| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103210 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918104050 | Doc | 60.3% | CN | US | 2025-05-12 |

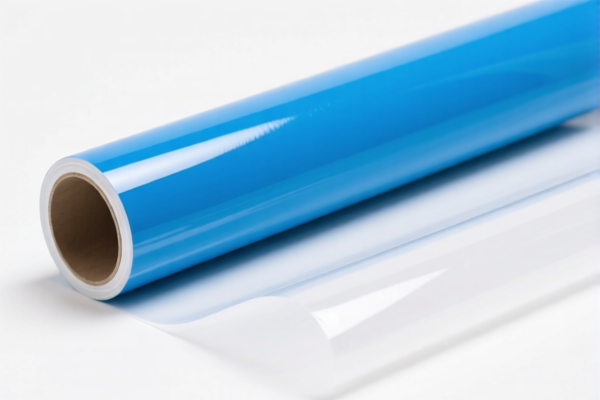

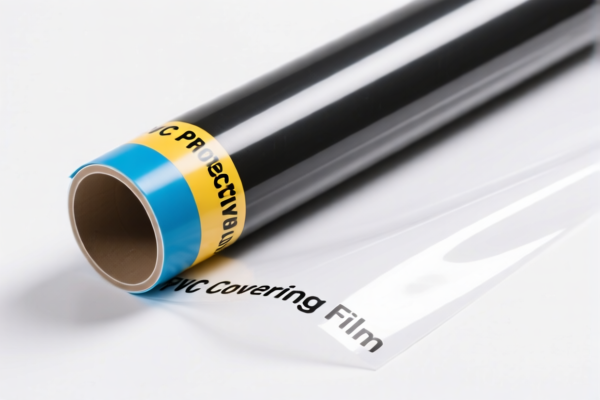

Product Classification: PVC Protective Wall Covering Film

HS CODEs and Tax Information Summary:

- HS CODE 3918104050

- Description: PVC wall protective film, made of PVC polymer with textile fiber backing, classified under HS CODE 3918.10.40.10.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies specifically to PVC films with textile backing.

-

HS CODE 3918103210

- Description: PVC wall protective film, classified under HS CODE 3918.10.32.10. This code covers plastic wall coverings, including PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general PVC wall coverings without specific textile backing.

-

HS CODE 3918103250

- Description: PVC wall protective film, classified under HS CODE 3918.10.32.50. This code also falls under the category of plastic wall coverings.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to different specifications or thicknesses of PVC wall coverings.

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline accounts for this increase. -

Material and Certification Check:

- Confirm the material composition (e.g., whether it includes textile backing or not) to determine the correct HS CODE.

-

Verify if certifications (e.g., fire resistance, environmental compliance) are required for import.

-

Unit Price and Classification:

- The unit price may affect the classification or duty calculation, especially if the product is considered a "finished good" or "raw material."

-

Ensure the product description matches the HS CODE description to avoid misclassification penalties.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for PVC wall coverings. However, always check the latest customs notices for any updates.

✅ Proactive Advice:

- Double-check the product specifications (e.g., thickness, backing material, intended use) to ensure accurate HS CODE selection.

- Consult with customs brokers or classification experts if the product has mixed materials or special features.

-

Keep records of product samples, technical data sheets, and supplier documentation for customs audits. Product Classification: PVC Protective Wall Covering Film

HS CODEs and Tax Information Summary: -

HS CODE 3918104050

- Description: PVC wall protective film, made of PVC polymer with textile fiber backing, classified under HS CODE 3918.10.40.10.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies specifically to PVC films with textile backing.

-

HS CODE 3918103210

- Description: PVC wall protective film, classified under HS CODE 3918.10.32.10. This code covers plastic wall coverings, including PVC.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general PVC wall coverings without specific textile backing.

-

HS CODE 3918103250

- Description: PVC wall protective film, classified under HS CODE 3918.10.32.50. This code also falls under the category of plastic wall coverings.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to different specifications or thicknesses of PVC wall coverings.

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline accounts for this increase. -

Material and Certification Check:

- Confirm the material composition (e.g., whether it includes textile backing or not) to determine the correct HS CODE.

-

Verify if certifications (e.g., fire resistance, environmental compliance) are required for import.

-

Unit Price and Classification:

- The unit price may affect the classification or duty calculation, especially if the product is considered a "finished good" or "raw material."

-

Ensure the product description matches the HS CODE description to avoid misclassification penalties.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for PVC wall coverings. However, always check the latest customs notices for any updates.

✅ Proactive Advice:

- Double-check the product specifications (e.g., thickness, backing material, intended use) to ensure accurate HS CODE selection.

- Consult with customs brokers or classification experts if the product has mixed materials or special features.

- Keep records of product samples, technical data sheets, and supplier documentation for customs audits.

Customer Reviews

No reviews yet.