| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

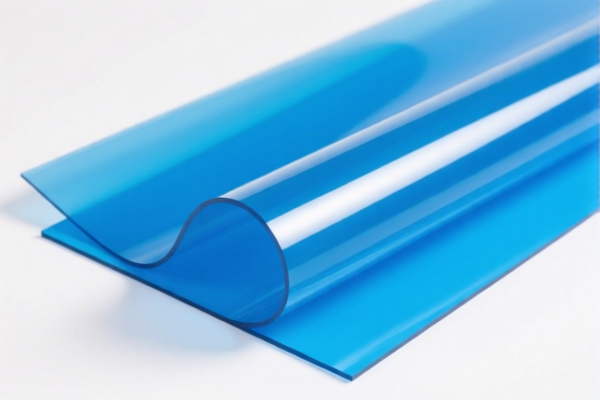

Here is the structured and professional analysis of the HS codes and tariff rates for PVC Plasticized Sheet for Signage, based on the provided data:

✅ HS CODE: 3921125000

Product Description: PVC signage board, classified under HS code 3921, which falls under plastic sheets.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is the most common classification for finished PVC signage boards.

✅ HS CODE: 3904210000

Product Description: Raw material for PVC signage board, classified under HS code 3904, which refers to unplasticized polyvinyl chloride (PVC).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is for raw PVC material, not the finished signage board.

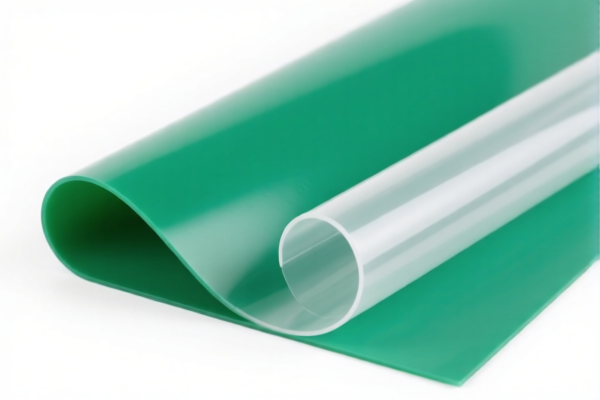

✅ HS CODE: 3920995000

Product Description: Plastic signage board, classified under HS code 3920995000, which covers various plastic sheets.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This is a broader category for plastic sheets, including PVC.

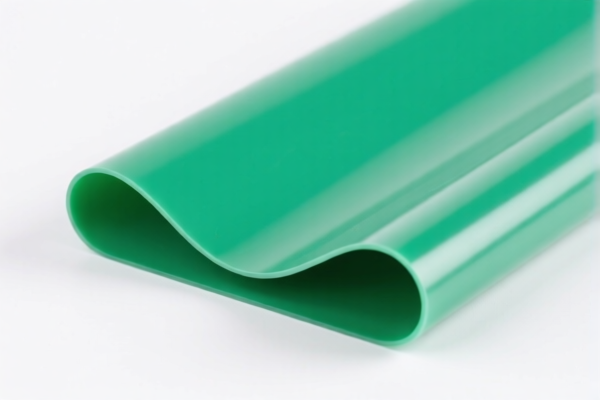

✅ HS CODE: 3921905050

Product Description: Plastic signage board, classified under HS code 3921905050, which covers plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes: This is a more favorable rate, but only applicable if the product fits the specific description of this HS code.

✅ HS CODE: 3916200020

Product Description: PVC plastic sheet, classified under HS code 3916.20.00.91, which refers to other PVC polymer products such as rods, sticks, and profiles.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This is for PVC in the form of rods or profiles, not flat sheets.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material (plasticized vs. unplasticized PVC) and form (sheet, rod, profile).

- Check Required Certifications: Some HS codes may require specific documentation or certifications (e.g., material safety, origin).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above HS codes, so plan accordingly for increased costs.

- Consider HS Code 3921905050 for Cost Savings: If your product fits the description, this code offers a lower total tax rate of 34.8%.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured and professional analysis of the HS codes and tariff rates for PVC Plasticized Sheet for Signage, based on the provided data:

✅ HS CODE: 3921125000

Product Description: PVC signage board, classified under HS code 3921, which falls under plastic sheets.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is the most common classification for finished PVC signage boards.

✅ HS CODE: 3904210000

Product Description: Raw material for PVC signage board, classified under HS code 3904, which refers to unplasticized polyvinyl chloride (PVC).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is for raw PVC material, not the finished signage board.

✅ HS CODE: 3920995000

Product Description: Plastic signage board, classified under HS code 3920995000, which covers various plastic sheets.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This is a broader category for plastic sheets, including PVC.

✅ HS CODE: 3921905050

Product Description: Plastic signage board, classified under HS code 3921905050, which covers plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes: This is a more favorable rate, but only applicable if the product fits the specific description of this HS code.

✅ HS CODE: 3916200020

Product Description: PVC plastic sheet, classified under HS code 3916.20.00.91, which refers to other PVC polymer products such as rods, sticks, and profiles.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This is for PVC in the form of rods or profiles, not flat sheets.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material (plasticized vs. unplasticized PVC) and form (sheet, rod, profile).

- Check Required Certifications: Some HS codes may require specific documentation or certifications (e.g., material safety, origin).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above HS codes, so plan accordingly for increased costs.

- Consider HS Code 3921905050 for Cost Savings: If your product fits the description, this code offers a lower total tax rate of 34.8%.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.