| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

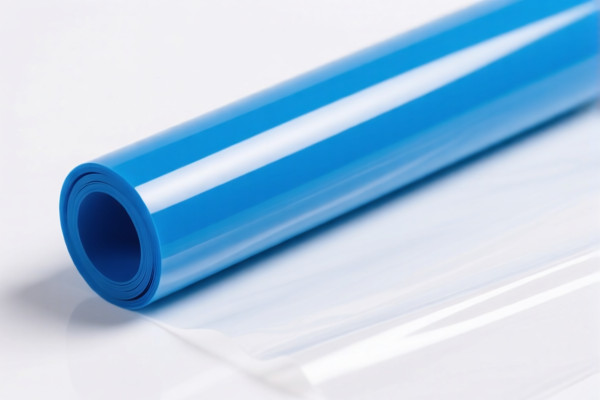

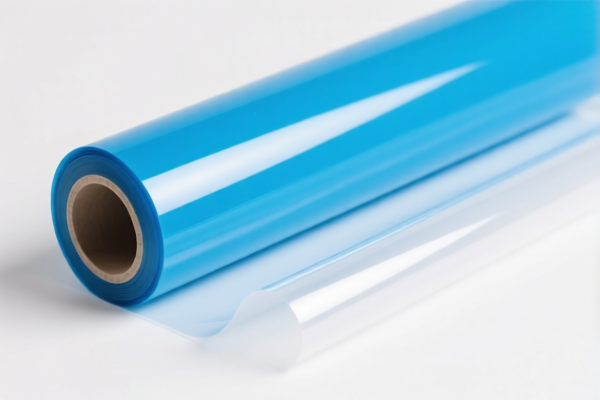

Product Classification: PVC Plasticized Film Laminating Material

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3920490000

- Product Description: PVC Plastic Film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most common classification for general-purpose PVC plasticized film.

-

HS CODE: 3921125000

- Product Description: PVC Foamed Plastic Film

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applies to PVC foam films used in packaging or insulation.

-

HS CODE: 3904210000

- Product Description: PVC Film Raw Material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for raw PVC resins used in film production.

-

HS CODE: 3918103150

- Product Description: PVC Wall Decor Film (with textile fiber backing, synthetic fiber, >70% plastic)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for decorative films with specific composition requirements.

-

HS CODE: 3904100000

- Product Description: PVC Resin (Film)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC resins used in film production, similar to 3904210000.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. Ensure your import timeline aligns with this policy to avoid unexpected costs. -

Anti-Dumping Duties:

No specific anti-dumping duties are listed for PVC films in this context, but always verify with customs or a compliance expert if your product is subject to ongoing investigations. -

Certifications and Documentation:

- Confirm the material composition (e.g., whether it's a finished product or raw material).

- Verify the unit price and product specifications to ensure correct classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for your product category.

-

Proactive Action:

If your product is used in construction or decoration, consider 3918103150 for decorative films with textile backing. Otherwise, 3920490000 is the standard for general-purpose PVC film.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Classification: PVC Plasticized Film Laminating Material

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3920490000

- Product Description: PVC Plastic Film

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most common classification for general-purpose PVC plasticized film.

-

HS CODE: 3921125000

- Product Description: PVC Foamed Plastic Film

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applies to PVC foam films used in packaging or insulation.

-

HS CODE: 3904210000

- Product Description: PVC Film Raw Material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This classification is for raw PVC resins used in film production.

-

HS CODE: 3918103150

- Product Description: PVC Wall Decor Film (with textile fiber backing, synthetic fiber, >70% plastic)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for decorative films with specific composition requirements.

-

HS CODE: 3904100000

- Product Description: PVC Resin (Film)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC resins used in film production, similar to 3904210000.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. Ensure your import timeline aligns with this policy to avoid unexpected costs. -

Anti-Dumping Duties:

No specific anti-dumping duties are listed for PVC films in this context, but always verify with customs or a compliance expert if your product is subject to ongoing investigations. -

Certifications and Documentation:

- Confirm the material composition (e.g., whether it's a finished product or raw material).

- Verify the unit price and product specifications to ensure correct classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for your product category.

-

Proactive Action:

If your product is used in construction or decoration, consider 3918103150 for decorative films with textile backing. Otherwise, 3920490000 is the standard for general-purpose PVC film.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.