| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920431000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 9503000013 | Doc | 30.0% | CN | US | 2025-05-12 |

| 3916200020 | Doc | 60.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for PVC Plasticized Sheet for Toys, based on the provided HS codes and tax details:

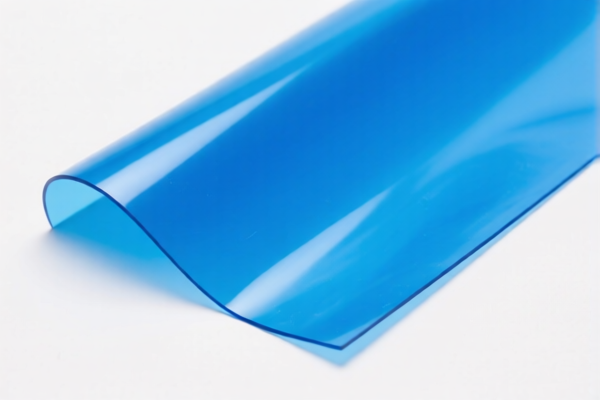

✅ HS CODE: 3920431000

Product Description: PVC plasticized sheet used as a toy packaging film, falls under the category of plastic sheets, films, foils, and strips.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Note: This code is suitable if the product is primarily used as a packaging film for toys.

✅ HS CODE: 3921904090

Product Description: Soft PVC plastic sheets, classified under flexible plastic sheets.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Note: This code is suitable if the product is a soft, flexible PVC sheet used in toy manufacturing.

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, films, foils, and strips (not specifically defined in other categories).

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Note: This is a general category for other types of plastic sheets, including PVC, if not covered by more specific codes.

✅ HS CODE: 9503000013

Product Description: Toy balls, including children's toys such as tricycles, scooters, dolls, models, puzzles, and accessories.

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Note: This code is for finished toys, not raw materials. If your product is a finished toy, this may be the correct classification.

✅ HS CODE: 3916200020

Product Description: PVC plastic sheets, classified under other polyvinyl chloride polymer products, such as rods, sticks, and profiles.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Note: This code is suitable if the product is a PVC rod, stick, or profile, not a flat sheet.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material composition and intended use (e.g., packaging vs. toy component).

- Check Required Certifications: Confirm if safety certifications (e.g., EN71 for toys) are required for import into your destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so plan your import schedule accordingly.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties based on the country of origin.

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation. Here is the structured classification and tariff information for PVC Plasticized Sheet for Toys, based on the provided HS codes and tax details:

✅ HS CODE: 3920431000

Product Description: PVC plasticized sheet used as a toy packaging film, falls under the category of plastic sheets, films, foils, and strips.

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

- Note: This code is suitable if the product is primarily used as a packaging film for toys.

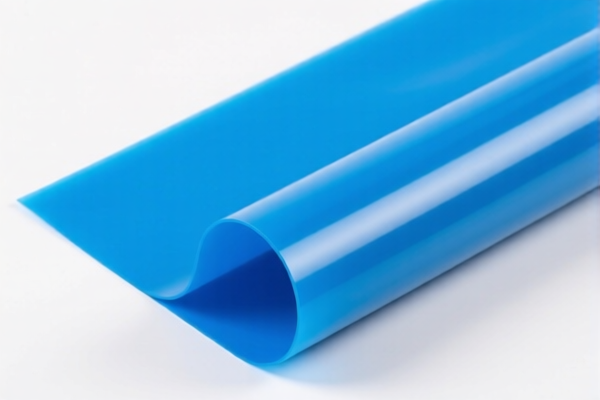

✅ HS CODE: 3921904090

Product Description: Soft PVC plastic sheets, classified under flexible plastic sheets.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Note: This code is suitable if the product is a soft, flexible PVC sheet used in toy manufacturing.

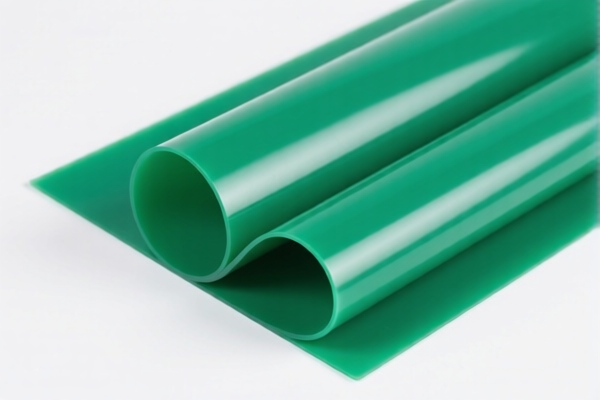

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, films, foils, and strips (not specifically defined in other categories).

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Note: This is a general category for other types of plastic sheets, including PVC, if not covered by more specific codes.

✅ HS CODE: 9503000013

Product Description: Toy balls, including children's toys such as tricycles, scooters, dolls, models, puzzles, and accessories.

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Note: This code is for finished toys, not raw materials. If your product is a finished toy, this may be the correct classification.

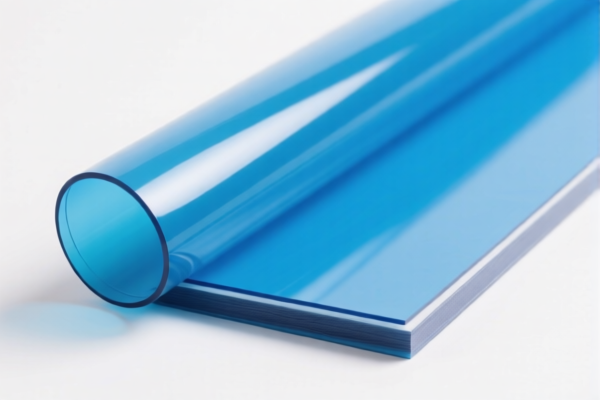

✅ HS CODE: 3916200020

Product Description: PVC plastic sheets, classified under other polyvinyl chloride polymer products, such as rods, sticks, and profiles.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Note: This code is suitable if the product is a PVC rod, stick, or profile, not a flat sheet.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material composition and intended use (e.g., packaging vs. toy component).

- Check Required Certifications: Confirm if safety certifications (e.g., EN71 for toys) are required for import into your destination country.

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes, so plan your import schedule accordingly.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties based on the country of origin.

Let me know if you need help determining the most accurate HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.