| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

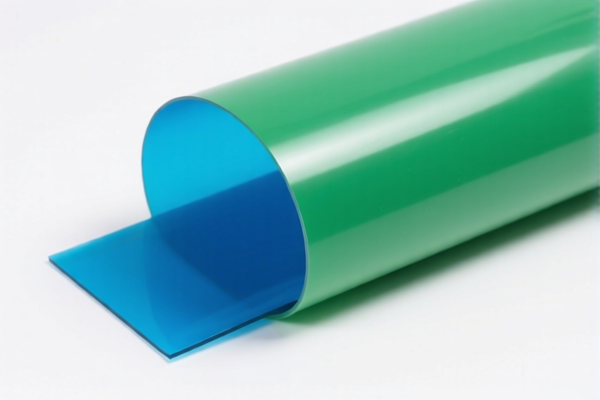

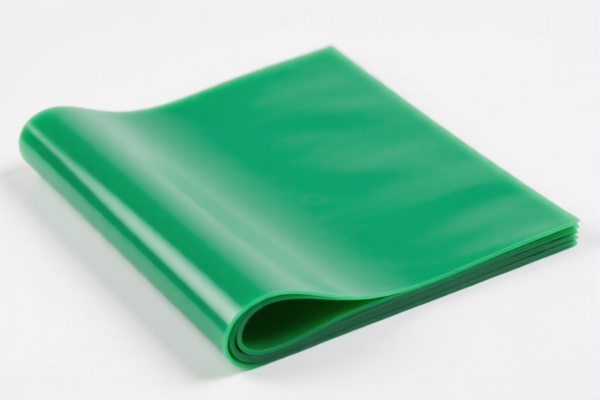

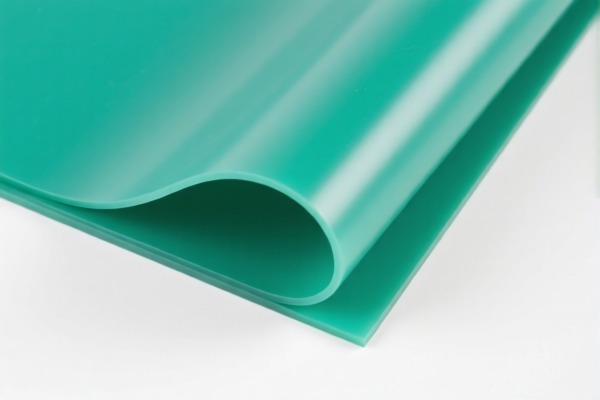

Product Classification: PVC Plasticized Antistatic Sheet

HS CODEs and Tax Information Summary:

- HS CODE: 3921125000

- Description: PVC antistatic sheet, classified under HS CODE 3921, which includes other plastic sheets, films, foils, and strips based on polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to PVC-based antistatic sheets.

-

HS CODE: 3904220000

- Description: PVC antistatic sheet, classified under HS CODE 3904, which includes plastic products made of polyvinyl chloride, specifically plasticized PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for plasticized PVC products.

-

HS CODE: 3921905050

- Description: Antistatic plastic sheet, classified under HS CODE 3921905050, which includes other plastic sheets, films, foils, and strips.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code has a lower base tax rate but still applies the 30% special tariff after April 11, 2025.

-

HS CODE: 3920995000

- Description: Antistatic plastic sheet, classified under HS CODE 3920995000, which includes other plastic products.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general plastic products not covered by more specific categories.

-

HS CODE: 3920490000

- Description: PVC antistatic film, classified under HS CODE 3920490000, which includes plastic sheets, films, and foils based on polyvinyl chloride polymer.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC-based films or sheets.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is indeed PVC-based and plasticized, as this will determine the correct HS CODE.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., antistatic, fire resistance) are required for import.

- Monitor Tariff Changes: The special tariff of 30% applies after April 11, 2025, so plan accordingly for cost estimation.

-

Consult Local Customs Authority: For the most up-to-date HS CODE and tariff information, always verify with local customs or a qualified customs broker. Product Classification: PVC Plasticized Antistatic Sheet

HS CODEs and Tax Information Summary: -

HS CODE: 3921125000

- Description: PVC antistatic sheet, classified under HS CODE 3921, which includes other plastic sheets, films, foils, and strips based on polyvinyl chloride (PVC) polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to PVC-based antistatic sheets.

-

HS CODE: 3904220000

- Description: PVC antistatic sheet, classified under HS CODE 3904, which includes plastic products made of polyvinyl chloride, specifically plasticized PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for plasticized PVC products.

-

HS CODE: 3921905050

- Description: Antistatic plastic sheet, classified under HS CODE 3921905050, which includes other plastic sheets, films, foils, and strips.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code has a lower base tax rate but still applies the 30% special tariff after April 11, 2025.

-

HS CODE: 3920995000

- Description: Antistatic plastic sheet, classified under HS CODE 3920995000, which includes other plastic products.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general plastic products not covered by more specific categories.

-

HS CODE: 3920490000

- Description: PVC antistatic film, classified under HS CODE 3920490000, which includes plastic sheets, films, and foils based on polyvinyl chloride polymer.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC-based films or sheets.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is indeed PVC-based and plasticized, as this will determine the correct HS CODE.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., antistatic, fire resistance) are required for import.

- Monitor Tariff Changes: The special tariff of 30% applies after April 11, 2025, so plan accordingly for cost estimation.

- Consult Local Customs Authority: For the most up-to-date HS CODE and tariff information, always verify with local customs or a qualified customs broker.

Customer Reviews

No reviews yet.