Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 9001908000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 7314420060 | Doc | 105.0% | CN | US | 2025-05-12 |

| 3924905610 | Doc | 40.9% | CN | US | 2025-05-12 |

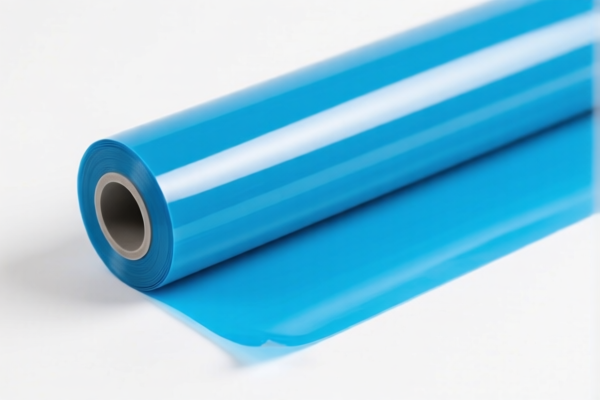

Product Classification and Tax Analysis for "PVC Plasticized Film Diffraction Grating Material"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3920490000 - PVC Plastic Film

- Description: PVC plastic film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This is the most likely classification for PVC plasticized film.

- High total tax rate due to the combination of base and additional tariffs.

- Action Required: Confirm the exact composition and thickness of the film to ensure correct classification.

✅ HS CODE: 9001908000 - Diffraction Grating Screen

- Description: Diffraction grating screen

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for optical components like diffraction gratings.

- No base tariff, but high additional tariffs apply.

- Action Required: Verify if the product is a finished diffraction grating or a component.

✅ HS CODE: 3926909989 - Plastic Grid

- Description: Plastic grid

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This may apply to plastic grids used in construction or industrial applications.

- Lower tax rate compared to PVC film, but still subject to additional tariffs.

- Action Required: Confirm the intended use and structure of the grid.

✅ HS CODE: 7314420060 - Plastic-Coated Steel Grid

- Description: Plastic-coated steel grid

- Total Tax Rate: 105.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Special Note: Steel, aluminum, and copper products are subject to an additional 50% tariff

- Notes:

- This is a high-tariff category, especially for products containing steel or aluminum.

- Action Required: Avoid this classification if possible; confirm the material composition and coating type.

✅ HS CODE: 3924905610 - Plastic Isolation Grid

- Description: Plastic isolation grid

- Total Tax Rate: 40.9%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This may be used in construction or civil engineering for isolation purposes.

- Lower tax rate than some other plastic grid classifications.

- Action Required: Confirm the exact application and structure of the grid.

📌 Important Reminders:

- April 11, 2025 Tariff Adjustment: All products listed above will be subject to an additional 30% tariff after this date.

- Anti-Dumping Duties: If the product contains steel, aluminum, or copper, an additional 50% tariff may apply (as in HS CODE 7314420060).

- Certifications Required: Ensure compliance with any required certifications (e.g., RoHS, REACH, or customs documentation).

- Material Verification: Confirm the exact composition and structure of the product to avoid misclassification and unnecessary tariffs.

🛑 Proactive Advice:

- Verify the material composition (e.g., is it PVC, plastic-coated steel, or another type of plastic grid?).

- Check the unit price to understand the impact of tariffs on the final cost.

- Consult a customs broker or classification expert if the product is complex or used in multiple applications.

Let me know if you need help with customs documentation or classification clarification. Product Classification and Tax Analysis for "PVC Plasticized Film Diffraction Grating Material"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3920490000 - PVC Plastic Film

- Description: PVC plastic film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This is the most likely classification for PVC plasticized film.

- High total tax rate due to the combination of base and additional tariffs.

- Action Required: Confirm the exact composition and thickness of the film to ensure correct classification.

✅ HS CODE: 9001908000 - Diffraction Grating Screen

- Description: Diffraction grating screen

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This code is for optical components like diffraction gratings.

- No base tariff, but high additional tariffs apply.

- Action Required: Verify if the product is a finished diffraction grating or a component.

✅ HS CODE: 3926909989 - Plastic Grid

- Description: Plastic grid

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This may apply to plastic grids used in construction or industrial applications.

- Lower tax rate compared to PVC film, but still subject to additional tariffs.

- Action Required: Confirm the intended use and structure of the grid.

✅ HS CODE: 7314420060 - Plastic-Coated Steel Grid

- Description: Plastic-coated steel grid

- Total Tax Rate: 105.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Special Note: Steel, aluminum, and copper products are subject to an additional 50% tariff

- Notes:

- This is a high-tariff category, especially for products containing steel or aluminum.

- Action Required: Avoid this classification if possible; confirm the material composition and coating type.

✅ HS CODE: 3924905610 - Plastic Isolation Grid

- Description: Plastic isolation grid

- Total Tax Rate: 40.9%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

- Notes:

- This may be used in construction or civil engineering for isolation purposes.

- Lower tax rate than some other plastic grid classifications.

- Action Required: Confirm the exact application and structure of the grid.

📌 Important Reminders:

- April 11, 2025 Tariff Adjustment: All products listed above will be subject to an additional 30% tariff after this date.

- Anti-Dumping Duties: If the product contains steel, aluminum, or copper, an additional 50% tariff may apply (as in HS CODE 7314420060).

- Certifications Required: Ensure compliance with any required certifications (e.g., RoHS, REACH, or customs documentation).

- Material Verification: Confirm the exact composition and structure of the product to avoid misclassification and unnecessary tariffs.

🛑 Proactive Advice:

- Verify the material composition (e.g., is it PVC, plastic-coated steel, or another type of plastic grid?).

- Check the unit price to understand the impact of tariffs on the final cost.

- Consult a customs broker or classification expert if the product is complex or used in multiple applications.

Let me know if you need help with customs documentation or classification clarification.

Customer Reviews

No reviews yet.