| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

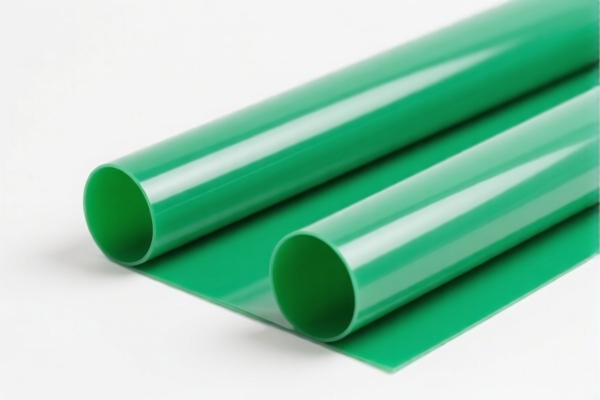

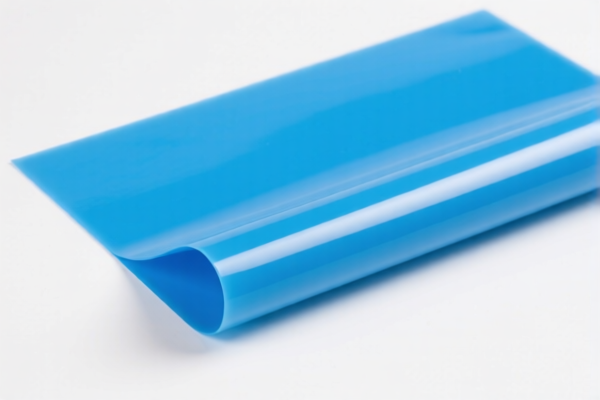

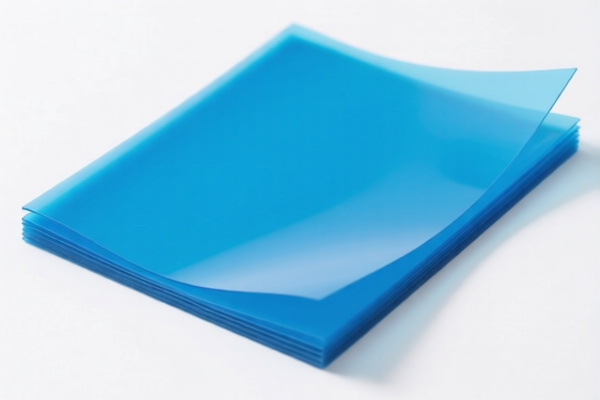

Product Classification: PVC Plasticized Sheet (Engraving Material)

HS CODE: 3920435000, 3920995000, 3920490000, 3921125000, 3916200020

Tariff Overview (as of current regulations):

- Base Tariff Rate: Varies between 4.2% and 6.5%, depending on the specific HS code.

- Additional Tariff (General): 25.0% (applies to all listed HS codes).

- Special Tariff (April 11, 2025 onwards): 30.0% (applies to all listed HS codes).

- Anti-dumping duties on iron and aluminum: Not applicable for PVC plasticized sheets.

Key Tax Rate Breakdown by HS Code:

- HS CODE 3921125000

- Base Tariff: 6.5%

- Total Tax: 61.5% (6.5% + 25.0% + 30.0%)

-

Description: PVC engraved sheets, including plastic sheets, films, foils, and strips made from PVC polymer.

-

HS CODE 3920435000

- Base Tariff: 4.2%

- Total Tax: 59.2% (4.2% + 25.0% + 30.0%)

-

Description: PVC engraved sheets with at least 6% plasticizer, classified under 3920.

-

HS CODE 3920995000

- Base Tariff: 5.8%

- Total Tax: 60.8% (5.8% + 25.0% + 30.0%)

-

Description: General plastic engraved sheets, non-cellular, non-reinforced, possibly laminated or combined.

-

HS CODE 3920490000

- Base Tariff: 5.8%

- Total Tax: 60.8% (5.8% + 25.0% + 30.0%)

-

Description: PVC decorative sheet materials, specifically for decorative use.

-

HS CODE 3916200020

- Base Tariff: 5.8%

- Total Tax: 60.8% (5.8% + 25.0% + 30.0%)

- Description: PVC plastic sheets, classified under "other" as they are not specified for particular uses like windows or doors.

Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the PVC sheet (e.g., percentage of plasticizer, reinforcement, or laminates) to ensure correct HS code classification. -

Certifications Required:

Check if import permits, product certifications, or environmental compliance documents are required for PVC products in your destination country. -

Unit Price and Classification:

The unit price may influence the classification, especially if the product is considered "decorative" or "industrial-grade."

Proactive Advice:

- Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification.

- Keep records of material specifications, including plasticizer content and intended use.

- Monitor policy updates for any changes in tariff rates or import restrictions after April 11, 2025.

Let me know if you need help with HS code selection or customs documentation.

Product Classification: PVC Plasticized Sheet (Engraving Material)

HS CODE: 3920435000, 3920995000, 3920490000, 3921125000, 3916200020

Tariff Overview (as of current regulations):

- Base Tariff Rate: Varies between 4.2% and 6.5%, depending on the specific HS code.

- Additional Tariff (General): 25.0% (applies to all listed HS codes).

- Special Tariff (April 11, 2025 onwards): 30.0% (applies to all listed HS codes).

- Anti-dumping duties on iron and aluminum: Not applicable for PVC plasticized sheets.

Key Tax Rate Breakdown by HS Code:

- HS CODE 3921125000

- Base Tariff: 6.5%

- Total Tax: 61.5% (6.5% + 25.0% + 30.0%)

-

Description: PVC engraved sheets, including plastic sheets, films, foils, and strips made from PVC polymer.

-

HS CODE 3920435000

- Base Tariff: 4.2%

- Total Tax: 59.2% (4.2% + 25.0% + 30.0%)

-

Description: PVC engraved sheets with at least 6% plasticizer, classified under 3920.

-

HS CODE 3920995000

- Base Tariff: 5.8%

- Total Tax: 60.8% (5.8% + 25.0% + 30.0%)

-

Description: General plastic engraved sheets, non-cellular, non-reinforced, possibly laminated or combined.

-

HS CODE 3920490000

- Base Tariff: 5.8%

- Total Tax: 60.8% (5.8% + 25.0% + 30.0%)

-

Description: PVC decorative sheet materials, specifically for decorative use.

-

HS CODE 3916200020

- Base Tariff: 5.8%

- Total Tax: 60.8% (5.8% + 25.0% + 30.0%)

- Description: PVC plastic sheets, classified under "other" as they are not specified for particular uses like windows or doors.

Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the PVC sheet (e.g., percentage of plasticizer, reinforcement, or laminates) to ensure correct HS code classification. -

Certifications Required:

Check if import permits, product certifications, or environmental compliance documents are required for PVC products in your destination country. -

Unit Price and Classification:

The unit price may influence the classification, especially if the product is considered "decorative" or "industrial-grade."

Proactive Advice:

- Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification.

- Keep records of material specifications, including plasticizer content and intended use.

- Monitor policy updates for any changes in tariff rates or import restrictions after April 11, 2025.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.