipes and pipe fittings, not reinforced, not combined with other materials, without fittings."

- Total Tax Rate: 58.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917320010, but may apply to slightly different product specifications.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm that the product is indeed made of PVC and not a composite or reinforced material, as this can change the HS code.

- Check Required Certifications: Some countries may require specific certifications (e.g., RoHS, REACH) for imported plastic products.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so ensure your import plans are adjusted accordingly.

-

Consult Customs Authority: For precise classification, especially if the product has special features (e.g., flame retardant, reinforced), consult local customs or a customs broker. Product Classification: PVC Plastic Ventilation Tubes

HS CODEs and Tax Information Summary: -

HS CODE: 3917320010

- Description: PVC ventilation tubes made of polyvinyl chloride (PVC), classified under "Other plastic pipes and pipe fittings, not reinforced, not combined with other materials, without fittings."

- Total Tax Rate: 58.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is one of the most commonly applicable codes for standard PVC ventilation tubes.

-

HS CODE: 3904220000

- Description: PVC ventilation tubes made from polyvinyl chloride (PVC), a halogenated ethylene polymer, classified under "Other forms of polyvinyl chloride."

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Higher base tariff due to classification under primary forms of PVC.

-

HS CODE: 3917230000

- Description: PVC ventilation tubes made of vinyl polymers, classified under "Hard plastic pipes."

- Total Tax Rate: 58.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable for rigid PVC ventilation tubes.

-

HS CODE: 3917390020

- Description: PVC ventilation tubes made of polyvinyl chloride (PVC), classified under "Other plastic pipes."

- Total Tax Rate: 33.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower total tax due to no additional tariff, but still subject to the April 11 special tariff.

-

HS CODE: 3917320050

- Description: Plastic ventilation tubes classified under "Other plastic pipes and pipe fittings, not reinforced, not combined with other materials, without fittings."

- Total Tax Rate: 58.1%

- Tax Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917320010, but may apply to slightly different product specifications.

✅ Proactive Advice:

- Verify Material and Unit Price: Confirm that the product is indeed made of PVC and not a composite or reinforced material, as this can change the HS code.

- Check Required Certifications: Some countries may require specific certifications (e.g., RoHS, REACH) for imported plastic products.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so ensure your import plans are adjusted accordingly.

- Consult Customs Authority: For precise classification, especially if the product has special features (e.g., flame retardant, reinforced), consult local customs or a customs broker.

Customer Reviews

No reviews yet.