| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918102000 | Doc | 60.3% | CN | US | 2025-05-12 |

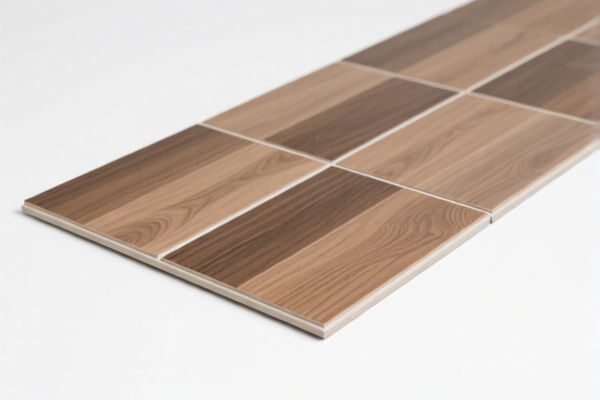

Product Classification: PVC Solid Floor Tile

HS CODEs (10-digit):

- 3918101020

- 3918901000

- 3918101040

- 3918101030

- 3918102000

🔍 Key Classification Notes:

- All listed HS codes are applicable to PVC (Polyvinyl Chloride) solid floor tiles, including those in tile or roll form.

- These codes fall under Chapter 39 (Plastics and articles thereof) and Heading 3918 (Floor coverings, wall or ceiling coverings, of plastics).

- The specific description in the summary includes:

- Whether the product is self-adhesive or not.

- Whether it is in tile or roll form.

- Made of rigid solid polymer core (for 3918101020).

📊 Tariff Structure Overview:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3% (5.3% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Proactive Compliance Advice:

- Verify Material Composition: Confirm that the product is made of PVC polymer and not a composite or mixed material, as this may affect classification.

- Check Unit Price: Tariff rates may vary based on the value per unit or quantity, especially if falling under different tariff categories.

- Certifications Required: Some countries may require product certifications (e.g., fire resistance, environmental standards) for import clearance.

- Documentation: Ensure proper commercial invoice, packing list, and product specifications are included for customs review.

📌 Additional Considerations:

- Anti-dumping duties: Not applicable for PVC floor tiles unless specifically imposed by the importing country (check with local customs or trade compliance experts).

- Customs Valuation: Be aware of valuation rules (e.g., CIF value, transaction value) to avoid disputes or delays.

✅ Summary of Tax Rates:

| Tariff Type | Rate |

|---|---|

| Base Tariff | 5.3% |

| General Additional Tariff | 25.0% |

| Special Tariff (after April 11, 2025) | 30.0% |

| Total Tax Rate | 60.3% |

If you need further assistance with customs documentation, certification requirements, or tariff exemptions, feel free to ask.

Product Classification: PVC Solid Floor Tile

HS CODEs (10-digit):

- 3918101020

- 3918901000

- 3918101040

- 3918101030

- 3918102000

🔍 Key Classification Notes:

- All listed HS codes are applicable to PVC (Polyvinyl Chloride) solid floor tiles, including those in tile or roll form.

- These codes fall under Chapter 39 (Plastics and articles thereof) and Heading 3918 (Floor coverings, wall or ceiling coverings, of plastics).

- The specific description in the summary includes:

- Whether the product is self-adhesive or not.

- Whether it is in tile or roll form.

- Made of rigid solid polymer core (for 3918101020).

📊 Tariff Structure Overview:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.3% (5.3% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Proactive Compliance Advice:

- Verify Material Composition: Confirm that the product is made of PVC polymer and not a composite or mixed material, as this may affect classification.

- Check Unit Price: Tariff rates may vary based on the value per unit or quantity, especially if falling under different tariff categories.

- Certifications Required: Some countries may require product certifications (e.g., fire resistance, environmental standards) for import clearance.

- Documentation: Ensure proper commercial invoice, packing list, and product specifications are included for customs review.

📌 Additional Considerations:

- Anti-dumping duties: Not applicable for PVC floor tiles unless specifically imposed by the importing country (check with local customs or trade compliance experts).

- Customs Valuation: Be aware of valuation rules (e.g., CIF value, transaction value) to avoid disputes or delays.

✅ Summary of Tax Rates:

| Tariff Type | Rate |

|---|---|

| Base Tariff | 5.3% |

| General Additional Tariff | 25.0% |

| Special Tariff (after April 11, 2025) | 30.0% |

| Total Tax Rate | 60.3% |

If you need further assistance with customs documentation, certification requirements, or tariff exemptions, feel free to ask.

Customer Reviews

No reviews yet.