Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

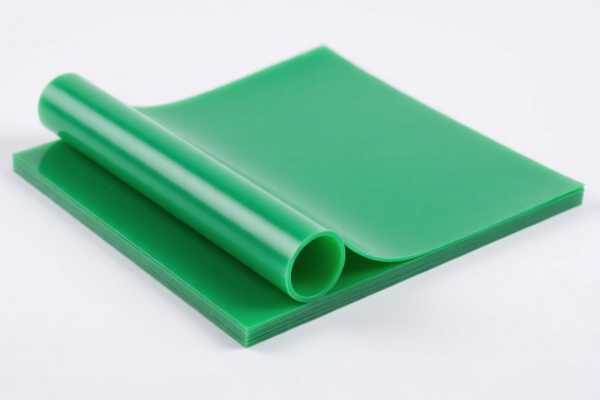

Here is the structured and professional analysis of the HS codes and tariff rates for PVC Plasticized Sheet for Printing, based on the provided data:

✅ HS CODE: 3916200020

- Description: Other polyvinyl chloride (PVC) polymer made plastic monofilament, rods, sticks, and profiles.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be suitable if the PVC sheet is classified as a profile or rod-like shape.

✅ HS CODE: 3920431000

- Description: Plastic sheets made of chlor乙烯 polymer containing plasticizers.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a likely candidate for plasticized PVC sheets used in printing, as it specifically mentions plasticizers.

✅ HS CODE: 3920995000

- Description: Plastic sheets, non-cellular, not reinforced, not layered or combined with other materials.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply if the sheet is not layered or combined with other materials.

✅ HS CODE: 3921905050

- Description: Other plastic sheets, films, foils, and strips, including PVC.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower total tax rate and may be more favorable for printing-grade PVC sheets.

- Important: Confirm if the product is classified under this code based on its specific form and use (e.g., film, sheet, or foil).

✅ HS CODE: 3921125000

- Description: Other plastic sheets, films, foils, and strips, including PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to specific types of PVC sheets, but the higher tax rate makes it less favorable unless required by product specifications.

📌 Key Observations and Recommendations:

- Lowest Tax Rate: HS CODE 3921905050 (34.8%) is the most cost-effective option, but only if the product fits the description (e.g., not layered, not reinforced).

- Time-Sensitive Policy: All codes are subject to an additional 30% tariff after April 11, 2025. This is a critical date to consider for import planning.

- Certifications Required: Verify if certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product.

- Material and Unit Price: Confirm the exact composition of the PVC sheet (e.g., plasticizer content, thickness, and form) to ensure correct classification.

- Consult a Customs Broker: For high-value or complex imports, it is advisable to seek professional customs advice to avoid misclassification penalties.

Let me know if you need help determining the most appropriate HS code based on your product’s specifications. Here is the structured and professional analysis of the HS codes and tariff rates for PVC Plasticized Sheet for Printing, based on the provided data:

✅ HS CODE: 3916200020

- Description: Other polyvinyl chloride (PVC) polymer made plastic monofilament, rods, sticks, and profiles.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be suitable if the PVC sheet is classified as a profile or rod-like shape.

✅ HS CODE: 3920431000

- Description: Plastic sheets made of chlor乙烯 polymer containing plasticizers.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a likely candidate for plasticized PVC sheets used in printing, as it specifically mentions plasticizers.

✅ HS CODE: 3920995000

- Description: Plastic sheets, non-cellular, not reinforced, not layered or combined with other materials.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply if the sheet is not layered or combined with other materials.

✅ HS CODE: 3921905050

- Description: Other plastic sheets, films, foils, and strips, including PVC.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has a lower total tax rate and may be more favorable for printing-grade PVC sheets.

- Important: Confirm if the product is classified under this code based on its specific form and use (e.g., film, sheet, or foil).

✅ HS CODE: 3921125000

- Description: Other plastic sheets, films, foils, and strips, including PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to specific types of PVC sheets, but the higher tax rate makes it less favorable unless required by product specifications.

📌 Key Observations and Recommendations:

- Lowest Tax Rate: HS CODE 3921905050 (34.8%) is the most cost-effective option, but only if the product fits the description (e.g., not layered, not reinforced).

- Time-Sensitive Policy: All codes are subject to an additional 30% tariff after April 11, 2025. This is a critical date to consider for import planning.

- Certifications Required: Verify if certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product.

- Material and Unit Price: Confirm the exact composition of the PVC sheet (e.g., plasticizer content, thickness, and form) to ensure correct classification.

- Consult a Customs Broker: For high-value or complex imports, it is advisable to seek professional customs advice to avoid misclassification penalties.

Let me know if you need help determining the most appropriate HS code based on your product’s specifications.

Customer Reviews

No reviews yet.