| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8534000070 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

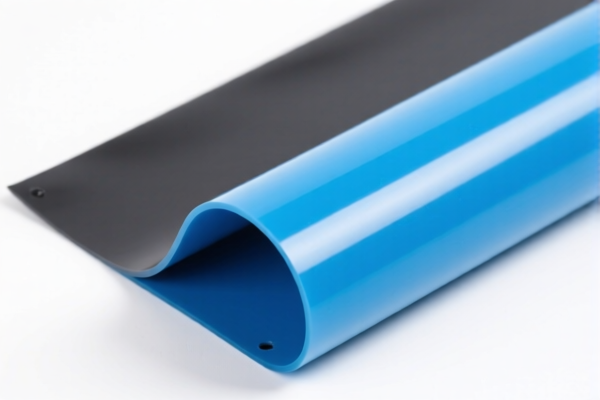

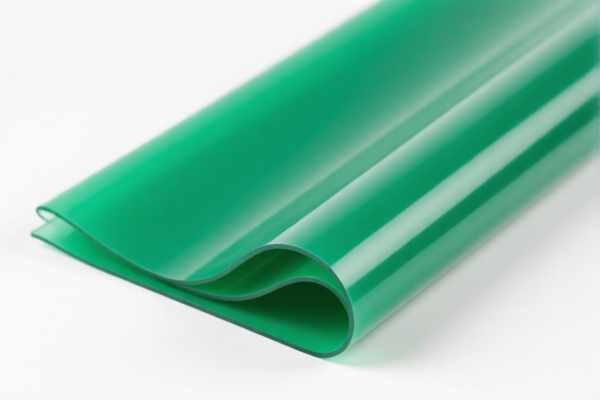

Product Name: PVC Plasticized Sheet Conductive Material

Classification: Based on the provided HS codes and descriptions, the product can be classified under several HS codes depending on specific attributes such as form (sheet vs. rod), conductivity, and intended use. Below is a structured analysis:

🔍 HS Code Classification Overview

1. HS CODE: 3916200091

- Description: PVC Plastic Conductive Rod

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 60.8%

- Notes:

- This code applies to PVC rods or rods made of PVC, not further processed.

- Ensure the product is not classified as a sheet or plate, as that would fall under a different code.

2. HS CODE: 3920995000

- Description: PVC Plastic Sheet (General Purpose)

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 60.8%

- Notes:

- This code is for general-purpose PVC sheets, not reinforced or combined with other materials.

- If the sheet is conductive, it may be better classified under a different code (see below).

3. HS CODE: 3916200020

- Description: PVC Plastic Sheet (Rod or Bar Form)

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 60.8%

- Notes:

- This code applies to PVC sheets or rods that are not specifically designed for a particular use (e.g., windows, doors).

- If the sheet is conductive, this may not be the most accurate classification.

4. HS CODE: 8534000070

- Description: Conductive Plastic Sheet (Printed Circuit Board Type)

- Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 55.0%

- Notes:

- This code is for conductive plastic sheets used in printed circuits, typically non-flexible.

- If the product is used in electronics or circuit boards, this may be the most accurate classification.

5. HS CODE: 3921905050

- Description: Conductive Plastic Sheet (General Purpose)

- Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 34.8%

- Notes:

- This code is for "other plastic sheets, plates, films, foils, and strips" that are not specifically defined elsewhere.

- It is a more favorable tax rate for conductive plastic sheets not used in electronics.

📌 Proactive Advice for Users

- Verify Material and Unit Price: Confirm whether the product is made of PVC or another plastic, and whether it is conductive or not. This will help in selecting the correct HS code.

- Check Certifications: If the product is used in electronics or circuit boards, ensure it meets relevant safety and compliance standards (e.g., RoHS, REACH).

- Consider Intended Use: If the sheet is for general use, 3921905050 may be more appropriate. If it's for circuit boards, 8534000070 is more accurate.

- Monitor Tariff Changes: The April 11, 2025, special tariff applies to all the above codes, so be prepared for a 30% increase in duty after that date.

✅ Summary of Tax Rates (after April 11, 2025)

| HS Code | Total Tax Rate | Notes |

|---|---|---|

| 3916200091 | 60.8% | PVC Conductive Rod |

| 3920995000 | 60.8% | General PVC Sheet |

| 3916200020 | 60.8% | PVC Sheet (Rod Form) |

| 8534000070 | 55.0% | Conductive Plastic Sheet (Circuit Board Type) |

| 3921905050 | 34.8% | Conductive Plastic Sheet (General Purpose) |

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: PVC Plasticized Sheet Conductive Material

Classification: Based on the provided HS codes and descriptions, the product can be classified under several HS codes depending on specific attributes such as form (sheet vs. rod), conductivity, and intended use. Below is a structured analysis:

🔍 HS Code Classification Overview

1. HS CODE: 3916200091

- Description: PVC Plastic Conductive Rod

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 60.8%

- Notes:

- This code applies to PVC rods or rods made of PVC, not further processed.

- Ensure the product is not classified as a sheet or plate, as that would fall under a different code.

2. HS CODE: 3920995000

- Description: PVC Plastic Sheet (General Purpose)

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 60.8%

- Notes:

- This code is for general-purpose PVC sheets, not reinforced or combined with other materials.

- If the sheet is conductive, it may be better classified under a different code (see below).

3. HS CODE: 3916200020

- Description: PVC Plastic Sheet (Rod or Bar Form)

- Tariff Summary:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 60.8%

- Notes:

- This code applies to PVC sheets or rods that are not specifically designed for a particular use (e.g., windows, doors).

- If the sheet is conductive, this may not be the most accurate classification.

4. HS CODE: 8534000070

- Description: Conductive Plastic Sheet (Printed Circuit Board Type)

- Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 55.0%

- Notes:

- This code is for conductive plastic sheets used in printed circuits, typically non-flexible.

- If the product is used in electronics or circuit boards, this may be the most accurate classification.

5. HS CODE: 3921905050

- Description: Conductive Plastic Sheet (General Purpose)

- Tariff Summary:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax: 34.8%

- Notes:

- This code is for "other plastic sheets, plates, films, foils, and strips" that are not specifically defined elsewhere.

- It is a more favorable tax rate for conductive plastic sheets not used in electronics.

📌 Proactive Advice for Users

- Verify Material and Unit Price: Confirm whether the product is made of PVC or another plastic, and whether it is conductive or not. This will help in selecting the correct HS code.

- Check Certifications: If the product is used in electronics or circuit boards, ensure it meets relevant safety and compliance standards (e.g., RoHS, REACH).

- Consider Intended Use: If the sheet is for general use, 3921905050 may be more appropriate. If it's for circuit boards, 8534000070 is more accurate.

- Monitor Tariff Changes: The April 11, 2025, special tariff applies to all the above codes, so be prepared for a 30% increase in duty after that date.

✅ Summary of Tax Rates (after April 11, 2025)

| HS Code | Total Tax Rate | Notes |

|---|---|---|

| 3916200091 | 60.8% | PVC Conductive Rod |

| 3920995000 | 60.8% | General PVC Sheet |

| 3916200020 | 60.8% | PVC Sheet (Rod Form) |

| 8534000070 | 55.0% | Conductive Plastic Sheet (Circuit Board Type) |

| 3921905050 | 34.8% | Conductive Plastic Sheet (General Purpose) |

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.