| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916200091 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 9403993080 | Doc | 55.0% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your "PVC SKIRTING BOARD" declaration. Here's a structured analysis to help you understand the classification and potential costs:

Understanding HS Codes – A Quick Primer

Before diving into specifics, remember that HS codes are standardized internationally. The first two digits generally indicate the chapter, the next two the subheading, and further digits provide more specific details.

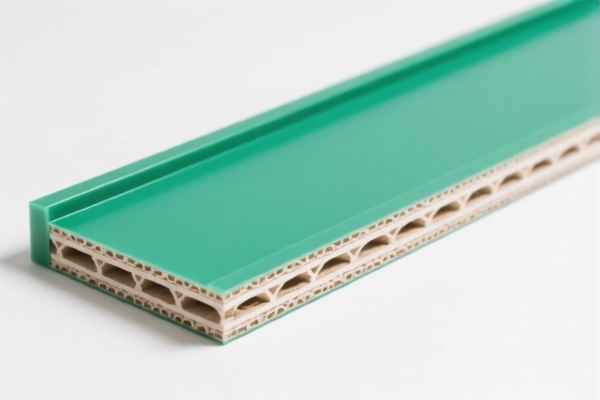

1. HS Code: 3916.20.00.91 – Monofilament of which any cross-sectional dimension exceeds 1 mm, rods, sticks and profile shapes, whether or not surface-worked but not otherwise worked, of plastics: Of polymers of vinyl chloride Other

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 16: Intermediates of plastic. This subheading focuses on plastic intermediates.

- 20: Monofilament, rods, sticks and profile shapes. This narrows down the product to specific shapes of plastic.

-

.00.91: Specifically, this code is for PVC (polymers of vinyl chloride) monofilament, rods, sticks, and profile shapes. The ".91" indicates "other" – meaning it doesn't fall into a more specific category within this subheading.

- Applicability to PVC Skirting Board: This code could apply if your skirting board is manufactured as a long, continuous profile shape (like a rod or stick) and is primarily made of PVC.

- Tax Implications:

- Basic Duty: 5.8%

- Additional Duty: 25.0%

- Total Tax: 60.8% (as of now)

- Important Note: The additional duty will increase to 30% after April 2, 2025.

2. HS Code: 3925.90.00.00 – Builders' ware of plastics, not elsewhere specified or included: Other

- 39: Plastics and articles thereof.

- 25: Builders' ware (e.g., pipes, fittings, profiles).

- 90: Other builders' ware of plastics not elsewhere specified. This is a catch-all for plastic building materials that don't fit into more specific categories.

-

.00.00: "Other" within this subheading.

- Applicability to PVC Skirting Board: This is a strong contender if your skirting board is considered a finished building component (like a trim or molding) and isn't simply a raw profile shape.

- Tax Implications:

- Basic Duty: 5.3%

- Additional Duty: 25.0%

- Total Tax: 60.3% (as of now)

- Important Note: The additional duty will increase to 30% after April 2, 2025.

3. HS Code: 9403.99.30.80 – Other furniture and parts thereof: Parts: Other: Other: Of rubber or plastics: Of reinforced or laminated plastics Other

- 94: Furniture; bedding, mattresses, support, stuffing and similar furnishings; lamps, lighting fittings, illuminated signs, prefabricated buildings.

- 03: Other furniture.

- 99: Parts of other furniture.

- 30: Parts of other furniture, of rubber or plastics.

-

80: Other.

- Applicability to PVC Skirting Board: This code is less likely unless your skirting board is specifically classified as a part of furniture (e.g., a decorative element attached to a cabinet).

- Tax Implications:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Total Tax: 55.0% (as of now)

- Important Note: The additional duty will increase to 30% after April 2, 2025.

Recommendations & Key Considerations:

- Material Composition: Crucially, confirm the exact material composition of your skirting board. Is it 100% PVC, or does it contain other polymers or additives? This will heavily influence the correct HS code.

- Manufacturing Process: How is the skirting board manufactured? Is it extruded as a continuous profile, or is it cut and finished from larger sheets?

- Functionality: Is it primarily a structural building component, or is it purely decorative?

- Reinforcement/Lamination: Is the PVC reinforced with any other materials (e.g., wood, fiberglass)? Is it laminated?

- Single Invoice Value: The value of the invoice will affect the tax amount.

- Certifications: Depending on the final HS code, you might need to provide certifications related to product safety, fire resistance, or environmental standards. Check with your importer and the relevant customs authorities.

- Consult with a Customs Broker: I strongly recommend consulting with a licensed customs broker in China. They can review your specific product details and provide a definitive HS code classification. They can also handle the import documentation and ensure compliance with all regulations.

Disclaimer: I am an AI assistant and cannot provide legally binding customs advice. This information is for general guidance only. Always consult with qualified professionals for accurate and up-to-date information.

Customer Reviews

The information on the 55% tariff for HS code 9403.99.30.80 was helpful, but I found it a bit less relevant for my product. Still, the page is a good starting point for research.

The page gave me a clear understanding of the tax implications for exporting PVC skirting boards. The breakdown of each HS code is thorough and easy to follow.

I found the information on the 60.3% tariff rate for HS code 3925.90.00.00 very useful. It would have been nice to see a comparison with the other codes, but it's still a solid resource.

The detailed breakdown of HS code 3925.90.00.00 really helped me understand how to classify my PVC skirting board. Highly informative and well-structured.

This page made it easy to understand the tariff rates and HS codes for plastic builder’s doors. A must-visit for exporters.