| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3812205000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 3812201000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3812399000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 3920435000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3812205000 | Doc | 60.0% | CN | US | 2025-05-12 |

Product Name: PVC Plasticizer Compound

Classification: Rubber or plastic composite plasticizers

HS CODEs and Tax Details:

- HS CODE: 3812205000

- Description: Composite plasticizers for rubber or plastics

- Total Tax Rate: 60.0%

- Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code appears twice in the input, but it is the same classification.

-

HS CODE: 3812201000

- Description: Composite plasticizers for rubber or plastics

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff compared to 3812205000.

-

HS CODE: 3812399000

- Description: Composite plasticizers for rubber or plastics (other)

- Total Tax Rate: 60.0%

-

Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

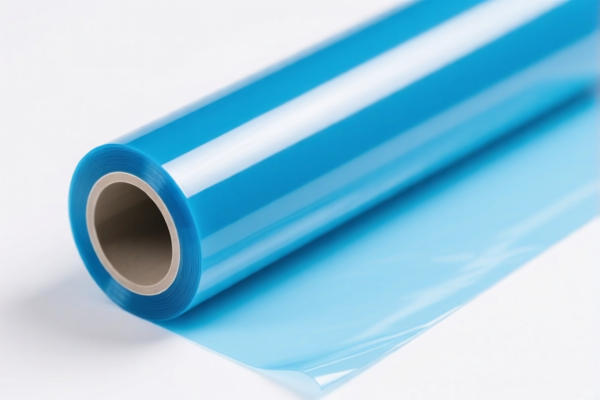

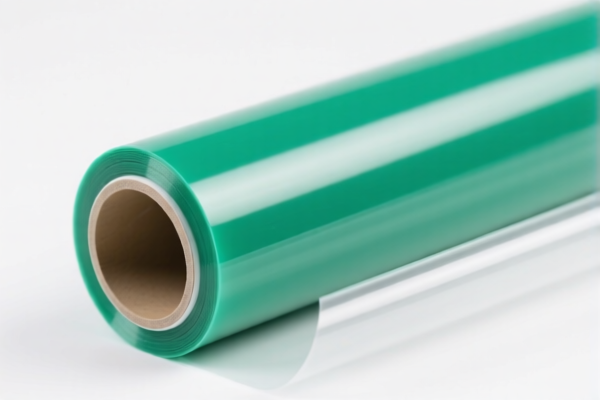

HS CODE: 3920435000

- Description: Plastic sheets, plates, films, foils, and strips made of vinyl polymers, containing not less than 6% plasticizer by weight

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for finished plastic products containing plasticizers, not the plasticizer compound itself.

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline accounts for this increase. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC plasticizers in the provided data. However, it is advisable to check for any ongoing investigations or duties related to PVC plasticizers in the relevant trade agreements or customs notices. -

Certifications and Documentation:

- Verify the material composition and unit price to ensure correct classification.

- Confirm if certifications (e.g., REACH, RoHS, or other regulatory compliance documents) are required for import.

-

Ensure product specifications align with the HS code description to avoid misclassification penalties.

-

Proactive Action:

If your product is a finished plastic product (e.g., plastic sheets or films) containing PVC plasticizer, consider HS CODE 3920435000. If it is the plasticizer compound itself, use one of the 381220xx codes.

Let me know if you need help determining the most accurate HS code based on your product’s specific composition or origin.

Product Name: PVC Plasticizer Compound

Classification: Rubber or plastic composite plasticizers

HS CODEs and Tax Details:

- HS CODE: 3812205000

- Description: Composite plasticizers for rubber or plastics

- Total Tax Rate: 60.0%

- Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code appears twice in the input, but it is the same classification.

-

HS CODE: 3812201000

- Description: Composite plasticizers for rubber or plastics

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly higher base tariff compared to 3812205000.

-

HS CODE: 3812399000

- Description: Composite plasticizers for rubber or plastics (other)

- Total Tax Rate: 60.0%

-

Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920435000

- Description: Plastic sheets, plates, films, foils, and strips made of vinyl polymers, containing not less than 6% plasticizer by weight

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is for finished plastic products containing plasticizers, not the plasticizer compound itself.

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline accounts for this increase. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for PVC plasticizers in the provided data. However, it is advisable to check for any ongoing investigations or duties related to PVC plasticizers in the relevant trade agreements or customs notices. -

Certifications and Documentation:

- Verify the material composition and unit price to ensure correct classification.

- Confirm if certifications (e.g., REACH, RoHS, or other regulatory compliance documents) are required for import.

-

Ensure product specifications align with the HS code description to avoid misclassification penalties.

-

Proactive Action:

If your product is a finished plastic product (e.g., plastic sheets or films) containing PVC plasticizer, consider HS CODE 3920435000. If it is the plasticizer compound itself, use one of the 381220xx codes.

Let me know if you need help determining the most accurate HS code based on your product’s specific composition or origin.

Customer Reviews

No reviews yet.