| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

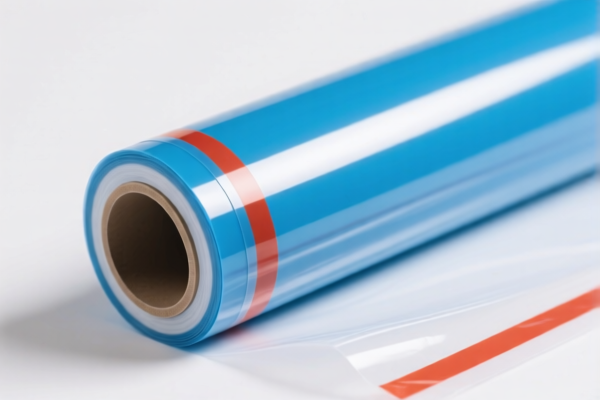

Product Name: PVC Plasticized Film for Industrial Packaging

Classification: Based on HS Code (Harmonized System Code) and related tariff regulations

✅ HS Code Classification Overview

Below are the HS codes and corresponding tax details for PVC plasticized film used in industrial packaging:

🔢 HS Code 3920490000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is repeated in the input, but it is the most relevant for general industrial packaging films.

🔢 HS Code 3920435000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code may apply to specific types of PVC films with particular thickness or use.

🔢 HS Code 3920992000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for other types of plasticized films not covered by more specific codes.

🔢 HS Code 3904220000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code may apply to PVC films with specific additives or processing.

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for PVC plasticized film (not in the scope of iron or aluminum anti-dumping duties). -

Certifications Required:

Ensure your product meets all customs documentation requirements, including: - Material specifications (e.g., thickness, composition)

- Unit price and packaging details

- Any required certifications (e.g., RoHS, REACH, or industry-specific standards)

📌 Proactive Advice for Importers

- Verify the exact HS code based on the material composition, thickness, and intended use of the film.

- Check the unit price and total cost including all applicable tariffs, especially after April 2, 2025.

- Consult with customs brokers or legal advisors to ensure compliance with local and international trade regulations.

- Maintain proper documentation for customs clearance, including product specifications and origin certificates.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: PVC Plasticized Film for Industrial Packaging

Classification: Based on HS Code (Harmonized System Code) and related tariff regulations

✅ HS Code Classification Overview

Below are the HS codes and corresponding tax details for PVC plasticized film used in industrial packaging:

🔢 HS Code 3920490000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is repeated in the input, but it is the most relevant for general industrial packaging films.

🔢 HS Code 3920435000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code may apply to specific types of PVC films with particular thickness or use.

🔢 HS Code 3920992000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code is for other types of plasticized films not covered by more specific codes.

🔢 HS Code 3904220000

- Description: PVC Plasticized Film for Industrial Packaging

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code may apply to PVC films with specific additives or processing.

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-dumping duties:

Not applicable for PVC plasticized film (not in the scope of iron or aluminum anti-dumping duties). -

Certifications Required:

Ensure your product meets all customs documentation requirements, including: - Material specifications (e.g., thickness, composition)

- Unit price and packaging details

- Any required certifications (e.g., RoHS, REACH, or industry-specific standards)

📌 Proactive Advice for Importers

- Verify the exact HS code based on the material composition, thickness, and intended use of the film.

- Check the unit price and total cost including all applicable tariffs, especially after April 2, 2025.

- Consult with customs brokers or legal advisors to ensure compliance with local and international trade regulations.

- Maintain proper documentation for customs clearance, including product specifications and origin certificates.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.