| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

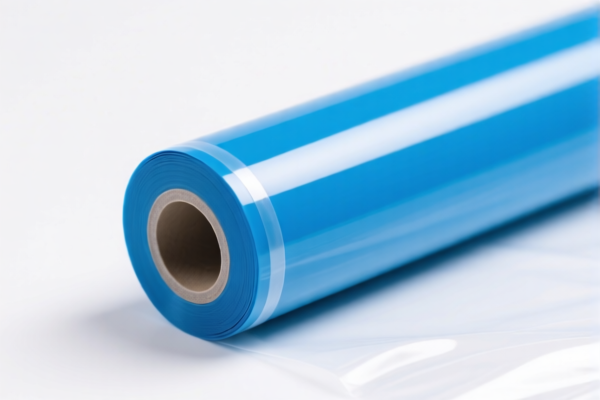

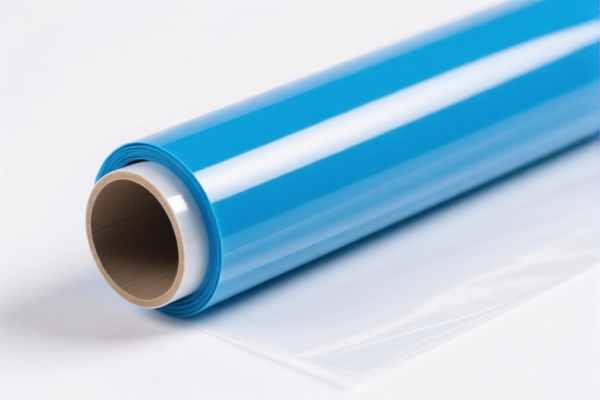

Product Classification: PVC Plasticized Film for Labels

Based on the provided HS codes and tax details, here is a structured breakdown of the classification and tariff implications for PVC Plasticized Film for Labels:

✅ HS CODE: 3920490000

Description: PVC plastic film that fits the description of HS code 3920490000.

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a common classification for general PVC plastic films, but ensure the product does not contain specific additives or formulations that might qualify for a more specific code.

✅ HS CODE: 3920435000

Description: PVC label film containing plasticizers.

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is more specific and applies to PVC films with added plasticizers. Confirm the product contains plasticizers to use this code.

✅ HS CODE: 3904220000

Description: PVC labels classified under HS code 3904, which refers to halogenated ethylene polymers.

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for halogenated polyethylene, which may not be the best fit for general PVC films unless the product is specifically made from halogenated ethylene polymers.

✅ HS CODE: 3916200091

Description: PVC plastic label rods, classified under HS code 3916200091, which refers to polyvinyl chloride (PVC) polymer monofilaments, rods, sticks, and profiles.

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for PVC rods or sticks, not films. Ensure the product is not in rod form before using this code.

✅ HS CODE: 3920992000

Description: Plastic label film classified under HS code 3920992000, which refers to other plastic sheets, plates, films, foils, and strips.

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a general category for other plastic films. It may be applicable if the product does not fit more specific codes like 3920435000.

📌 Key Considerations for Customs Compliance:

- Material Composition: Confirm whether the PVC film contains plasticizers, halogenated components, or is in rod form, as this will affect the correct HS code.

- Unit Price and Certification: Verify the unit price and whether any certifications (e.g., RoHS, REACH) are required for import.

- Tariff Changes: Be aware that additional tariffs of 30% will apply after April 11, 2025, which could significantly increase the total cost.

- Anti-Dumping Duties: While not explicitly mentioned here, be cautious of potential anti-dumping duties on PVC products, especially if imported from countries with known dumping practices.

🛑 Proactive Advice:

- Double-check the product’s exact composition and form (e.g., film, rod, sheet) to ensure the correct HS code is used.

- Consult with a customs broker or classification expert if the product contains additives or is used in specialized applications.

- Keep records of material specifications and supplier documentation to support customs declarations and avoid delays.

Let me know if you need help determining the most accurate HS code for your specific product. Product Classification: PVC Plasticized Film for Labels

Based on the provided HS codes and tax details, here is a structured breakdown of the classification and tariff implications for PVC Plasticized Film for Labels:

✅ HS CODE: 3920490000

Description: PVC plastic film that fits the description of HS code 3920490000.

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a common classification for general PVC plastic films, but ensure the product does not contain specific additives or formulations that might qualify for a more specific code.

✅ HS CODE: 3920435000

Description: PVC label film containing plasticizers.

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is more specific and applies to PVC films with added plasticizers. Confirm the product contains plasticizers to use this code.

✅ HS CODE: 3904220000

Description: PVC labels classified under HS code 3904, which refers to halogenated ethylene polymers.

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for halogenated polyethylene, which may not be the best fit for general PVC films unless the product is specifically made from halogenated ethylene polymers.

✅ HS CODE: 3916200091

Description: PVC plastic label rods, classified under HS code 3916200091, which refers to polyvinyl chloride (PVC) polymer monofilaments, rods, sticks, and profiles.

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for PVC rods or sticks, not films. Ensure the product is not in rod form before using this code.

✅ HS CODE: 3920992000

Description: Plastic label film classified under HS code 3920992000, which refers to other plastic sheets, plates, films, foils, and strips.

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is a general category for other plastic films. It may be applicable if the product does not fit more specific codes like 3920435000.

📌 Key Considerations for Customs Compliance:

- Material Composition: Confirm whether the PVC film contains plasticizers, halogenated components, or is in rod form, as this will affect the correct HS code.

- Unit Price and Certification: Verify the unit price and whether any certifications (e.g., RoHS, REACH) are required for import.

- Tariff Changes: Be aware that additional tariffs of 30% will apply after April 11, 2025, which could significantly increase the total cost.

- Anti-Dumping Duties: While not explicitly mentioned here, be cautious of potential anti-dumping duties on PVC products, especially if imported from countries with known dumping practices.

🛑 Proactive Advice:

- Double-check the product’s exact composition and form (e.g., film, rod, sheet) to ensure the correct HS code is used.

- Consult with a customs broker or classification expert if the product contains additives or is used in specialized applications.

- Keep records of material specifications and supplier documentation to support customs declarations and avoid delays.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.