| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured and professional analysis of the HS codes and tariff rates for the PVC Plasticized Sheet / Hot Lamination Sheet product, based on the provided data:

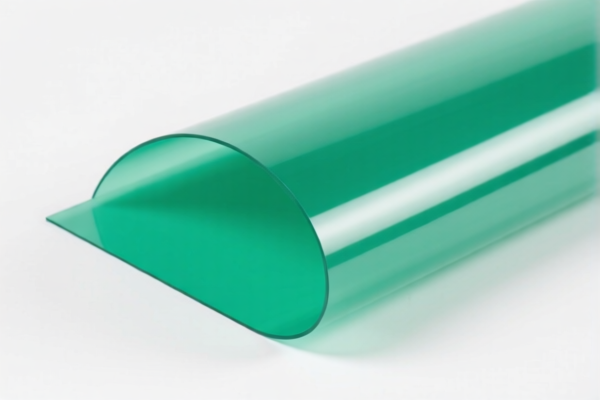

✅ HS CODE: 3920490000

Product Description: PVC Plastic Sheet / PVC Plastic Packaging Film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is listed twice in the input, once for "PVC Plastic Sheet" and once for "PVC Plastic Packaging Film." Ensure the product description matches the actual item being imported.

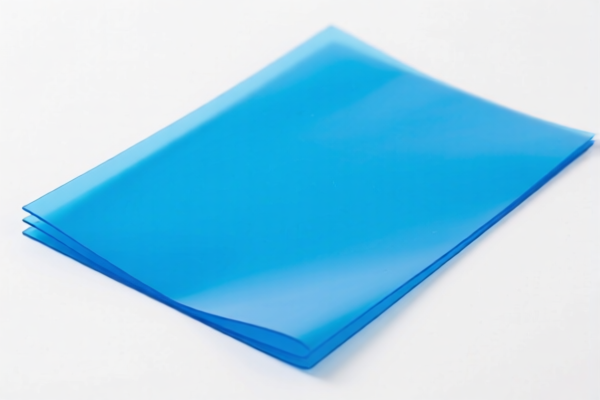

✅ HS CODE: 3920992000

Product Description: Thermoplastic Plastic Film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general thermoplastic films. Confirm if the product is indeed a "thermoplastic film" and not a specific type like PVC.

✅ HS CODE: 3904220000

Product Description: PVC Heat Shrink Film

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to PVC heat shrink film. Ensure the product is not misclassified under a broader category.

✅ HS CODE: 3921125000

Product Description: PVC Heat Shrink Film

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for PVC heat shrink film. Verify if this is the most accurate classification for your product.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly.

-

Anti-Dumping Duties: While not explicitly mentioned in the data, be aware that anti-dumping duties on iron and aluminum may apply if the product is part of a targeted sector. Confirm with customs or a compliance expert if your product is affected.

-

Material and Certification Verification:

- Confirm the exact material composition (e.g., is it 100% PVC? Are there additives or coatings?)

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Unit Price and Classification:

- Ensure the HS code matches the product description and unit price. Misclassification can lead to delays, penalties, or higher tariffs.

🛑 Action Required:

- Verify the exact product name and technical specifications to ensure the correct HS code is used.

- Consult with customs or a compliance expert if the product is a composite or modified version of standard PVC films.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with HS code selection or tariff calculation for a specific product description. Here is the structured and professional analysis of the HS codes and tariff rates for the PVC Plasticized Sheet / Hot Lamination Sheet product, based on the provided data:

✅ HS CODE: 3920490000

Product Description: PVC Plastic Sheet / PVC Plastic Packaging Film

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is listed twice in the input, once for "PVC Plastic Sheet" and once for "PVC Plastic Packaging Film." Ensure the product description matches the actual item being imported.

✅ HS CODE: 3920992000

Product Description: Thermoplastic Plastic Film

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general thermoplastic films. Confirm if the product is indeed a "thermoplastic film" and not a specific type like PVC.

✅ HS CODE: 3904220000

Product Description: PVC Heat Shrink Film

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to PVC heat shrink film. Ensure the product is not misclassified under a broader category.

✅ HS CODE: 3921125000

Product Description: PVC Heat Shrink Film

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for PVC heat shrink film. Verify if this is the most accurate classification for your product.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly.

-

Anti-Dumping Duties: While not explicitly mentioned in the data, be aware that anti-dumping duties on iron and aluminum may apply if the product is part of a targeted sector. Confirm with customs or a compliance expert if your product is affected.

-

Material and Certification Verification:

- Confirm the exact material composition (e.g., is it 100% PVC? Are there additives or coatings?)

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Unit Price and Classification:

- Ensure the HS code matches the product description and unit price. Misclassification can lead to delays, penalties, or higher tariffs.

🛑 Action Required:

- Verify the exact product name and technical specifications to ensure the correct HS code is used.

- Consult with customs or a compliance expert if the product is a composite or modified version of standard PVC films.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

Let me know if you need help with HS code selection or tariff calculation for a specific product description.

Customer Reviews

No reviews yet.