Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905030 | Doc | 60.8% | CN | US | 2025-05-12 |

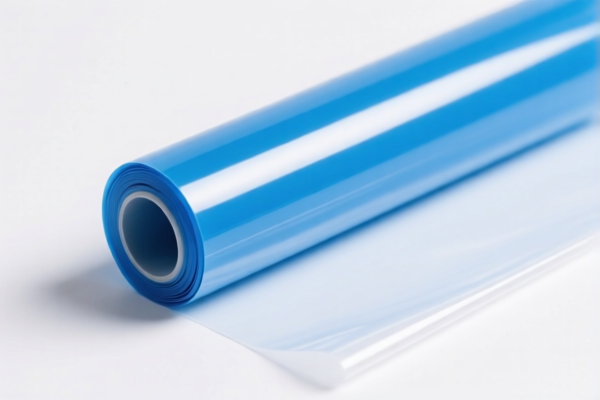

Here is the structured analysis and customs compliance information for the PVC Plasticized Film / Protective Film product based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

| HS Code | Product Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3920490000 | PVC Plastic Film | 60.8% | 5.8% | 25.0% | 30.0% |

| 3920435000 | PVC Protective Film | 59.2% | 4.2% | 25.0% | 30.0% |

| 3904220000 | PVC Protective Film | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921125000 | PVC Protective Film | 61.5% | 6.5% | 25.0% | 30.0% |

| 3919905030 | PVC Protective Film | 60.8% | 5.8% | 25.0% | 30.0% |

📌 Key Observations and Tax Rate Changes

- Base Tariff Rates vary between 4.2% and 6.5%, depending on the specific HS code.

- Additional Tariff of 25.0% is uniformly applied across all listed HS codes.

- Special Tariff after April 11, 2025 is 30.0% for all products, significantly increasing the total tax burden.

- Total Tax Rates range from 59.2% to 61.5%, with the highest being for HS codes 3904220000 and 3921125000.

⚠️ Important Alerts

- April 11, 2025 Special Tariff will apply to all products listed, increasing the total tax burden by 30.0%. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties are not explicitly mentioned for this product category, but it is advisable to confirm with customs or a trade compliance expert if the product is subject to any such duties.

- No specific anti-dumping duties on iron or aluminum are indicated for this product.

📦 Proactive Compliance Advice

- Verify the exact product description and material composition to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the applicability of certain tariffs or exemptions.

- Confirm required certifications (e.g., RoHS, REACH, or other import compliance documents) depending on the destination country.

- Review the product's end-use to determine if it qualifies for any preferential tariff treatment or trade agreements.

✅ Summary

- PVC Plasticized Film / Protective Film is subject to high total tax rates (59.2% to 61.5%) due to the combination of base, additional, and special tariffs.

- April 11, 2025 is a critical date for tariff changes—plan accordingly.

- Double-check HS code accuracy and ensure all compliance documentation is in place to avoid delays or penalties at customs.

Let me know if you need help with HS code verification or customs documentation! Here is the structured analysis and customs compliance information for the PVC Plasticized Film / Protective Film product based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

| HS Code | Product Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3920490000 | PVC Plastic Film | 60.8% | 5.8% | 25.0% | 30.0% |

| 3920435000 | PVC Protective Film | 59.2% | 4.2% | 25.0% | 30.0% |

| 3904220000 | PVC Protective Film | 61.5% | 6.5% | 25.0% | 30.0% |

| 3921125000 | PVC Protective Film | 61.5% | 6.5% | 25.0% | 30.0% |

| 3919905030 | PVC Protective Film | 60.8% | 5.8% | 25.0% | 30.0% |

📌 Key Observations and Tax Rate Changes

- Base Tariff Rates vary between 4.2% and 6.5%, depending on the specific HS code.

- Additional Tariff of 25.0% is uniformly applied across all listed HS codes.

- Special Tariff after April 11, 2025 is 30.0% for all products, significantly increasing the total tax burden.

- Total Tax Rates range from 59.2% to 61.5%, with the highest being for HS codes 3904220000 and 3921125000.

⚠️ Important Alerts

- April 11, 2025 Special Tariff will apply to all products listed, increasing the total tax burden by 30.0%. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties are not explicitly mentioned for this product category, but it is advisable to confirm with customs or a trade compliance expert if the product is subject to any such duties.

- No specific anti-dumping duties on iron or aluminum are indicated for this product.

📦 Proactive Compliance Advice

- Verify the exact product description and material composition to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the applicability of certain tariffs or exemptions.

- Confirm required certifications (e.g., RoHS, REACH, or other import compliance documents) depending on the destination country.

- Review the product's end-use to determine if it qualifies for any preferential tariff treatment or trade agreements.

✅ Summary

- PVC Plasticized Film / Protective Film is subject to high total tax rates (59.2% to 61.5%) due to the combination of base, additional, and special tariffs.

- April 11, 2025 is a critical date for tariff changes—plan accordingly.

- Double-check HS code accuracy and ensure all compliance documentation is in place to avoid delays or penalties at customs.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.