| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

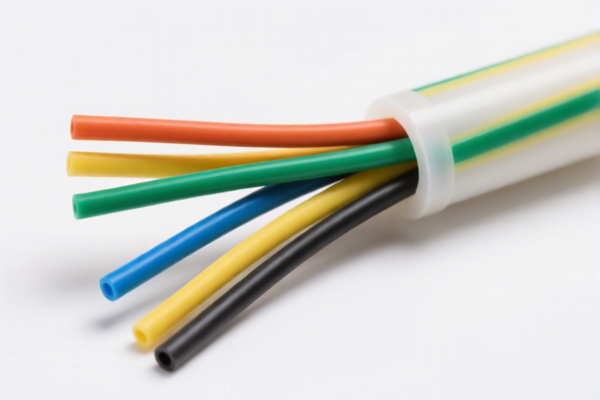

Here is the structured and professional analysis of the customs classification and tariff details for PVC Resin for Wire and Cable based on the provided HS codes and tax information:

✅ Product Classification Overview: PVC Resin for Wire and Cable

Below are the relevant HS codes and their associated tariff details:

🔢 HS CODE: 3904100000

Description: PVC Resin (Wire and Cable Grade) – Primary form of PVC, not mixed with other substances.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to unmodified PVC resin used in wire and cable manufacturing.

🔢 HS CODE: 3904220000

Description: PVC Wire and Cable – This code applies to plasticized PVC used in wire and cable production.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for finished PVC products used in wire and cable manufacturing.

🔢 HS CODE: 3904400000

Description: PVC Wire and Cable – This code applies to PVC products that are not in primary form.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC products used in wire and cable, but not in the primary form.

🔢 HS CODE: 3917320010

Description: PVC Wire Tubing – This code applies to PVC plastic tubes that are not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC tubes used in wire and cable insulation or protection.

🔢 HS CODE: 3920490000

Description: PVC Wire Tubing – This code applies to PVC sheets, films, or strips used in wire and cable applications.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC sheets or films used in wire and cable manufacturing.

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-Dumping Duties:

If the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert. -

Certifications Required:

Ensure that the product meets customs and safety standards (e.g., RoHS, REACH, or local regulations). Some countries may require product certification or origin documentation.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm whether the PVC is in primary form (3904100000) or plasticized (3904220000).

- Check Unit Price and Composition: The tax rate can vary based on material content and processing.

- Review Certification Requirements: Some countries may require technical documentation or certifications for PVC products.

- Plan for April 11, 2025 Tariff Increase: If importing after this date, budget for the 30.0% additional tariff.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools. Here is the structured and professional analysis of the customs classification and tariff details for PVC Resin for Wire and Cable based on the provided HS codes and tax information:

✅ Product Classification Overview: PVC Resin for Wire and Cable

Below are the relevant HS codes and their associated tariff details:

🔢 HS CODE: 3904100000

Description: PVC Resin (Wire and Cable Grade) – Primary form of PVC, not mixed with other substances.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to unmodified PVC resin used in wire and cable manufacturing.

🔢 HS CODE: 3904220000

Description: PVC Wire and Cable – This code applies to plasticized PVC used in wire and cable production.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for finished PVC products used in wire and cable manufacturing.

🔢 HS CODE: 3904400000

Description: PVC Wire and Cable – This code applies to PVC products that are not in primary form.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC products used in wire and cable, but not in the primary form.

🔢 HS CODE: 3917320010

Description: PVC Wire Tubing – This code applies to PVC plastic tubes that are not reinforced or combined with other materials.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC tubes used in wire and cable insulation or protection.

🔢 HS CODE: 3920490000

Description: PVC Wire Tubing – This code applies to PVC sheets, films, or strips used in wire and cable applications.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for PVC sheets or films used in wire and cable manufacturing.

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-Dumping Duties:

If the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert. -

Certifications Required:

Ensure that the product meets customs and safety standards (e.g., RoHS, REACH, or local regulations). Some countries may require product certification or origin documentation.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm whether the PVC is in primary form (3904100000) or plasticized (3904220000).

- Check Unit Price and Composition: The tax rate can vary based on material content and processing.

- Review Certification Requirements: Some countries may require technical documentation or certifications for PVC products.

- Plan for April 11, 2025 Tariff Increase: If importing after this date, budget for the 30.0% additional tariff.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.