| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

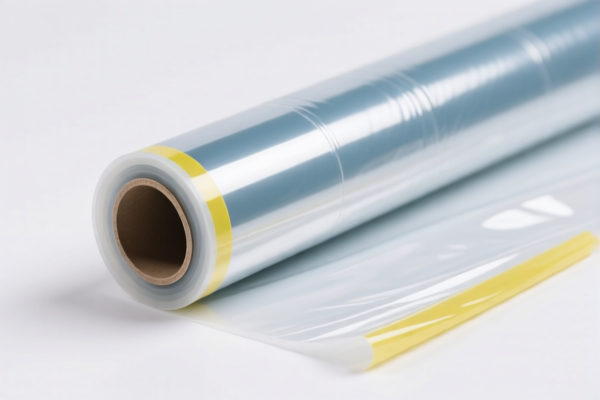

Product Classification: PVC Plasticized Film / Cold Lamination Film

HS CODE: 3920490000, 3920435000, 3904220000, 3904400000, 3920100000

Below is a structured breakdown of the HS codes and associated tariff information for PVC plasticized film and cold lamination film:

🔍 HS Code: 3920490000

Description: Other non-cellular, non-reinforced plastic sheets, plates, films, foils and strips, laminated, supported or otherwise combined with other materials — Vinyl chloride polymers — Other

Total Tax Rate: 60.8%

Tariff Details:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to PVC films that are not specifically defined under other subheadings (e.g., not containing ≥6% plasticizer).

- Proactive Advice: Confirm whether the product contains ≥6% plasticizer, as this may qualify it under a different HS code (e.g., 3920435000).

🔍 HS Code: 3920435000

Description: Other non-cellular, non-reinforced plastic sheets, plates, films, foils and strips, laminated, supported or otherwise combined with other materials — Vinyl chloride polymers — Containing not less than 6% plasticizer

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for PVC films with ≥6% plasticizer, commonly used in cold lamination.

- Proactive Advice: Verify the plasticizer content and material composition to ensure correct classification.

🔍 HS Code: 3904220000

Description: Plasticized polyvinyl chloride

Total Tax Rate: 61.5%

Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for plasticized PVC in general, not specifically laminated or combined with other materials.

- Proactive Advice: If the product is used for lamination or combined with other materials, consider 3920435000 or 3920490000 instead.

🔍 HS Code: 3904400000

Description: Other polyvinyl chloride copolymers

Total Tax Rate: 60.3%

Tariff Details:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to PVC copolymers that are not plasticized or not specifically defined elsewhere.

- Proactive Advice: Confirm if the product is plasticized or copolymer-based to avoid misclassification.

🔍 HS Code: 3920100000

Description: Ethylene polymers

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for polyethylene products, not PVC.

- Proactive Advice: Ensure the product is PVC-based, not polyethylene, to avoid misclassification.

📌 Key Tariff Changes (April 11, 2025 onwards):

- All listed HS codes will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy and may significantly increase import costs.

- Anti-dumping duties are not currently listed for PVC films, but always verify with customs or a compliance expert for the latest updates.

✅ Proactive Actions for Importers:

- Verify the exact composition (e.g., plasticizer content, whether it's a copolymer or not).

- Check the unit price and material specifications to ensure correct HS code selection.

- Confirm required certifications (e.g., RoHS, REACH, or other local regulations).

- Review the April 11, 2025 deadline and plan for increased costs if applicable.

Let me know if you need help with HS code selection based on product specifications.

Product Classification: PVC Plasticized Film / Cold Lamination Film

HS CODE: 3920490000, 3920435000, 3904220000, 3904400000, 3920100000

Below is a structured breakdown of the HS codes and associated tariff information for PVC plasticized film and cold lamination film:

🔍 HS Code: 3920490000

Description: Other non-cellular, non-reinforced plastic sheets, plates, films, foils and strips, laminated, supported or otherwise combined with other materials — Vinyl chloride polymers — Other

Total Tax Rate: 60.8%

Tariff Details:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to PVC films that are not specifically defined under other subheadings (e.g., not containing ≥6% plasticizer).

- Proactive Advice: Confirm whether the product contains ≥6% plasticizer, as this may qualify it under a different HS code (e.g., 3920435000).

🔍 HS Code: 3920435000

Description: Other non-cellular, non-reinforced plastic sheets, plates, films, foils and strips, laminated, supported or otherwise combined with other materials — Vinyl chloride polymers — Containing not less than 6% plasticizer

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for PVC films with ≥6% plasticizer, commonly used in cold lamination.

- Proactive Advice: Verify the plasticizer content and material composition to ensure correct classification.

🔍 HS Code: 3904220000

Description: Plasticized polyvinyl chloride

Total Tax Rate: 61.5%

Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for plasticized PVC in general, not specifically laminated or combined with other materials.

- Proactive Advice: If the product is used for lamination or combined with other materials, consider 3920435000 or 3920490000 instead.

🔍 HS Code: 3904400000

Description: Other polyvinyl chloride copolymers

Total Tax Rate: 60.3%

Tariff Details:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code applies to PVC copolymers that are not plasticized or not specifically defined elsewhere.

- Proactive Advice: Confirm if the product is plasticized or copolymer-based to avoid misclassification.

🔍 HS Code: 3920100000

Description: Ethylene polymers

Total Tax Rate: 59.2%

Tariff Details:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Notes:

- This code is for polyethylene products, not PVC.

- Proactive Advice: Ensure the product is PVC-based, not polyethylene, to avoid misclassification.

📌 Key Tariff Changes (April 11, 2025 onwards):

- All listed HS codes will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy and may significantly increase import costs.

- Anti-dumping duties are not currently listed for PVC films, but always verify with customs or a compliance expert for the latest updates.

✅ Proactive Actions for Importers:

- Verify the exact composition (e.g., plasticizer content, whether it's a copolymer or not).

- Check the unit price and material specifications to ensure correct HS code selection.

- Confirm required certifications (e.g., RoHS, REACH, or other local regulations).

- Review the April 11, 2025 deadline and plan for increased costs if applicable.

Let me know if you need help with HS code selection based on product specifications.

Customer Reviews

No reviews yet.