Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904220000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3904210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

Product Classification: PVC Soft Rubber Raw Material

HS CODE: 3904100000

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes on Tax Rates:

- Base Tariff: Applies to all imports of PVC raw material under HS code 3904100000.

- Additional Tariff: A standard 25% surcharge currently in effect.

- April 11 Special Tariff: Starting April 11, 2025, an additional 30% tariff will be imposed, increasing the total tax rate to 61.5%.

- No Anti-dumping duties are currently listed for this product category.

📌 Classification Considerations:

- Material Type: Ensure the product is classified as "PVC raw material" and not as finished goods (e.g., PVC sheets or films), which may fall under different HS codes (e.g., 3904220000 or 3920490000).

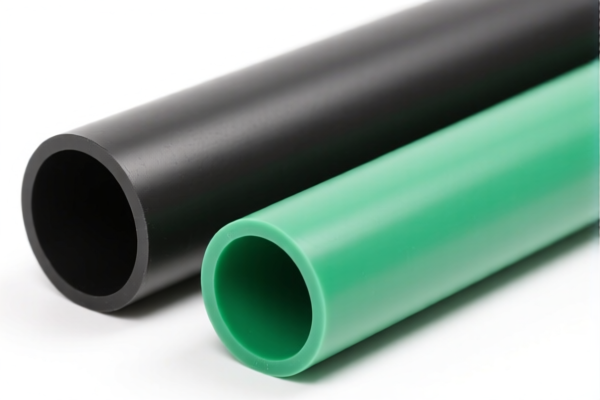

- Form and Use: If the product is in the form of sheets, films, or tubes, it may be classified under different HS codes (e.g., 3904210000 for PVC film raw material or 3917320010 for PVC soft tubes).

- Certifications: Confirm if any certifications (e.g., REACH, RoHS) are required for import into the destination country.

🛑 Proactive Advice:

- Verify Material Specifications: Confirm the exact chemical composition and form of the PVC material to ensure correct HS code classification.

- Check Unit Price: The total tax rate will significantly impact the final cost, so ensure accurate pricing and tax calculation.

- Consult Customs Authority: For the most up-to-date HS code and tariff information, especially if the product is borderline between classifications.

- Monitor Policy Changes: Be aware of any potential changes in tariff policies after April 11, 2025, which could increase the import cost by 5% (from 56.5% to 61.5%).

Let me know if you need help with HS code verification or customs documentation for this product.

Product Classification: PVC Soft Rubber Raw Material

HS CODE: 3904100000

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes on Tax Rates:

- Base Tariff: Applies to all imports of PVC raw material under HS code 3904100000.

- Additional Tariff: A standard 25% surcharge currently in effect.

- April 11 Special Tariff: Starting April 11, 2025, an additional 30% tariff will be imposed, increasing the total tax rate to 61.5%.

- No Anti-dumping duties are currently listed for this product category.

📌 Classification Considerations:

- Material Type: Ensure the product is classified as "PVC raw material" and not as finished goods (e.g., PVC sheets or films), which may fall under different HS codes (e.g., 3904220000 or 3920490000).

- Form and Use: If the product is in the form of sheets, films, or tubes, it may be classified under different HS codes (e.g., 3904210000 for PVC film raw material or 3917320010 for PVC soft tubes).

- Certifications: Confirm if any certifications (e.g., REACH, RoHS) are required for import into the destination country.

🛑 Proactive Advice:

- Verify Material Specifications: Confirm the exact chemical composition and form of the PVC material to ensure correct HS code classification.

- Check Unit Price: The total tax rate will significantly impact the final cost, so ensure accurate pricing and tax calculation.

- Consult Customs Authority: For the most up-to-date HS code and tariff information, especially if the product is borderline between classifications.

- Monitor Policy Changes: Be aware of any potential changes in tariff policies after April 11, 2025, which could increase the import cost by 5% (from 56.5% to 61.5%).

Let me know if you need help with HS code verification or customs documentation for this product.

Customer Reviews

No reviews yet.