| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for PVC Plasticized Sheet for Advertising:

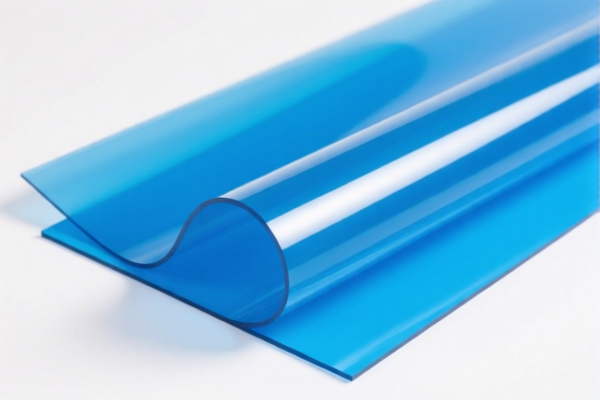

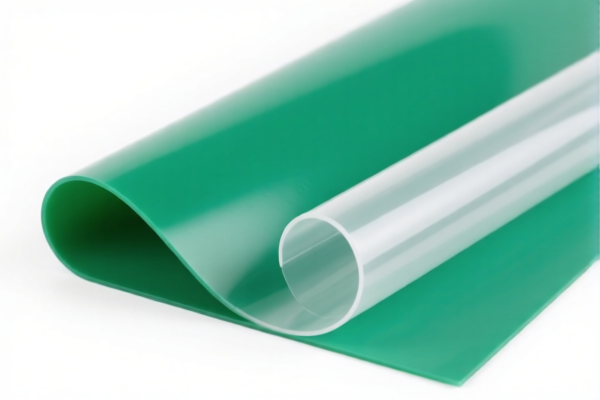

📦 Product Classification Overview: PVC Plasticized Sheet for Advertising

✅ HS CODE: 3904400000

- Description: PVC advertising materials

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is one of the highest tax rates among the listed options.

✅ HS CODE: 3920490000

- Description: PVC advertising sheet

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher than 3904400000 due to a higher base rate.

✅ HS CODE: 3920992000

- Description: Plastic sheets for advertising displays

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but still subject to the same additional and special tariffs.

✅ HS CODE: 3904220000

- Description: PVC advertising film

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Highest total tax rate among all options.

✅ HS CODE: 3921125000

- Description: PVC advertising board

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same total tax rate as 3904220000, but different product description.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

-

Anti-dumping duties: Not explicitly mentioned in the data, but be aware that PVC products may be subject to anti-dumping duties depending on the country of origin and specific trade policies.

-

Material and Certification Verification:

- Confirm the exact material composition (e.g., PVC, thickness, additives) to ensure correct HS code classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Unit Price and Tax Calculation:

- Be mindful of total tax impact on your product cost. For example, a 61.5% tax rate on a $100 product would add $61.50 in tariffs.

📌 Proactive Advice:

- Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification penalties.

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

- Consider alternative materials or sourcing strategies if high tariffs significantly impact your cost structure.

Let me know if you need help calculating the total cost or verifying the correct HS code for your specific product. Here is the structured and professional breakdown of the HS codes and associated tariffs for PVC Plasticized Sheet for Advertising:

📦 Product Classification Overview: PVC Plasticized Sheet for Advertising

✅ HS CODE: 3904400000

- Description: PVC advertising materials

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is one of the highest tax rates among the listed options.

✅ HS CODE: 3920490000

- Description: PVC advertising sheet

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher than 3904400000 due to a higher base rate.

✅ HS CODE: 3920992000

- Description: Plastic sheets for advertising displays

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but still subject to the same additional and special tariffs.

✅ HS CODE: 3904220000

- Description: PVC advertising film

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Highest total tax rate among all options.

✅ HS CODE: 3921125000

- Description: PVC advertising board

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Same total tax rate as 3904220000, but different product description.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

-

Anti-dumping duties: Not explicitly mentioned in the data, but be aware that PVC products may be subject to anti-dumping duties depending on the country of origin and specific trade policies.

-

Material and Certification Verification:

- Confirm the exact material composition (e.g., PVC, thickness, additives) to ensure correct HS code classification.

-

Check if certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

-

Unit Price and Tax Calculation:

- Be mindful of total tax impact on your product cost. For example, a 61.5% tax rate on a $100 product would add $61.50 in tariffs.

📌 Proactive Advice:

- Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification penalties.

- Monitor policy updates after April 11, 2025, as the special tariff may change or be extended.

- Consider alternative materials or sourcing strategies if high tariffs significantly impact your cost structure.

Let me know if you need help calculating the total cost or verifying the correct HS code for your specific product.

Customer Reviews

No reviews yet.