| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

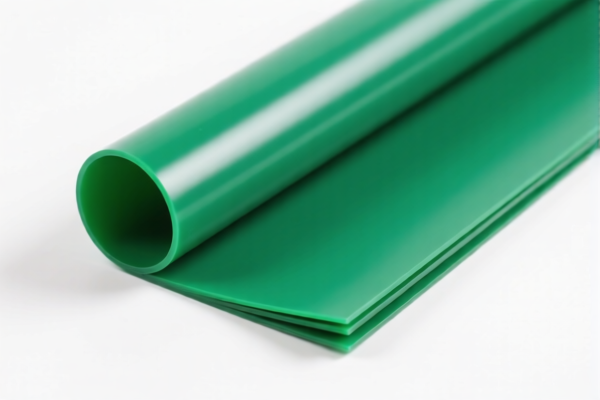

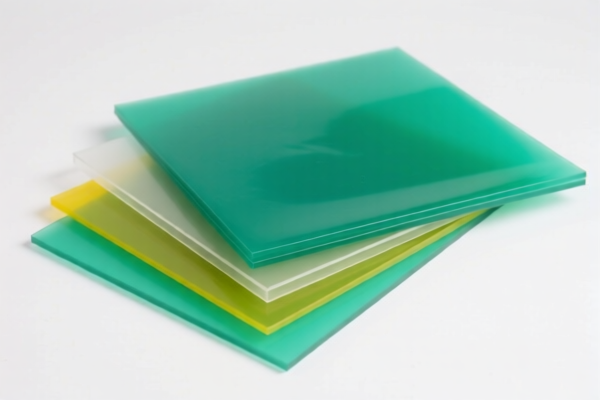

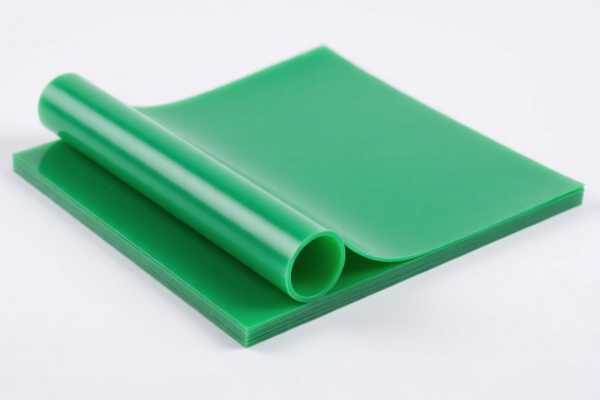

Product Name: PVC Plasticized Sheet for Construction

Classification: Plastic sheets made of PVC (Polyvinyl Chloride) with plasticizers, used in construction.

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for PVC plasticized sheets, based on your input:

1. HS CODE: 3920995000

- Description: Plastic sheets, non-cellular, not reinforced, not layered or combined with other materials, made of various plastics (including PVC).

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC sheets that are not layered or combined with other materials.

2. HS CODE: 3916200020

- Description: Plastic monofilaments, rods, sticks, and profiles made of other polyvinyl chloride polymers.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC rods or profiles, not sheets. Not ideal for your product unless it's in a different form.

3. HS CODE: 3920431000

- Description: Plastic sheets made of chlorinated vinyl polymers containing plasticizers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific code for PVC sheets with plasticizers, which aligns well with your product.

4. HS CODE: 3921905050

- Description: Other plastic sheets, films, foils, and strips, including those made of polyvinyl chloride.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is broader and may apply to PVC sheets, but it's less specific than 3920431000.

5. HS CODE: 3921125000

- Description: Other plastic sheets, films, foils, and strips, including those made of polyvinyl chloride.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for PVC sheets but may be more general and less precise for your product.

🔍 Key Observations and Recommendations

- Best Fit: HS CODE 3920431000 is the most accurate for PVC plasticized sheets used in construction, as it specifically refers to chlorinated vinyl polymers with plasticizers.

- Tax Rate Alert: All codes are subject to an additional 30% tariff after April 11, 2025, which is a time-sensitive policy. Ensure your import timeline accounts for this.

- Anti-dumping duties: Not applicable for PVC sheets unless specified by the importing country (e.g., China may have specific anti-dumping measures for certain PVC products).

- Certifications: Verify if your product requires customs documentation, material certifications, or compliance with local building standards (e.g., fire resistance, environmental impact).

📌 Proactive Advice for Importers

- Confirm Product Specifications: Ensure the product is plasticized PVC and not reinforced or layered with other materials.

- Check Unit Price and Material Composition: This will help in accurate classification and tax calculation.

- Review Import Regulations: Some countries may have additional restrictions or special tariffs for construction materials.

- Consult a Customs Broker: For complex cases, especially if the product is used in regulated construction projects.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: PVC Plasticized Sheet for Construction

Classification: Plastic sheets made of PVC (Polyvinyl Chloride) with plasticizers, used in construction.

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for PVC plasticized sheets, based on your input:

1. HS CODE: 3920995000

- Description: Plastic sheets, non-cellular, not reinforced, not layered or combined with other materials, made of various plastics (including PVC).

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for PVC sheets that are not layered or combined with other materials.

2. HS CODE: 3916200020

- Description: Plastic monofilaments, rods, sticks, and profiles made of other polyvinyl chloride polymers.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to PVC rods or profiles, not sheets. Not ideal for your product unless it's in a different form.

3. HS CODE: 3920431000

- Description: Plastic sheets made of chlorinated vinyl polymers containing plasticizers.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific code for PVC sheets with plasticizers, which aligns well with your product.

4. HS CODE: 3921905050

- Description: Other plastic sheets, films, foils, and strips, including those made of polyvinyl chloride.

- Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is broader and may apply to PVC sheets, but it's less specific than 3920431000.

5. HS CODE: 3921125000

- Description: Other plastic sheets, films, foils, and strips, including those made of polyvinyl chloride.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also for PVC sheets but may be more general and less precise for your product.

🔍 Key Observations and Recommendations

- Best Fit: HS CODE 3920431000 is the most accurate for PVC plasticized sheets used in construction, as it specifically refers to chlorinated vinyl polymers with plasticizers.

- Tax Rate Alert: All codes are subject to an additional 30% tariff after April 11, 2025, which is a time-sensitive policy. Ensure your import timeline accounts for this.

- Anti-dumping duties: Not applicable for PVC sheets unless specified by the importing country (e.g., China may have specific anti-dumping measures for certain PVC products).

- Certifications: Verify if your product requires customs documentation, material certifications, or compliance with local building standards (e.g., fire resistance, environmental impact).

📌 Proactive Advice for Importers

- Confirm Product Specifications: Ensure the product is plasticized PVC and not reinforced or layered with other materials.

- Check Unit Price and Material Composition: This will help in accurate classification and tax calculation.

- Review Import Regulations: Some countries may have additional restrictions or special tariffs for construction materials.

- Consult a Customs Broker: For complex cases, especially if the product is used in regulated construction projects.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.